Early on I commented on the Greek debt crises

including also that of the other ‘Club Med’ countries.

Yet by now Greece

is a lost cause. No amount of fiddling, massaging or austerity is going to

save the country from default.

Not only is the

Greek public debt by now already a staggering

$500 billion (see below) as mentioned earlier Greece (something many

reporters and tv station covering the story are not conscious of) has a history of defaults/ refinancing.

It is unclear how important European or other foreign powers presently

consider preventing major economic, political or social instability in Greece.

The financial and political price of preventing the country’s economic

collapse, and the potential dissolution of the modern European system — has

grown vastly since the beginning of the crisis in 2008, yet not a single party

has decided to cut its losses and walk away. For better or worse, Greece is

integrated into the European system, and its failure would have repercussions

on the system. If European leaders believe the preservation of Greece is key to

preventing their own economic demise, then perhaps Greece has not lost its

strategic value to the West after all. However, that remains to be seen.

To handle the challenge of at least a structured (orderly) default the

Europeans however will need a fund of at least 2 trillion euros (something that

is not there yet).

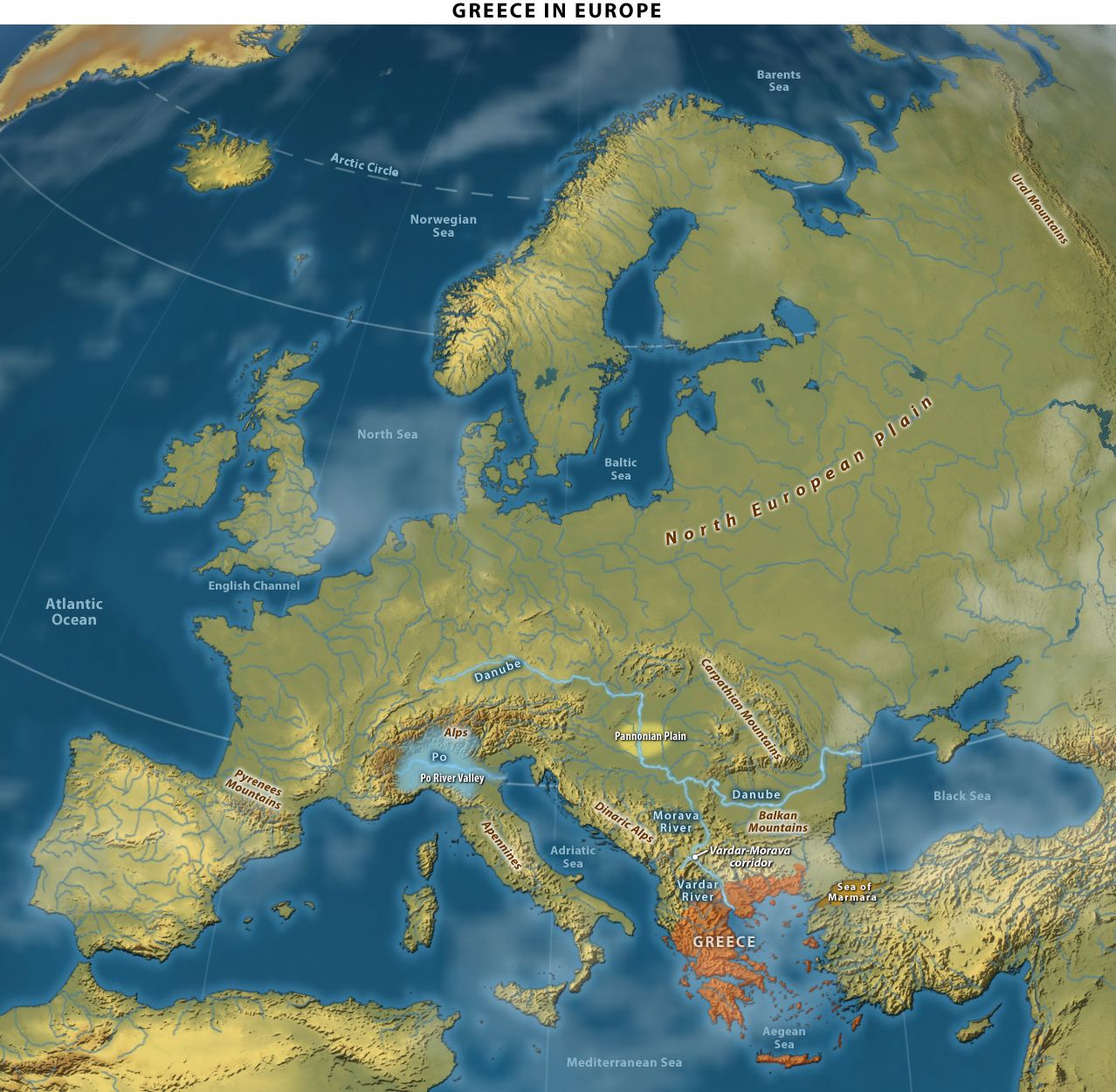

Starting with Greek’s geography , this has been both a blessing and a

curse, a blessing because it allowed Greece to dominate the “known Western

world” for a good portion of Europe’s ancient history due to a combination of

sea access and rugged topography. In the ancient era, these were perfect

conditions for a maritime city-state culture oriented toward commerce and one

that was difficult to dislodge by more powerful land-based opponents. This

geography incubated the West’s first advanced civilization (Athens) and

produced its first empire (ancient Macedon).

However, Greek geography is also a curse because it is isolated on the

very tip of the rugged and practically impassable Balkan Peninsula, forcing it

to rely on the Mediterranean Sea for trade and communication. None of the Greek

cities had much of a hinterland. These small coastal enclaves were easily

defendable, but they were not easily unified, nor could they become large or

rich due to a dearth of local resources. This has been a key disadvantage for

Greece, which has had to vie with more powerful civilizations throughout its

history, particularly those based on the Sea of Marmara in the east and the Po,

Tiber and Arno valleys of the Apennine Peninsula to the west.

Greece is located in southeastern Europe on the southernmost portion of

the Balkan Peninsula, an extremely mountainous peninsula extending south from

the fertile Pannonian plain. The Greek mainland culminates in what was once the

Peloponnesian Peninsula and is now a similarly rugged island separated by the

man-made Corinth Canal. Greek mountains are characterized by steep cliffs, deep

gorges and jagged peaks. The average terrain altitude of Greece is twice that

of Germany and comparable to the Alpine country of Slovenia. The Greek

coastline is also very mountainous with many cliffs rising right out of the

sea.

Greece is easily recognizable on a map by its multitude of islands,

about 6,000 in total. Hence, Greece consists of not only the peninsular

mainland but almost all of the Aegean Sea, which is bounded by the Dodecanese

Islands (of which Rhodes is the largest) in the east, off the coast of

Anatolia, and Crete in the south. Greece also includes the Ionian Islands (of

which Corfu is the largest) in the west and thousands of islands in the middle

of the Aegean. The combination of islands and rugged peninsular coastline gives

Greece the 10th longest coastline in the world, longer than those of Italy, the

United Kingdom and Mexico.

Mountainous barriers in the north and the northeast mean that the Greek

peninsula is largely insulated from mainland Europe. Throughout its history,

Greece has parlayed its natural borders and jagged terrain into a defensive

advantage. Invasion forces that managed to make a landing on one of the few

Greek plains were immediately met by high-rising cliffs hugging the coastline

and well-entrenched Greek defenders blocking the path forward. The famous

battle of Thermopylae is the best example, when a force of 300 Spartans and

another 1,000 or so Greeks challenged a Persian force numbering in the hundreds

of thousands. The Ottomans fared better than the Persians in that they actually

managed to conquer Greece, but they ruled little of Greece’s vast mountainous

interior, where roving bands of Greek brigands, called khlepts,

blocked key mountain passes and ravines and entered Greek lore as heroes. To

this day, its rugged topography gives Greece a regionalized character that

makes effective, centralized control practically impossible. Everything from

delivering mail to collecting taxes, the latter being a key factor in Greece’s

ongoing debt crisis, becomes a challenge.

Modern Greece has traditionally been supported by three pillars. First

is shipping. As a culture that is mostly coastal it makes sense they would be

very good at sailing; however, in the age of modern transport and super

container ships, Greece simply can’t compete, and most of its ship building

industry has long ago left for greener pastures in places such as Norway, China

or Korea. The second pillar is tourism and this continues to be an option, but

tourism by itself cannot support a modern state. The final option and the one

that the Greeks have gotten the most mileage out of is leveraging Greece’s

position. Typically to allow some external power a means of battling somebody

in Greece’s neighborhood. When Greece achieved independence in the early 1800’s

that external power was the United Kingdom who used Greece as a foil against

the Turks. Later, the Americans played a similar role supporting Greece against

the Soviets. In both cases massive volumes of capital came in to support

Greece. However, in the post-Cold War era Turkey is a member of NATO, and while

the Greeks might not get along with the Turks, nobody is looking to use Greece

as a military foil against them. Greece no longer has a regional foe that it

shares with anyone else. The closest might be the Turks again, but only if the

Turks miscalculate their ongoing relationship with Israel or Cyprus and

miscalculate very very badly.

Bottom-line, the various supports that have allow the Greek state to

exist since the 1820’s simply aren’t there anymore and so the path forward goes

like this: Greece is not salvageable. Greece simply can’t compete unless it is

being given a constant, steady supply of capital from abroad that it doesn’t

necessarily have to pay back. And even if that could be restarted, Greece

cannot emerge from its own debt load. It is simply too large.

It therefore is only a question of when, not if, the Europeans pull the

plug on Athens, which most likely will be at the first opportunity, when Greece

does not present a systemic risk to the rest of Europe. At that point, without

access to international capital or more bailout money, Greece could face a

total collapse of political control and social violence not seen since the

military junta of the 1970s.

For more on the Greek Geopolitical Imperatives continue here:

A Greek default will be much larger than other recent defaults, like the

one in Argentina in 2001 or in Russia in 1998. Greek public debt now comes to

about $500 billion. Argentina's debt when it defaulted was $82 billion, and

Russia's was $79 billion. The size of Greece's public debt assures that the

consequences of a Greek default would ravage its economy.

Inside Greece, banks would face huge losses on bonds in their portfolios

and would have to close their doors until somebody -- who? -- recapitalized

them. The economy would grind to a halt. Some projections put the contraction

in the gross domestic product at more than of 25%. ATMs would stop working.

Business credit would dry up, and businesses would shut their doors. The

government would be unable to pay its bills.

But the damage wouldn't stop at Greece's borders. Bond buyers would flee

Italian and Spanish government bonds, requiring the European Central Bank and

the European Financial Stability Facility -- if it's set up by then -- to pour

billions into buying those bonds to support the markets.

European banks would take a huge hit as the value of Greek government

and corporate debt in their portfolios plunged. Big banks and insurance

companies in Germany had a total exposure of $33 billion to Greek government

and corporate debt as of the end of March, according to the Bank for

International Settlements. French banks had exposure to Greek public and

private debt of almost $80 billion.

That exposure is not spread evenly. In France, much of it is

concentrated at three big banks: Crédit Agricole (CRARF 0.00%, news), Société

Générale (SCGLY +2.89%, news) and BNP Paribas (BNPQY +2.53%, news). In Germany,

the government set up bad banks as part of its bailout of Hypo Real Estate

Holding and WestLB. Those bad banks hold more than

half of all the Greek debt held by German banks and would undoubtedly need

another infusion of taxpayer cash.

Those scenarios seem so grim that it's hard to imagine any rational

politician steering his or her country into such a storm, begging the question

what are at least some, of the reasons.

The Lying Game of Statistics

There is an interesting belief, at least in the advanced industrial

countries, that government-issued statistics reflect reality. Yet a host of

reasons exists for looking at national statistics with a jaundiced eye beyond

the risk of politicians pressuring civil servants.

Yet it is not only Government officials and civil servants.

For example while undoubtedly true that the Greeks falsified financial

data in order to join the Euro. Yet the job of bankers for example, is to

analyze data from loan applicants and to uncover falsehoods. The charge against

the Greeks can thus be extended to bankers. How could they not have discovered

the Greek deception?

Compounding this challenge, the European Union has incorporated

societies on its periphery that never have accepted the principle that states

must be transparent, a problem exacerbated by EU regulations. Southern and

Central Europeans always have been less impressed by the state than Germans,

for example. This is not simply about paying taxes but about a broader distrust

of government, something deeply embedded in history. Meanwhile, regulations

from Brussels, whose tax and employment laws make entrepreneurship and small

business ownership extraordinarily difficult, have forced a good deal of the

economy “off the books,” aka underground.

In this case what exactly is the state of the Greek, Spanish or Italian

economy remains hard if not impossible to say.

Or to stay with the example of Greece, one assessment says that 10

percent of all employees are off the books. Another says 40 percent of Greeks

define themselves as self-employed. A third estimates that 40 percent of the

total Greek economy is in the grey sector. When evaluating what tries to remain

hidden, you’re reduced to guesswork. No one really knows, any more than anyone

really knows how many illegal immigrants are participating in the U.S. economy.

The difference, however, is that this knowledge is of profound importance to

the entire EU bailout.

Greek numbers on the consequences of austerity for government workers do

not take into account that many of those workers show up to work only

occasionally while working another job that is not taxed or known to the state

statistical services. Thus, one has a complete split between the state and

banking systems’ ability to honor debt obligations, the insistence on austerity

and the social reality of the country.

The realization that the rational civil servants of Brussels and Berlin

have failed to create systems that understand reality strikes at their

self-perceptions. There is a willful urge to retain the perception that they

understand what is going on.

Thus the crisis we are seeing, which Brussels, Luxemburg or/and Germany

somehow try’s to solve, rests on a highly unstable base. First, the European

banking system, like the American banking system, does not understand its

status. Second, the entire mathematics of national statistics is inherently

imprecise. Third, the peripheral countries of the European Union have economies

that cannot be measured at all because their informal economies are massive.

The fundamental principles and self-conception of Central Europe diverge

massively. The elites of these countries might like to think of themselves as

Europeans first, by definition, but the public know they are not, and they

don’t want to be.

Thus a precise solution to a vastly uncertain problem is unlikely to

return Europe to its happy past. Reality, or rather the fundamental unreality

of Europe, has returned.

In some sense, this is no different from the United States and China.

But the United States has its Constitution and the Civil War’s consequences to

hold itself together in the face of this problem, and China has the Communist

Party’s security apparatus to give it a shot. Europe, by contrast, has nothing

to hold it together but the promise of prosperity and the myth of the rational

civil servant, the cultural and political side of the underlying geopolitical

problem.

Consequences of the Coming

Default

The first Consequence of a coming default is that Greece most likely

will have to be kicked out of the euro zone, but between here and there, first,

a firebreak fund. The EFSF expansion has to happen because if you cannot

sequester the money of Greek government debt that exists outside of Greece,

then you’re going to trigger a massive financial catastrophe. And so to prepare

for a Greek ejection, you have to prepare a fund that can handle three things

more or less simultaneously. First, you need about 400 billion euro to

firebreak Greece off from the rest of euro zone. Second, you need about 800

billion euro in order to prevent a wide-scale banking meltdown, because the day

that Greece defaults on that debt, the day that it’s ejected from euro zone,

there will be catastrophic banking collapses in Portugal, Italy, Spain and

France, probably in that order.

Third, the markets will go wild and the state that is in the most danger

of falling after Greece is Portugal, Spain and Italy. Using the bailouts that

have happened to date as a template, any bailout of these three would have to

provide enough financing money that has not been made available yet.

General conclusion: European Union member states are not as committed to

the bloc as they once were. Yet all members joined with the understanding that

the union would grant them wealth. However, all those understandings are now in

breach.

Overall, the European economy is stagnant at best now. One of the few

European states still showing signs of economic activity is Germany.

It is most likely that ongoing efforts to strengthen the euro zone’s

bailout fund, a precondition for any solution that would save Europe, will

continue apace in the coming quarter. And while I do expect a structured Greek

default, there won’t be a euro dissolution or general European catastrophe in

the fourth quarter of 2011. But whatever fondness EU member countries have felt

for the bloc is ending. While in the coming months the leaders and populations

of the 27 EU states will feel nostalgic for the past, they will be unwilling to

bear the collective financial burden required to preserve it, disillusioned

with what Europe is becoming but only willing to blame others while evaluating

the options they might have if the European experiment comes to an inglorious

end.

Several other weak points beside the Greek bailout that could trigger a

series of events in the European system are:

• The Italian government and

Belgian caretaker government are both in precarious positions. An Italian

government collapse likely would overwhelm the fail-safes the Europeans have

thus far established. Belgium does not even have a government in any practical

sense, making it impossible for Brussels to negotiate, much less implement,

austerity measures. A financial crash in Belgium would bring the financial

crisis into the Northern European core.

• Political miscalculations or

opposition to more bailouts in Germany could limit financial support to Greece

at a key moment. Greece is living on bailout funds and will default on its debt

should the payout schedule be more than moderately interrupted. Such

interruption would trigger a financial cascade, starting in Greece and ending

in the Western European banks before EU bailout programs are expanded

sufficiently to handle the fallout.

• European banks suffer from a

number of deep maladies that include exposure to U.S. subprime real estate,

Europe’s home-grown real estate troubles, over crediting both within and beyond

the euro zone and decades of being used as slush funds by various governments.

Just as a sovereign debt meltdown could trigger a banking catastrophe, a

banking meltdown would trigger a sovereign debt catastrophe. Addressing this

issue will be a primary topic of the Oct. 17-18 EU heads of government summit.

For updates click homepage

here