What 2020 will bring part one

In its visualizing

2020, Council of Foreign Relations experts spotlighted some of the trends they

will be tracking in the year ahead, to which we will add an additional

three-part 2020 outlook.

The five issues the

Council of Foreign Relations experts spotlighted are:

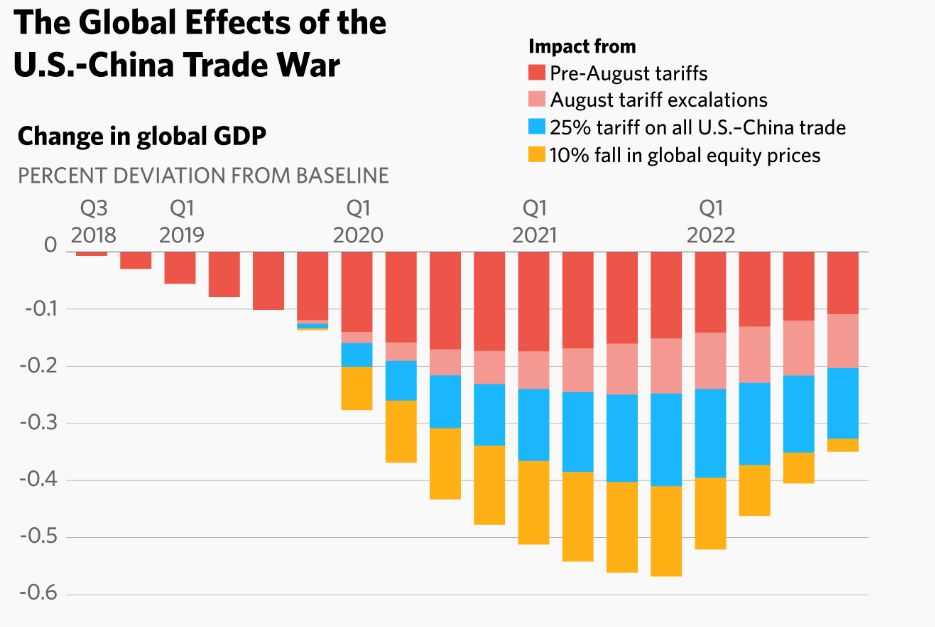

1) The Shrinking U.S.-China Trade Flows

2) An observation

about Latin America’s fading left (whereby underneath see our own observation

in reference to the unrest in Latin America):

3) Africa’s looming

housing crisis which could threaten urban health and safety and provoke serious

social frustration and political unrest. To head off a crisis, civic leaders

should move quickly to introduce zoning, construction, and related reforms that

set the stage for smart, sustainable additions to the urban housing stock.

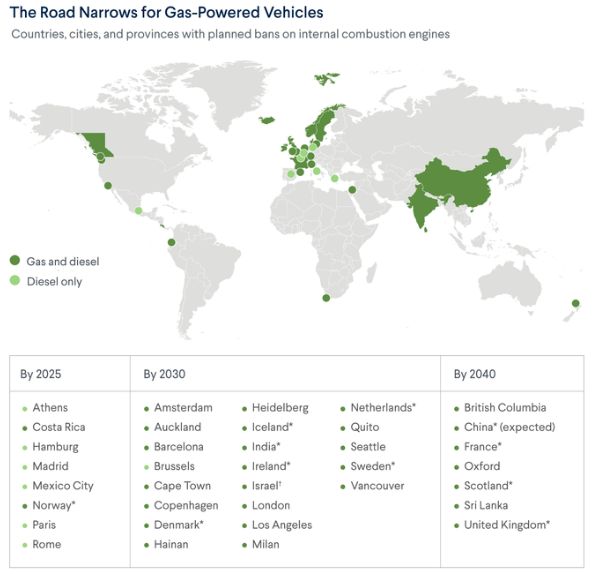

4) Zeroing out

automobile emissions whereby on 1 September we highlighted the proposal by

Klaus Gietinger how self-driving cars powered by

renewable energy, might yield significant tangible

benefits.

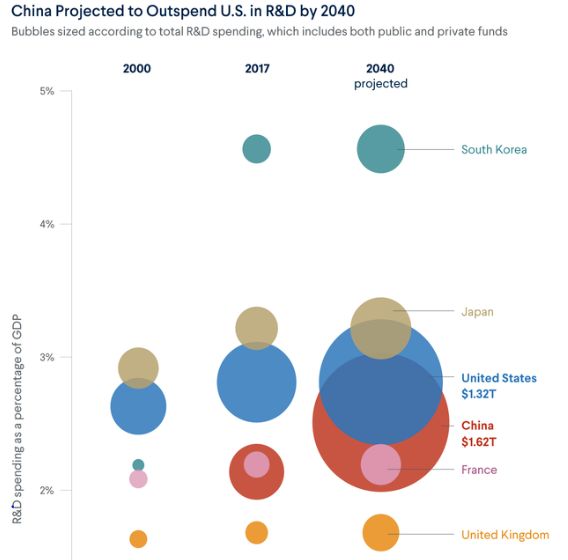

5) The research and

development race with China currently leading, adding that the US could remain

competitive if the government restores investments in this area to prior

levels. Boosting federal R&D spending to its historical average of about 1

percent of gross domestic product (GDP), some $230 billion, could ignite the

type of discoveries that have reshaped and revitalized the U.S. economy.

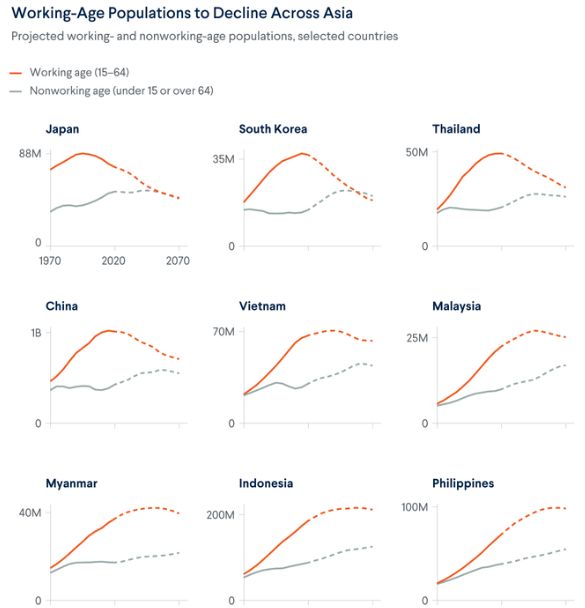

6) The issue of aging

Asia a subject we covered end 2018 using China as a

case study.

Outlook 2020 P.1

First, an overview

followed by details about hotspots, Brexit, Hong Kong, Unrest in Latin America

as also highlighted by the Chile example, the economy and technology

underneath.

Uncertainty

surrounding the outcome of the U.S. 2020 presidential and congressional

elections will shape the actions and decisions of countries around the world. A

contentious election year in the United States means that even as other nations

deal with their own domestic, regional and global concerns, they must take into

account the opportunities and risks in decisions that overlap U.S. interests,

considering the possible dramatic post-election change in U.S. posture.

"Rogue"

nations such as Iran and North Korea, and non-state actors including the

Taliban and the Islamic State, will assess ways in which they might leverage

their behavior to exploit perceived weaknesses in U.S. foreign policy, while

also calculating the risks or benefits in making deals with the Trump

administration, or waiting for a possible change in U.S. leadership. If they

press to accelerate a U.S. response in their favor, the risk of aggressive

posturing to include military and militant action will grow along with the

likelihood of miscalculation of U.S. responses to aggressive tactics.

China, Russia, and

other U.S. competitors, as well as Washington's partners in Europe and Asia,

will approach making or rejecting commitments with the United States in 2020

with more caution until there is certainty about the next administration. These

countries will consider their much longer-term relationship with the United

States, seeking to avoid obligations that could get overturned or taking

actions that assume a change of White House leadership.

I am not so sanguine

about the ability of the world to avoid localized economic shocks. Social and

political stresses stemming from slowing Chinese economic growth rates, rising

protests over social inequality and economic austerity programs across Latin

America, North Africa and the Middle East, exacerbated by sluggish commodity

prices, and Brexit-related uncertainty could contribute to localized economic

instability.

Hotspots to Watch

The Iranian-U.S. Escalation Will Stop Short of

Outright Conflict

Iran and the United States

will most likely avoid direct military conflict even as Tehran significantly

ramps up its nuclear program in response to U.S. sanctions pressure. Iran will

continue its aggressive strategy of targeting regional oil and gas

infrastructure and the Strait of Hormuz to up the price of the United States

maintaining its harsh sanctions strategy. Iran's retaliatory strategy risks

escalating into a military confrontation even though both the United States and

Iran will seek to avoid one. Iran's progressive escalation in its nuclear

program could lead it to follow the United States in withdrawing from the Joint

Comprehensive Plan of Action (JCPOA) nuclear deal. That would force Europe to

consider imposing sanctions on Iran or trigger the nuclear deal's dispute

resolution mechanism. If the JCPOA remains intact, the U.N. conventional arms

embargo on Iran would expire in October 2020 — pushing the United States to

take aggressive unilateral measures to try to enforce one.

A Year of Calm Will Mask Brexit's Future Disruptive

Potential

The new, Conservative

Party-led British Parliament will approve a Brexit deal, and the United Kingdom

will leave the European Union in early 2020. Initial disruptions will be

minimal because the United Kingdom will remain in the EU single market in 2020,

providing a period of certainty for global markets. London and Brussels will

spend the year in talks over a free trade agreement, but the complexity of the

negotiations will make it difficult for them to reach an accord in 2020. Key

friction points include Brussels pushing London to keep the norms and

regulations of the single market and London pushing the European Union to

include as many services as possible, a provision the European Union will

resist. Without a trade deal, uncertainty for global markets, supply chains,

and investors will again grow in mid-2020 as another cycle of waffling between

the possibility of extended negotiations or a disruptive turn to WTO tariffs

begins.

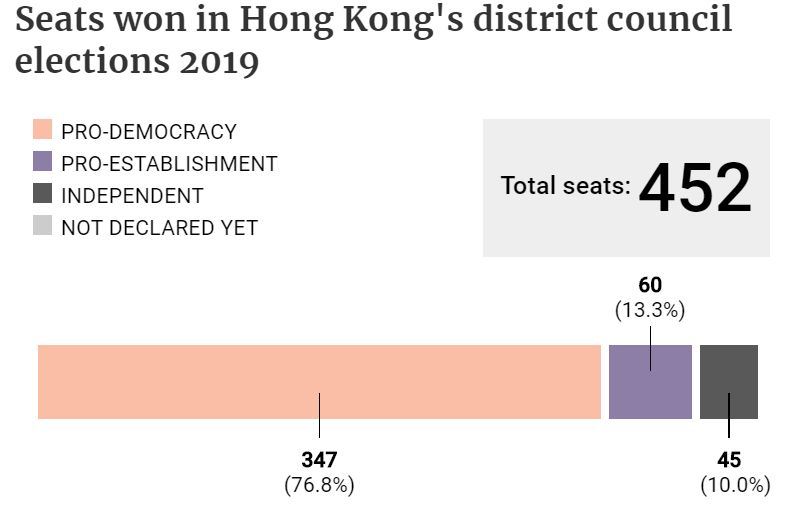

Protests Remain the New Normal in Hong Kong

Hong Kong's crisis will persist as the city's new

normal becomes prolonged political impasse and continued standoffs on the

street. Sustained business disruptions, vandalism and the withdrawal of more

foreign business and capital from Hong Kong will extend the city's recession

beyond 2020. Besides stoking the overall rivalry between the United States and

China in their trade war, the chronic acrimony in Hong Kong will allow other,

more stable business hubs such as Singapore or even Malaysia to attract

companies looking for alternatives. It will also spur China to further

emphasize mainland economic centers such as Shanghai, Shenzhen, and Beijing to

reduce reliance on Hong Kong. For more on where Hong Kong is going, see as an

example:

The results of Hong

Kong’s district council elections on Sunday were worse than expected and

Beijing should start considering how the outcome will affect the 2022 race for

the city’s chief executive, mainland specialists on Hong Kong affairs have

warned.

The pro-democracy

camp won 392 of the 452 seats to control 17 out of the city’s 18 district

councils.

Although councilors’

powers are limited, the victory will give the

bloc a bigger say in the selection process for the next chief executive by

handing them control of 117 seats on the 1,200-member committee that chooses

the chief executive.

Whatever the outcome

of the current crisis, Hong Kong is likely to be significantly altered. Even

before the crisis, the city was suffering because of China's slowing economy

and the trade war; since the unrest has started, the city has witnessed huge losses

to its all-important tourism and service industries (both of which account for

roughly 90 percent of GDP). A harsher crackdown would hurt the city much more.

At the same time, the city's position as a leading financial hub relies,

partially at least, on relative political neutrality. But as the city's

political and ideological polarization deepens, it could threaten the city's

business environment in the long term as the region's competition for capital

intensifies further. What's more, the antagonism toward Beijing that will stem

from such polarization will inevitably lead Beijing to increase support for

mainland cities, such as Shanghai and its trade zone or Shenzhen, to compensate

for Hong Kong's unreliability even as the city will remain a critical link for

the foreseeable future.

Despite its best

efforts, China will find it nearly impossible to also keep Hong Kong from

interfering in U.S. trade negotiations over the next year. Although the United

States and China recently reached a so-called "phase one" trade deal

in time for U.S. Election Day in November, the deal's narrow scope still leaves

the underlying commercial and economic disagreements unsettled. Organizations

caught in the middle of the dispute should not expect an improvement in

political relations, especially with Washington labelling China a competitor

and a potential security threat to the US.

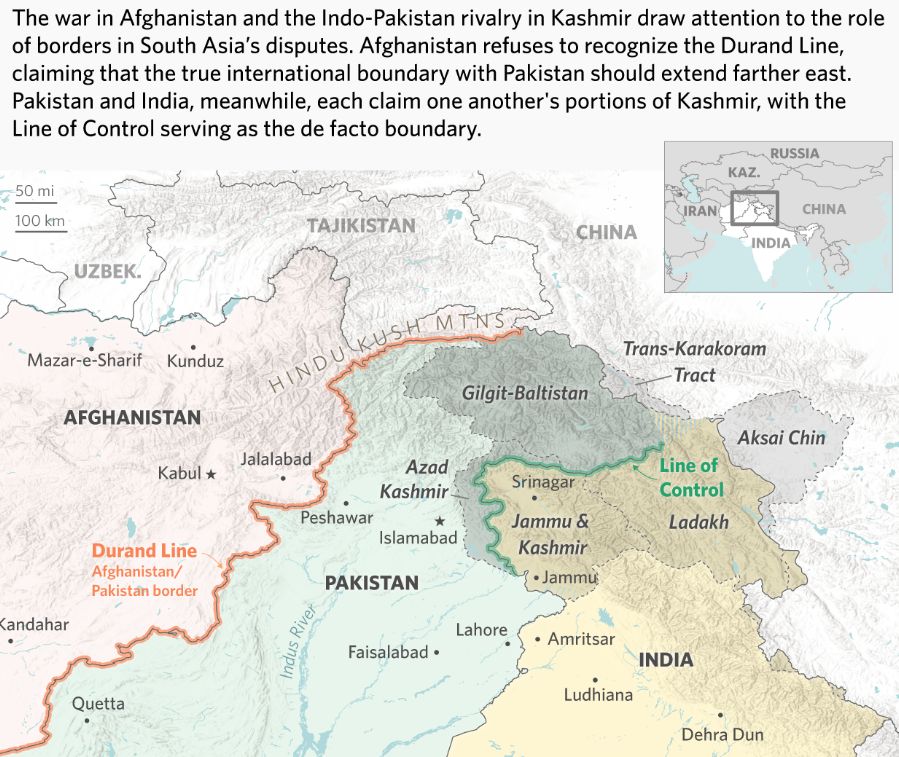

Kashmir will keep

India and Pakistan at risk of conflict in 2020

The majority of

attacks in Indian-controlled Kashmir since February have continued to involve

the three most active militant groups there: Jaish-e-Mohammed, Lashkar-e-Taiba

and Hizbul Mujahideen, all of which have leadership based in Pakistan.

Doubtless,

guaranteeing security will remain India's President Modi's priority for Kashmir

in 2020. A vigorous counterinsurgency remains underway there involving multiple

security detachments. The government claimed 3 Dec. that infiltration from Pakistan across the

Line of Control has increased by 50 percent, creating a pretext for more

retaliation against Pakistan should a sizable attack occur in Indian-controlled

Kashmir. Given that low-level militant incidents in Indian-controlled Kashmir

since March have not garnered a response from India against Pakistan (exchanges

of fire continue across the Line of Control, but they are not examples of

retaliation per se), it would appear that a significant number of Indian

security personnel must die before India would be willing to send its forces

across the Line of Control and risk a Pakistani response.

By fulfilling its

campaign promise to revoke the autonomy of Jammu and Kashmir, the BJP took a

major step toward advancing the territorial unity of India, though at the cost

of undermining talks aimed at normalizing relations with Pakistan. But

Indian-controlled Kashmir is still experiencing internet cutoffs; detentions,

such as that of three former chief ministers of the former state; and

restrictions on free movement. Until its security problems are resolved and

normalcy returns, the investment and migration from elsewhere in India that

Modi wants to foster in Indian-controlled Kashmir will not substantially

materialize. In the meantime, the dispute over the region will continue to loom

over Indian-Pakistani relations.

Unrest in Latin America

Bolivia: Despite both

sides agreeing to new elections for no later than April 14, each will probably

try to gain an advantage ahead of the vote. Protests may resume if either side

feels it has been cheated in the balloting.

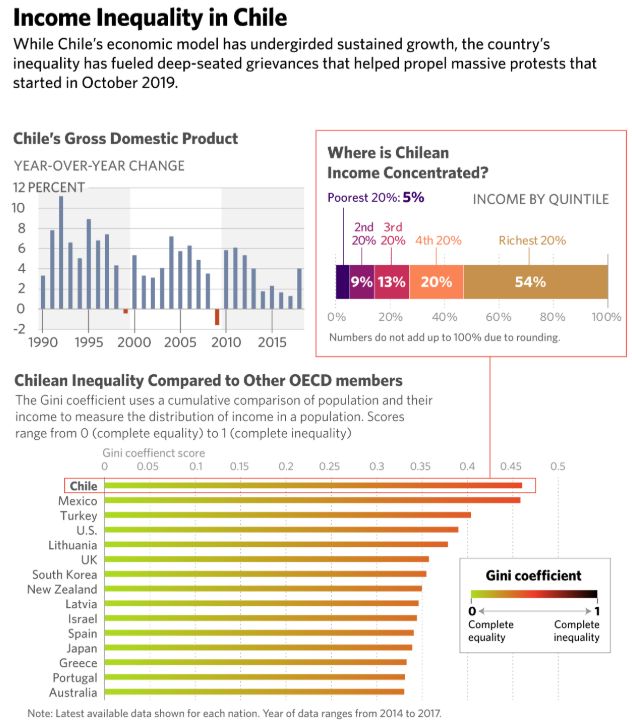

Chile: A

constitutional referendum scheduled for early 2020 will kick off a year of

debate, redrafting and additional votes. Protests are likely to continue as

activists seek to maintain pressure ahead of the referendum and on the

constitutional convention. Demonstrations are likely to escalate drastically if

the referendum fails or if irregularities undermine its legitimacy. The

convention will help to diminish some protests, but the underlying grievances

will continue to motivate extremists who want more radical reform.

Colombia: Widespread

unrest will likely continue as President Ivan Duque's administration faces off

against the array of left-wing groups that make up the National Strike

Committee. These protests aren't likely to be overly disruptive as long as the

committee enjoys broad popular and political support. However, the country

suffers from instability arising from armed militant groups and from its long

history of extrajudicial violence by security forces. Such strong-arm tactics

against protesters will drive disruptive action and possibly even a violent

backlash.

Argentina: The

victory in the presidential race of Peronist Alberto Fernandez has probably cut

the risk of widespread unrest from trade unionists. But the country's

long-running economic ills could still stoke grassroots protests against the

government or foreign institutions, such as the International Monetary Fund,

which are often blamed for Argentina's malaise.

Brazil: President

Jair Bolsonaro's administration succeeded in passing pension reform during

2019, but it is facing stiffer resistance on the rest of its legislative

agenda. This, combined with Bolsonaro's caustic tone on certain issues and his

support for pro-business policies, could boost opposition to his

administration; 2019 saw several major protests over specific issues, and it is

possible these will escalate in 2020.

The impact of unrest in Chile

The risk of unrest throughout

the constitutional reform process threatens Chile's economy and

business-friendly reputation. The protests already appear to have dampened

economic growth, with fourth-quarter GDP projected to contract 2.5 percent

year-on-year, and the central bank forecasting 2019 growth of only 1 percent,

the lowest since the 2008 global financial crisis.

Because protests have

been centered in urban areas, economic pain has been focused on the non-mining

sector, which contracted 4 percent as compared to mining sector growth of 2

percent. Chile's mineral exports, primarily copper and lithium, will, therefore,

become increasingly important to sustaining overall economic growth. The

central bank already projects that overall foreign investment in Chile may drop

4 percent in 2020. This will spur the government to incentivize investment in

the mineral sector, threatening Chile's longtime goal of moving up the value

chain of exports and moving away from reliance on sales of raw metals.

Growing copper demand

in the coming year due to a nascent energy transition could help increase

Chile's copper revenues and exports. So could a potential durable trade truce

between the United States and China, which alone accounts for over half of

global copper imports. Lithium presents some opportunities, but not as many as

copper. The Chilean government has plans to boost lithium production and expand

from the current operations in Atacama to new ones at the Aguilar salt flat.

Still, lithium prices remain depressed, despite an expected increase in demand

for electric vehicle batteries. U.S.-led efforts to secure a supply chain of

the strategic metal from friendly countries, however, could help offset the

economic headwinds limiting Chile's lithium ambitions.

But regardless of the

government's efforts, the next few years in Chilean politics will remain

unpredictable, and the economic damage from unrest could worsen, even

potentially affecting the mining sector. If nationwide unrest once again

spikes, copper miners or even critical fuel workers may stage sympathy strikes.

And given the need for political compromise, the final constitution may fall

short of satisfying public demands, meaning the successful conclusion of

charter change is unlikely to totally quiet unrest.

Slow Economic Recovery Takes Shape

Uncertainty injected

into global trade policy by aggressive U.S. actions will continue to be a chief

driver of economic weakness throughout the year even as the U.S.-China trade

deal injects some optimism for growth. A number of other downside risks that

could easily be triggered in 2020 will keep a lid on global economic growth.

While China has been able to manage its economic slowdown, its coping

strategies rest on a number of risky tactics, raising the possibility that it

will experience a sharp downturn, particularly if its trade war with the United

States intensifies. But it's more likely that while growth in the Chinese and

U.S. economies will slow, neither will undergo a sudden contraction.

Economic growth in

Western Europe will continue to be anemic, likely remaining below 1 percent for

the year. A significant factor in that weakness will be Germany’s continued

economic malaise and Berlin’s unwillingness to use significant fiscal stimulus to

counter it. Emerging markets are also set for a difficult 2020. Argentina will

be mired in an economic crisis. Brazil and India will each struggle to make the

structural reforms necessary to resume higher levels of growth. The Turkish

economy, driven by unsustainable levels of stimulus, may continue its slow

recovery, but no quick acceleration is likely. Continued global economic

weakness will help fuel conditions for more large-scale protests in developing

countries with economic inequality and weak governance.

Other factors

impeding global growth are the limitations many countries face in using the

strong monetary or fiscal response as an economic stimulus. In the developed

world, the use of monetary policy and low-interest rates to generate growth has

largely exhausted its utility. In some countries with room to employ fiscal

stimulus, such as Germany, political opposition will likely keep that option

off the table.

Despite a Deal With China, the Trade Offensive

Continues

With final approval

of the United States-Mexico-Canada Agreement imminent and a phase one deal with

China initially agreed upon, Trump has clearly made finalizing trade deals a

key goal ahead of the 2020 elections. The United States and China are unlikely

to follow their tariff-reducing deal with a more comprehensive trade

arrangement in 2020, as China is unlikely to make significant concessions on

U.S. demands for structural reform. Once the phase one deal is finalized, it is

likely to remain intact in 2020, but disagreements over interpretation and even

a potential small-scale escalation (such as a limited reintroduction of

tariffs) will remain a possibility. But because of Trump's desire to make the

deal a centerpiece of his trade policy's successes in the November elections,

any escalation will be tempered as to not completely upend the deal.

Meanwhile, U.S.-EU

trade talks will stall over disagreements on agricultural products, and the

United States will place more tariffs on European goods. The White House could

rely on a number of justifications to implement the tariffs, such as France's

digital services tax or U.S. national security concerns over auto imports. But

compared to Washington's trade war with Beijing, the scope and scale of its new

trade assaults against Europe will remain small.

U.S. efforts to

demobilize the World Trade Organization's appellate body by denying it

sufficient members to hear dispute cases will stymie the appeals process

through the mechanism throughout 2020. U.S. efforts to force new negotiations

over WTO reform may start to gain traction over the year, but in the meantime,

the WTO's members will try to keep dispute cases moving by modifying the

settlement process or finding alternatives. The nonexistent appeals process

will prompt other countries to follow the U.S. lead in employing aggressive and

unilateral action in trade disputes. This would include a European response to

U.S. tariffs against Airbus and the ongoing WTO case involving U.S. subsidies

to Boeing.

The Competition for Tech Supremacy Rages On

Amid growing

competition among Europe, the United States and China for technological

supremacy, more tech sectors will be classified as national and economic

security priorities. This competition will continue to fray global tech supply

chains. As auctions, rollouts and infrastructure buildout for 5G data networks

expand significantly in 2020, the United States is likely to maintain its

pressure on China's Huawei Technologies by continuing to sharpen export

controls to limit Huawei's access to U.S. technology and suppliers.

Washington will also

push its allies to similarly restrict the company, including barring its

equipment from 5G networks, but those efforts will meet with limited success.

Instead, most countries will try to appease both China and the United States by

allowing Huawei access to their networks, albeit limiting the use of its

equipment in those networks, increasing the cost of the global 5G rollout.

Eventually, the United States could take punitive action against countries that

continue to use Huawei's equipment, further fraying U.S. alliances. Huawei

represents but one facet of the sprawling global tech competition that will

continue to rage between the United States and China. There is much at stake:

Winning the race to develop a specific new technology will allow the victor,

whether Washington or Beijing, to begin to set that technology's global

standards by default.

China, Europe, and

the United States will prop up their domestic tech companies by using a wide

range of support mechanisms and restricting access to foreign investment. EU

efforts to expand the regulation of U.S. tech companies will increase in 2020.

In response, Washington will open more investigations looking into

anti-competitive behavior and could impose punitive trade measures. The

European Union will also seek to increase control over efforts by state-backed

Chinese companies to purchase European companies in strategic sectors. The

United States will use increased sanctions and export controls to cut down

China's tech sector, particularly for companies involved in places like Hong

Kong and Xinjiang and those involved in the development of strategic technologies,

such as artificial intelligence.

The Business Risks of Climate Change Will Increase

Businesses and

governments increasingly will be confronted with climate risk in 2020. This

includes the risk of damage to business infrastructure, as well as corporate

liability precipitated by governments and advocates who perceive corporate

responsibility for natural disasters or pollution that accelerate climate

change. An additional risk to future profits and company growth may come from

the decreasing use of fossil fuels as the energy transition to renewables takes

firmer hold and the role of electric vehicles expands, leading eventually to

peak oil demand at some point in the next 20 years.

The first check on

the progress of national plans and goals under the Paris Agreement on climate

change will come in 2020, illustrating just how little progress has been made,

which will probably renew international attention. The year will also most likely

mark the official exit of the United States from the accord.

Many countries will not

achieve their climate targets under the agreement. But citizen activism will

increase and more lawsuits will be filed to try to force change in national

climate policy beyond the two dozen countries already contending with legal

challenges. Government leaders will increasingly be compelled to more seriously

consider changing behaviors and economic calculus. Activists will also target

energy firms with legal challenges. Over the course of 2020, climate risk will

be more consistently priced into credit decisions and capital markets. Energy

companies will continue to be forced to reevaluate future investment as policy

shifts and judicial challenges begin to affect reliance on traditional

hydrocarbon plants to generate electricity, especially in Europe. The new

European Commission will prioritize aggressive renewable energy goals starting

in 2020 as it seeks both to stimulate the lagging European economy and maintain

Europe's position as a global standard-setter for climate measures. Demand for

electric vehicles will continue to grow in China, even as direct production and

consumer subsidies wane.

For updates click homepage here