It will dominate weather’s many twists and turns

through the end of this year and well into next. And it’s causing gyrations in

everything from the price of Colombian coffee to the fate of cold-water fish.

Strong El Nino conditions are expected to remain

through 2015 and possibly several months into 2016, with some regions

experiencing drought while others could receive much-needed rain.

Higher inflation has been attributed to El Nino events

and could occur, though the increase would be relatively small (less than 1

percent) and could benefit some countries more than others.

El Nino effects on inflation and commodity prices will

be short term, but when added with existing structural issues, it could affect

policies in certain countries.

The defining characteristic of El Nino is sustained

above-average temperatures in the middle of the Pacific Ocean. Traditionally,

Peruvian fishermen recognized the phenomenon when the catch would decline as

weak trade winds led to warmer waters around the west coast of South America,

decreasing the nutrients in the water and thus the number of fish it could

support. Now, a much more regimented system takes measurements of ocean

temperatures throughout the Pacific. The Oceanic Nino Index looks at temperature

anomalies in the region known as Nino 3.4, between 5 degrees north and 5

degrees south latitude and between 120 degrees and 170 degrees west longitude.

El Nino is declared if the average sea surface temperatures there are at least

0.5 degrees Celsius (0.9 degrees Fahrenheit) higher than normal for five

consecutive overlapping three-month periods.

The El Nino in 2015 was widely anticipated but was considerably delayed. A weak

El Nino was first announced in March, after which it gradually strengthened as

sea surface temperatures continued rising during the next several months.

Currently, forecasters with the National Oceanic and Atmospheric

Administration's Climate Prediction Center give a

very high probability (greater than 90 percent) for El Nino lasting through the

end of 2015 and a high probability (85 percent) of it lasting into spring of

2016. Forecasts show that the strength of this El Nino will remain high through

the winter.

A monster El Nino and its potentially extreme weather effects make for good

headlines. However, it is important to remember that an El Nino only increases

the probability of certain weather patterns; it does not make them a foregone

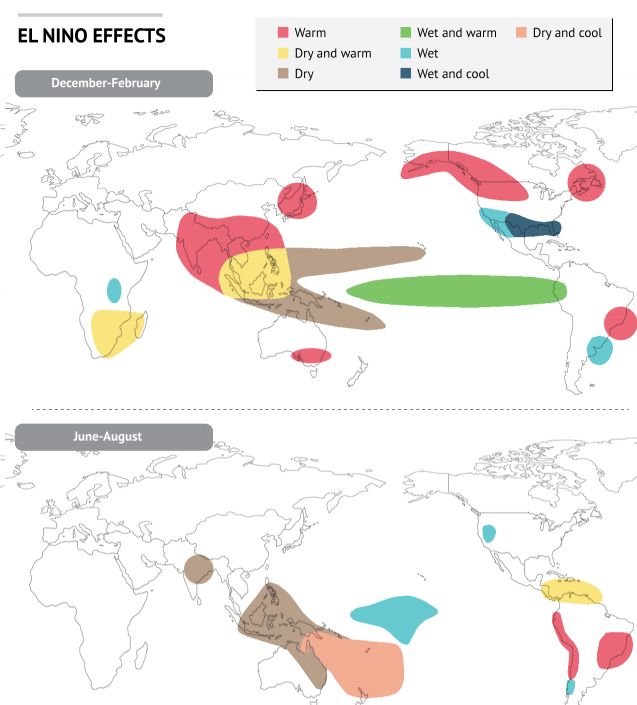

conclusion. Still, historical El Nino events indicate what the probable weather

patterns will be and how they can and will affect the global economy.

The El Nino weather pattern likely contributed to many of the ongoing droughts

around the world, such as those in Central America and Southeast Asia; dry

conditions in these regions are typical in El Nino years. El Nino also might

have contributed to the weaker-than-normal monsoon season in India. As autumn

(September-November) approaches in the Northern Hemisphere, the droughts in

Indonesia, Malaysia, Vietnam and Thailand, among other countries, are likely to

continue. El Nino also increases the likelihood that the season will be drier

for parts of Australia and southern Africa. In contrast, areas on the western

coast of South America can expect much wetter conditions than normal. As the

Northern Hemisphere moves into winter (December-February), the predominant

weather patterns include continued dryness in many Southeast Asian countries,

particularly Indonesia, while parts of North America will experience more

rainfall and other areas on the continent will have warmer temperatures. If

this El Nino extends through March-May, the weather pattern could bring

continued rainfall in North America and alter the 2016 monsoon season.

Secondary Effects

Weather patterns have obvious effects on industries such as mining and

agriculture. Droughts reduce agricultural output, and heavy rains can hamper

mining operations. Either situation can lead to a short-term increase in

commodity prices, especially for those commodities that have their output

restricted. Copper from South America and palm oil from Southeast Asia are two

such commodities that are especially vulnerable in El Nino years.

However, because potential price increases are not limited to just a few

commodities, El Nino years also tend to bring about inflation. But just like

the weather itself, El Nino's effects on inflation are not universal. The

International Monetary Fund conducted a study released in April 2015 showing

that El Nino conditions can correlate to some level of inflation in many

countries, albeit relatively low — less than 1 percent for most countries.

Inflation is not necessarily a detriment for many countries right now. Some

countries, particularly indebted Western nations looking to reinvigorate their

economies, are even seeking inflation.

In the IMF study, the correlation between El Nino and increases in inflation

was highest in Japan, South Korea, Chile, Thailand, India and Indonesia. By

examining these countries, we can predict how they might react to these small,

but significant, inflation rate raises.

Japan, an economy that has been stagnant for decades, now sees higher inflation

as the first step toward economic growth. Japanese Prime Minister Shinzo Abe is

struggling to see success in his economic plan nearly three years into his

term. For Japan, the IMF study attributes only a 0.1 percent inflation increase

to El Nino, but with inflation in Japan essentially at zero, even this smallest

bump could help, though it would likely be temporary.

According to the IMF, inflation in South Korea will increase by 0.44 percent

after four quarters in response to El Nino. With inflation currently at 0.7

percent, Seoul would not necessarily need to raise interest rates to curb

inflation. Interest rates were actually lowered

earlier this year to mitigate any declines in the tourism and retail sectors.

An inflation increase of even 0.5 percent might actually be

seen as a blessing to the Central Bank of South Korea, whose inflation target

is 2.5-3.5 percent.

At 5 percent, Chile's inflation rate is not excessive but still higher than it

has been all year. Santiago is worried about slipping into a slow-growth,

high-inflation trap, especially as copper prices remain low and Chinese demand

wanes. There has been some speculation about interest rate hikes, but analysts

expect them to remain steady through the end of the year. The IMF study found

El Nino's impact on Chile's inflation to be less than 0.4 percent even after

four quarters — a small impact relative to the overall inflation rate. Thus, El

Nino's most prominent effects on Chile are not likely to come from inflation.

Rather, Santiago will focus on El Nino's heavy rains that are expected to

disrupt the mining sector.

Meanwhile, Thailand, already dealing with the effect of low energy prices, is actually undergoing a period of deflation at a rate of

roughly 1 percent. Combined with other factors, El Nino's additional 0.55

percent inflation could help bring Bangkok out of its deflationary spin.

India is in almost the opposite position. Raghuram Rajan, the governor of

India's central bank, has sought to lower India's high inflation. Aided by low

commodity prices, inflation has fallen to roughly 4 percent. However, this has

not necessarily translated to renewed domestic demand. The public still

believes inflation rates could rise again, and even a small increase of

approximately 0.6 percent that could be attributed to El Nino could reinforce

that belief. Prime Minister Narendra Modi remains in a difficult position,

trying to attract foreign investment while bolstering domestic demand.

The last time there was an El Nino of similar

magnitude to the current one, the record-setting event of 1997-1998, floods,

fires, droughts and other calamities worldwide killed at least 30,000 people

and caused $100 billion in damage. Another powerful El Nino, in 1918-19, sank

India into a brutal drought and probably contributed to the global flu

pandemic, according to a study by the Climate Program Office of the National

Oceanic and Atmospheric Administration.

For updates click homepage here