By Eric Vandenbroeck and co-workers

The Bankman-Fried Case

Back in

early November 2022, a reader sent us a copy of Tracers in the Dark a

subject we had already been twice alerted about hence in October 2022 when we

started with an initial rough draft foreshadowing the current

situation soon to be published here

followed by two more articles here and here.

On 13 April

2022, Virgil Griffith, a US researcher for now infamous Ethereum

Foundation, was sentenced to more than five years in prison for conspiring

to help North Korea evade US sanctions using cryptocurrency. The sentence

was the minimum amount of prison time sought by prosecutors. The

39-year-old thus is now facing a maximum sentence of 20 years in prison and a

$1m fine.

Today Bankman-Fried’s 25-year sentence is about half

of the 40 to 50 years prosecutors had sought. Judge Kaplan said he weighed

several factors, including the brazenness of the crimes and Bankman-Fried’s

potential to commit crimes in the future.

There was a risk

“that this man will be in a position to do something very bad in the future,”

Kaplan said. “And it’s not a trivial risk.”

Kaplan recommended

that the Bureau of Prisons place Bankman-Fried in a medium-security or lower

facility, ideally in the San Francisco area so that his family may visit.

While there is no parole in federal cases, inmates can

still shave time off their sentences for good behavior. Bankman-Fried could end

up serving “as little as 12.5 years, if he gets all of the jailhouse credit

available to him,” Mitchell Epner, a former federal prosecutor, told CNN.

Bankman-Fried

addressed the court before his sentence was revealed, offering an at times

meandering statement about the mistakes he made as CEO of FTX.

He commended his

former business partners, including co-founder Gary Wang and his ex-girlfriend

Caroline Ellison, both of whom testified against him in trial in compliance

with their plea agreements.

Together, they all

“built something beautiful,” Bankman-Fried said.

“And I threw it all

away,” he added. “It haunts me every day.”

Judge Kaplan appeared

unmoved by parts of Bankman-Fried’s apology about customers being hurt. Kaplan

later acknowledged Bankman-Fried’s apology but added that Bankman-Fried said

“never a word of remorse for the commission of terrible crimes.”

Kaplan also ordered

Bankman-Fried to forfeit $11 billion, including properties and other assets

acquired with stolen customer funds.

The

forfeiture is intended to be paid over time, and Bankman-Fried will likely

be required to hand over all of his available assets, plus a nominal sum every

month.

“The forfeiture will

follow him for the rest of his life,” Epner said. “It would take the vast

majority of what he makes after he gets out of jail.”

He ruled Bankman-Fried’s forfeited assets could be

used to help fund the repayment of victims of the FTX

collapse.

Judge Kaplan roundly

rejected Bankman-Fried’s argument that there was no loss to former customers of

FTX because the bankruptcy estate indicated those victims are poised to recoup

most of their funds.

To say that FTX

customers and creditors will be paid in full “is misleading, it is logically

flawed, it is speculative,” Kaplan said.

FTX is now in the hands of corporate restructuring

expert John J. Ray III, who oversaw the liquidation of Enron in the early

2000s. Ray has stated in a letter to the court that the company Bankman-Fried

left behind was “neither solvent nor safe,” and that any recovered assets would

be thanks to the diligence of his team’s work over the past 18 months.

Some former FTX customers expressed anger and

disappointment on Thursday after Sam Bankman-Fried, the crypto exchange's

former billionaire boss, was sentenced to 25 years in prison for stealing $8

billion from customers.

"25 years is a joke," a member of an FTX

creditors group with the username Bruno Dixon wrote on the messaging app

Telegram minutes after the sentence was handed down by a New York judge.

Another member of the same Telegram group, going by

Steven, said the sentence was "laughable for such a serious crime."

More than an estimated 1 million customers face

potential losses as a result of FTX's sudden November 2022 collapse. Victims

say they are still owed more than $19 billion based on current crypto prices.

A New York jury last year found Bankman-Fried guilty

of stealing from unsuspecting customers to prop up his hedge fund Alameda

Research, buy luxury properties, and fund political donations.

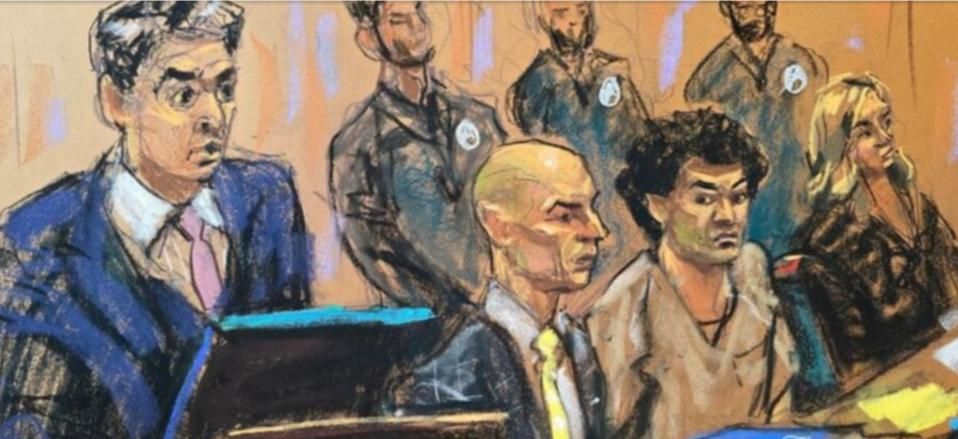

Manhattan judge ripped Sam Bankman-Fried

as a remorseless scammer obsessed with political power as he sentenced the

dethroned crypto king to 25 years in prison Thursday — five months after he was

found guilty of stealing more than $8 billion from customers of his

now-bankrupt cryptocurrency exchange FTX.

Judge Lewis Kaplan said the

32-year-old former billionaire owner of the popular FTX trading

platform “presented himself as the good guy” in favor of

“appropriate regulation of the crypto industry” — but that his

friendly persona was just an “act.”

Sam Bankman-Fried’s parents ‘heartbroken’ for

’empathetic’ son.

Elsewhere, several prominent voices in

the crypto community took issue with Sam Bankman Fried's 25-year sentence,

given Ross Ulbricht was sentenced to

life in prison in

2015.

Ulbricht created

Silk Road — a website that lets users anonymously buy and sell anything,

including drugs and hacking tutorials. Transactions on the site took place

using Bitcoin, making it much harder to trace.

Bitcoin Magazine, a crypto publication with more than

3 million followers, posted on X shortly after SBF was sentenced on Thursday.

For updates click hompage here