By Eric Vandenbroeck and co-workers

On February 26, 2022,

two days after Russia launched its full-scale invasion of Ukraine, Mykhailo Fedorov,

Ukraine’s minister of digital transformation, sent an urgent plea to Elon Musk

to provide Internet access to the country through his Starlink system. The invasion, which Russia had

preceded with a campaign of cyberattacks, had seriously disrupted Ukraine’s

digital networks. By the very next day, Musk responded that Starlink was active in Ukraine and that the

company would soon be sending more ground terminals to the country.

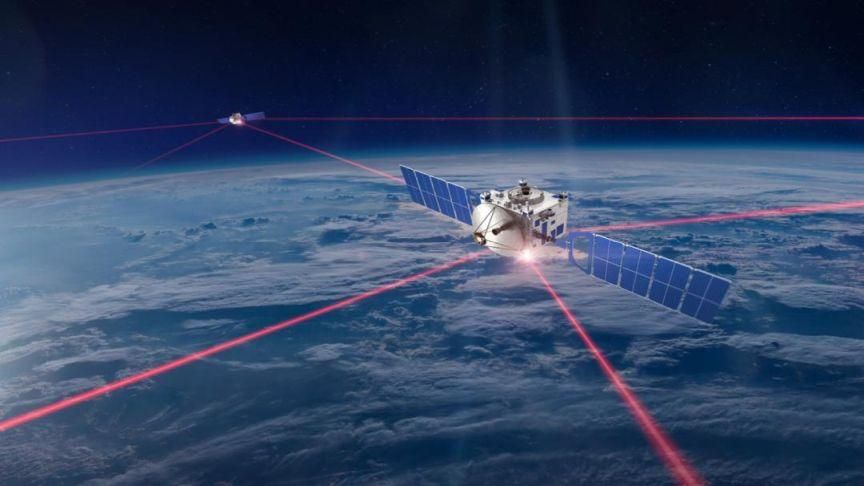

Starlink, which is a

subsidiary of Musk’s SpaceX, was not the only

Western technology company to come to Ukraine’s aid. By detecting

samples of Russian malware before the war began, Microsoft had warned Ukraine

about how the impending conflict could affect the country’s information

systems. Amazon Web Services (AWS) and Microsoft then migrated crucial

government data to their cloud servers for safekeeping, and after the war

began, Google and Microsoft offered continuing cybersecurity services. The

European aerospace conglomerate Airbus, the U.S.-based satellite manufacturer

ICEYE, and the space technology companies Capella Space, HawkEye

360, and Maxar Technologies have all been

providing invaluable battlefield imaging and data. The analytics company

Palantir has been aggregating this data to paint a more complete picture of the

war on the ground.

Although corporations

have long been involved in modern wars, their past roles have almost always

focused on the production of goods and equipment under government contracts. By

contrast, the conflict in Ukraine has initiated a new era of warfare in which

commercial companies, many of them American, are likely to provide and secure

critical digital infrastructure themselves—crucially, at their discretion and

even for no cost. For example, because of AWS and Microsoft’s

efforts to secure Ukrainian government data, Russia’s targeting of

data centers outside Kyiv at the start of the war failed to disrupt key

government services. Russia’s effort to deploy malware also had

little effect because of Microsoft’s intervention. And although Russia hacked Viasat, a U.S. company whose satellites were vital

to Ukrainian military and civil communications, Ukraine was able to pivot

within a few days to Starlink, on which President Volodymyr Zelensky relied for

nightly broadcasts to assure Ukrainians he was still in Kyiv and disprove

Russian misinformation that he had fled the country. Without such assistance

from Western companies, Ukraine’s government might have quickly collapsed. None

of these companies build weaponry; nonetheless, their ability to provide

crucial services in the digital realm has become what might be called warfare’s

new “commercial frontier”: essential battlefield capabilities that are

controlled and furnished by civilian technology firms.

Since the private

sector drives innovation in so many of these digital technologies and can

deploy them more nimbly than governments can, technology corporations are

likely to play an ever more important role in future wars. The challenge will

be ensuring that these companies’ interests are

aligned with national ones. In Ukraine, this alignment was largely due to

chance. Ukrainian leaders had developed close personal relationships with some

of the corporations that later came to the country’s aid. Moreover, Western

countries felt a sense of urgency to defend Ukraine and, crucially, anticipated

that the war would be short; the companies offering their services—mostly for

free—assumed that the costs of doing so would be low.

A Ukrainian soldier attending to a satellite in Kreminna, Ukraine

Future conflicts,

however, may have more complicated circumstances. One of the central

geopolitical unknowns of the present era is whether the United States would

defend Taiwan in the event of a Chinese invasion. But this question cannot be

answered by the U.S. government alone. In any such offensive, China’s plans

would almost certainly include attacks on Taiwan’s digital infrastructure,

scenarios that Beijing has already tested by launching cyberattacks and

severing Internet cables. Many of the same companies that protected

Ukraine will be needed to protect Taiwan. But many U.S. technology firms today

have a far greater economic stake in China than they

did in Russia in 2022, and it’s highly uncertain whether they would choose

to support Taiwan. Corporate leaders’ increasing involvement in global politics

and foreign policy will only add to this uncertainty. In October, for

instance, The Wall Street Journal reported that Elon Musk has

been in regular contact with Russian President Vladimir Putin since 2022; at

one point, Putin requested that Musk withhold Starlink access to Taiwan as a

favor to Chinese leader Xi Jinping. (It was not reported whether Musk agreed.)

Making matters even more complex, Musk is now a close adviser to President

Donald Trump and leads the administration’s government efficiency efforts.

Several other of the tech industry’s biggest names also joined Musk at Trump’s

inauguration. By seeking closer ties to the administration, the country’s

biggest tech firms may be trying to move national interests toward their own,

which may prioritize shareholder value more than national security.

The only way for the

U.S. government to ensure that its own interests are advanced at the commercial

frontier of warfare is to secure that frontier for itself. To do so, the

government must understand the capabilities needed to protect an ally’s digital

infrastructure during conflict and then seek to manage their use by

contracting the relevant vendors to provide their services under U.S.

governmental auspices. The government must seek to contract these new

capabilities before conflict breaks out, preposition these technologies’

physical assets in potential geopolitical hotspots, and begin to treat the

companies that are providing these services as allies. Only then can the United

States protect digital critical infrastructure in the wars in which it is involved,

whether directly or indirectly.

Corporate Deployment

In the early days of the

war in Ukraine, firms such as AWS, Microsoft, and SpaceX could not draw on any

previous experience of involvement in global conflict. And ultimately, their

actions were not spurred by grand strategies or government directives. They all

made quick decisions that were often based on direct contact with Kyiv or

Washington and that drew on favorable circumstances.

In the weeks leading

up to the war, Vadym Prystaiko, Ukraine’s then

ambassador to the United Kingdom, and Liam Maxwell, AWS’s director of

government transformation, discussed the idea of moving Ukraine’s data to the

cloud. Prystaiko, a former computer scientist, had

previously befriended Maxwell, a former chief technology officer for the

British government. On the day of the invasion, they sat together

and listed, with pen and paper, the essential data that would need

to be moved from government servers to the cloud, such as records

pertaining to land ownership, tax payments, and bank transactions. The massive

migration happened just before Russia attacked areas around Kyiv that house

critical data centers.

Corporate support for

Ukraine also relied on relationships with U.S. officials. Hours before the

invasion began, Microsoft uncovered a Russian malware attack on Ukraine’s

government ministries and financial institutions. During previous incidents,

Tom Burt, a senior security executive at Microsoft, had asked Anne

Neuberger, the White House’s senior cyber official, with whom he had a personal

relationship, to connect him to Ukrainian officials he could trust. When the

larger malware attack came, Microsoft had a direct line to Ukraine and was able

to quickly notify the country’s top cybersecurity authority.

The urgency of

Russia’s all-out invasion also created a special demand for corporate

involvement, because the private sector was better equipped than the U.S.

government to respond in real time. Big tech firms were able to

transfer huge quantities of Ukraine’s sensitive data almost immediately, with

AWS even delivering to Ukraine physical data-storage units known as Snowballs

to facilitate data transfers that would have taken too long to do over the

Internet. SpaceX activated Starlink in Ukraine just two days into the war. In

addition to covering all the initial service costs, SpaceX also paid to ship

enough terminals to meet Ukrainian demand from Southern California, where

SpaceX is based. “People were dying, and we thought we could be helpful in that

urgent phase of the conflict,” one SpaceX official later said. In contrast, it

took two weeks for the U.S. military to deliver its first supplies to Ukraine,

and some forms of military assistance took much longer. Major General Steven

Butow, the director of the Space Portfolio at the Pentagon’s Defense Innovation

Unit, said, “When we had delivered 25 things, there were already over 1,000

Starlink terminals being used every day.” Starlink has been described as “the

essential backbone” of Ukrainian battlefield communications.

The cost of all this

aid has become significant. To date, Microsoft’s support, which includes

hosting Ukraine’s data on its cloud for free, amounts to more than $500 million

worth of services. SpaceX spent more than $80 million on Starlink terminals and

services. The companies denied that financial interests played a

role in their decisions, but they also did not expect their involvement to last

as long as it has. At the start of the war, the

predominant view among the U.S. foreign policy establishment was that Ukraine

would lose and lose quickly. These companies had the same expectation,

but once it proved false some began to withdraw. Microsoft, for instance, still

provides the Ukrainian government with free cloud storage, but SpaceX

transferred the cost of Ukraine’s Starlink access to the U.S. government in

late 2022. The service became part of the United States aid package to Ukraine.

Some terminals have been provided by European allies, too.

The Fire Next Time

If Ukraine was the

technology industry’s initial foray into warfare, it won’t be the last. Yet in

future wars, many of the conditions that pushed corporate entities to deliver

massive aid to Ukraine may be different. For one thing, the

personal relationships that encouraged direct, fast communication between the

Ukrainian government and the big U.S. companies that could help it may not

exist. The corporations that mobilized for Ukraine were also acting on

decisions they had never anticipated making. They are far more aware of the

risk that conflicts can last longer than expected, that costs can accumulate to

significant levels, and even that overwhelming public support to help a country

in conflict can wane over time. As of December 2024, opinion polls

showed that for the first time, a majority of

Americans expressed a desire to end the war in Ukraine quickly, even if it

meant Ukraine forfeiting territory.

All these factors

will influence how the commercial frontier will play into what might be the

next big conflict: Taiwan. A Chinese invasion of the island would

likely start with a campaign to dismantle the Taiwanese government’s digital

infrastructure. In anticipation, Taiwan has discussed Starlink access with both

SpaceX and U.S. government officials. But Musk’s appetite for supporting Taiwan

through Starlink appears low. In 2023, he compared China’s relationship with

Taiwan to that between the United States and Hawaii, and

asserted that the island was an “integral part of China.” Taiwan is

wary of relying on Starlink access, as well, owing to Musk’s business links to

China, where Tesla operates several large factories and recently broke ground

on its first energy-storage plant outside the United States. As a result,

Taiwan has decided to partner with Eutelsat OneWeb, a European provider, and

discussed partnering with Amazon’s Project Kuiper, too. Neither has nearly as

many satellites or the same proven resilience as Starlink. Separately, Taiwan

has begun building its satellite network, though by its projections, it will

not have a communications satellite in orbit until at least 2026, and it will

take far longer to field the constellation of satellites needed to operate an

effective system.

SpaceX is not the

only company whose support for Taiwan is uncertain. Although AWS, Google, and Microsoft

have all significantly curtailed their operations in China, each continues to

rely on Chinese manufacturing and sells to the Chinese market. That these tech

firms will have potential conflicts of interest underscores the importance of

developing a U.S. strategy for the commercial frontier, centered on

guaranteeing to allies such as Taiwan the availability of essential

technological capabilities before a military confrontation arises. Doing so

would ensure a greater alignment between governmental and corporate interests

in future wars; establish any necessary relationships and connections in

advance; and involve newer companies in emerging industries, such as artificial

intelligence and mesh communications networks, with technologies that could one

day prove essential on the battlefield. Deploying such capabilities now has

geopolitical advantages, as well. In the case of Taiwan, a U.S. government-led

effort to secure the island’s digital infrastructure would not only support the

island in the face of a Chinese invasion—it could help to deter an invasion in

the first place because China would feel less certain about its ability to

cripple Taiwan without armed conflict.

Ready, Set

The U.S. government,

through the Department of Defense, should build strategies for protecting

allies’ digital infrastructure ahead of potential conflicts. First,

the department must fully understand each country’s needs. It must then

contract the relevant vendors, such as the companies that supported Ukraine, to

provide access to their services immediately in the event of a conflict.

Physical assets like Starlink terminals and AWS Snowballs should be in place

beforehand. For capabilities that do not require pre-positioning, such as AWS

cloud licenses or radio-frequency satellite communications, the U.S. government

does not even have to spend the money today; it can contract now for future

services, so that if an emergency arises, pricing and provisioning for vendors’

licenses are set and vendors know what they need to deliver. Given the lessons

of the war in Ukraine, which demonstrated that private-sector companies could

deploy technologies far faster than the government, the United States should

provide contracts in advance for companies that can offer immediate logistical

support to an ally in the event of an invasion.

The Department of

Defense’s authority over the use of these capabilities would not only help

ensure that the right technologies reach allies in a time of need but also ease

concerns over some regulatory controls. Ukraine’s use of Starlink, for example,

raised questions about possible violations of the International Traffic in Arms

Regulations, which govern the ability of U.S. companies to provide military

technologies to other countries. Management by the Department of Defense will

also streamline the process of introducing new technologies into warfare’s commercial frontier. To identify new players and

determine necessary capabilities, the Department of Defense should establish an

advisory group comprising officials from the National Security Council and the

Department of Homeland Security’s Cybersecurity and Infrastructure Security

Agency as well as executives from the companies that supported Ukraine and

policy experts who have war-gamed Taiwan scenarios. The department has tools to

reduce acquisition time of new capabilities to a few

years or to deploy existing solutions under development urgently at 80 percent

readiness. It can also make any immediate purchases through its Rapid

Acquisition Authority, which has a budget of $800 million.

The U.S. government

should manage public-private partnerships with active diplomacy, treating

corporate entities and their leaders as it would allies. This means being

prepared to hold technology companies accountable for

actions that may undermine the national interest. But it also means including

them in national security discussions, providing certain personnel with

security clearances, and sharing information about threats that their technologies

could be used to counter. Additionally, the government should

praise firms for acting in the national interest, appealing to their desires to

maintain positive public images. Ukraine, for instance, awarded “peace prizes”

to AWS, Google, and Microsoft; Ukrainian officials have likewise praised Musk

and SpaceX publicly and privately.

The U.S. government,

on the other hand, has missed critical opportunities to recognize these firms’

work in Ukraine. For instance, in September 2022, when SpaceX tried to shift

the cost burden of Starlink service in Ukraine over to the Pentagon, after months

of paying for most of it , media coverage

framed the company as uncharitable—a characterization the U.S. government did

not attempt to change. A year later, Musk was heavily criticized after he

refused to activate Starlink for a Ukrainian drone operation in the Black Sea

because he feared the operation would be too escalatory. The U.S. government

likely felt the same—at this point, it was prohibiting Ukraine from using U.S.

weapons for offensive operations—but remained silent. Other tech leaders watched

Musk deal with the complexities of war without the apparent support of the U.S.

government; this experience may lead them to hesitate to offer their solutions

in the future.

In the decisive early

days of the Taiwan conflict, resilient digital critical infrastructure may

again prove vital, as it did in Ukraine. Securing that infrastructure for the

future requires that the U.S. government act now. Leaders in Washington must recognize

that, although corporate interests and national interests will not always

align, commercial capabilities may be essential to national security

objectives. Because of this, the government must devise a framework that allows

these interests to complement each other. The United States’ continued ability

to defend its allies and partners may soon depend on how well it can harness

U.S. tech companies’ growing power.

For updates click hompage here