By Eric Vandenbroeck

and co-workers

As China emerges this

month from the all-important 20th National Congress of the Chinese Communist

Party (CCP), its leadership will have to confront the most difficult set of

economic choices it has faced in decades. It can shift out of an economic

growth model that has generated a great deal of wealth, albeit at the cost of

growing inequality, surging debt, and an increasing amount of wasted investment

over the last decade. Or Beijing can continue with its current economic model

for a few more years until these rising costs force it into an even more

painful transition.

The problem facing

China is one that the German American economist Albert Hirschman described many

decades ago. All rapid growth is unbalanced growth, Hirschman noted, and a

successful development model is one in which unbalanced growth addresses and

reverses the existing imbalances in the economy. But as these are reversed and

the economy develops, the model becomes increasingly irrelevant to the

original imbalances and eventually creates a different set of problems.

Unfortunately,

Hirschman noted, abandoning a successful development model is a complex. Its

success tends to generate a set of deeply embedded political, business,

financial, and cultural institutions based on the continuance of the model, and

there is likely to be strong institutional and political opposition to any

substantial reversal.

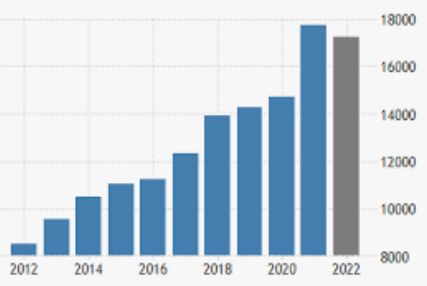

Chinese

GDP Projection

That’s where China finds

itself today. Its high-investment development

model was designed to resolve China’s extraordinary investment deficiency, but

nearly four decades later, it left China with an excessively high investment

rate. According to the World Bank, investment typically comprises around 25

percent of global GDP, ranging from 17 to 23 percent for more mature economies

to 28 to 32 percent for developing economies in their high-growth stages. For a

decade, however, China has invested an amount equal to 40 to 50 percent of its

annual GDP every year. It must reduce this unusually high level by a lot.

Still, growth so dependent on investment probably cannot do so without a sharp

slowdown in overall economic activity.

Deeper Into Debt

High investment rates

weren’t always a bad thing for China. The country was hugely underinvested in

infrastructure, logistics, and manufacturing capacity when it began its era of

“reform and opening up” in the late 1970s, after five decades that included war

with Japan, civil war, and Maoism. What it needed above all was a development

model that prioritized rapid investment.

The approach it took

over the next several years did just that. First, Beijing forced up the

domestic savings share of GDP needed to fund investment. In any economy,

everything produced that is not consumed is, by definition, saved, so forcing

up the savings share of GDP means forcing down the consumption share.

Beijing did this by

systemically constraining the growth of the household

share of GDP. A country’s total income is divided among households,

businesses, and the government, and households, unlike businesses and

government, consume most of what they earn. In practice, forcing down the

consumption share meant ensuring that businesses and government retained a

disproportionate share of what was produced and households a declining share.

The smaller the share households retain of GDP, the lower the consumption share

and the higher the savings share.

By the late 1990s,

the domestic savings share of GDP reached 50 percent, the highest level ever

recorded by any country. The banking system, China’s main intermediary for

savings, made these enormous savings available for Chinese businesses, property

developers, and local governments at artificially low, government-determined

interest rates. The consequence was rapid growth driven by high levels of

investment. That dynamic allowed China to close its underinvestment gap at an

astonishing pace.

But like every other

country that has followed a similar model, including the Soviet Union and

Brazil in the 1950s and 1960s and Japan in the 1970s and 1980s, China faced a

hidden trap. Once China closed the gap between its level of capital stock and

the level that its workers and businesses could productively absorb, it would

need to shift to a different growth strategy that de-emphasized investment in

favor of consumption. This gap was probably closed at least 15 years ago when

China’s debt burden rose rapidly.

This was not a

coincidence. Usually, when an economy channels large amounts of debt into

productive investment, the resulting rise in its GDP is likely to exceed the

rise in debt, and the country’s debt burden remains low. But when debt is used

to fund investments whose economic benefits are less than the cost of labor and

resources employed (known as “nonproductive investment”), debt rises faster

than GDP. China’s debt burden began to surge around

2006 to 2008.

Since then, China’s

official debt ratio has risen from roughly 150 percent to nearly 280 percent of

GDP–one of the fastest increases any country has ever experienced. The primary

sources of this rising debt burden were a private investment in China’s

property sector, including buildings filled with empty apartments that had been

purchased for speculative reasons, and investment by local governments in

excess infrastructure, such as overly ambitious rail systems, underutilized

roads and highways, and trophy stadiums and convention centers.

While the property

and infrastructure sectors had contributed so much to China’s economic activity

that they had become politically important to local elites, economic

policymakers became increasingly concerned that the only way they could regain

control of debt was by constraining nonproductive investment in these two

sectors. But with these accounting for over half of all Chinese GDP growth in

recent years–and a lot more than half during challenging periods for the

economy–it was almost impossible to constrain them without causing a sharp drop

in economic activity.

Bursting The Bubble

Regulators finally

took an essential first step in addressing the surge in debt last year when

they decided to clamp down on leverage by making it more difficult for the most

indebted property developers to borrow. For years, these developers had been in

a race to borrow as much as they could, not just from banks but also from

customers, suppliers, and contractors. They had used these funds to acquire as

much property as possible, and as long as real estate prices could be counted

on to rise forever, they took little credit risk and were always able to sell

at a profit.

But with the property

sector accounting for 20 to 30 percent of all economic activity, it was

inevitable that any sharp contraction in real

estate would quickly become self-reinforcing and lead to a substantial–and very

unwelcome–slowdown in economic activity. What was perhaps unexpected after last

year’s clampdown on the property sector’s borrowing was how financial distress

spread to other parts of the economy. This was especially true for local

governments, for which land sales comprised the largest single source of

revenues; households suddenly began to worry that prices wouldn’t rise

indefinitely, and businesses were directly and indirectly affected by

insolvency in the property sector.

With growing concerns about the pace of China’s economic

slowdown, Beijing can respond only in limited ways. One option is to return to

the days of rapid, debt-fueled growth, either by attempting to revive the

property sector or make up for its decline by significantly increasing spending

on infrastructure. Local governments have been eager, almost desperate, to

revive the property market, but it may be too late for that if homebuyers’ expectations that home prices in

China can keep rising have been permanently punctured.

Moreover, Beijing

officials seem very reluctant to return to the old ways of doing business in which

developers took on enormous amounts of debt to finance speculative new

projects. With Chinese residential real estate priced at roughly three times

the comparable level in the United States and with the property sector

representing such an extraordinarily high share of total economic activity,

most economic policymakers have long wanted to see the market cool down.

More likely is that

the Chinese government will compensate for the adverse impact of a slower and

smaller property market, at least partly, by stepping up spending on

infrastructure. Beijing already seems willing to follow this path and has told

local governments to accelerate or increase their infrastructure spending

plans.

But building more

bridges and high-speed railway systems still means allowing growth to be driven

mainly by nonproductive investment, as it has been during the past decade. This

will cause China’s debt burden to rise and resources to be misallocated until

the economy can no longer sustain the consequences. In previous cases, the

result has usually been a very disruptive adjustment, often in the form of

a financial crisis akin to Brazil’s in the early 1980s.

The second option for

Beijing is to maintain high growth by rebalancing the economy increasingly

toward consumption. Beijing has been trying to do this since at least 2007, but

an increase in consumer spending requires increasing the share households

retain of GDP. Ordinary people, in other words, would have to receive a larger

share of what the economy produces in the form of higher wages, stronger

pensions, more welfare benefits, and so on, and this would have to be paid for

by Beijing and local governments by giving up some of their share of GDP.

Such an adjustment is

tough to accomplish politically. The distribution of political power in

China, as in any country, is partly the consequence of the distribution of

economic power, and a significant shift in the latter would almost certainly

set off a commensurate shift in the former. That doesn’t mean it cannot happen,

but so far, there is no evidence that China will manage a rebalancing of the

distribution of income than other countries.

The second option for

Beijing is to maintain high growth by rebalancing the economy increasingly

toward consumption. Beijing has been trying to do this since at least 2007, but

an increase in consumer spending requires increasing the share households

retain of GDP. Ordinary people, in other words, would have to receive a larger

share of what the economy produces in the form of higher wages, more vital

pensions, more welfare benefits, and so on, and this would have to be paid for

by Beijing and local governments by giving up some of their share of GDP.

Such an adjustment is

tough to accomplish politically. The distribution of political power in China,

as in any country, is partly the consequence of the distribution of economic

power. A significant shift in the latter would almost certainly set off a

commensurate shift in the former. That doesn’t mean it cannot happen. Still, so

far, there is no evidence that China will manage a rebalancing of the

distribution of income that other countries with similar problems have

been unable to achieve.

Finally, suppose

Beijing is determined to act now to control the unsustainable increase in debt

and cannot rebalance the economy. In that case, the third option is simply for

Beijing to allow GDP growth rates to fall sharply, probably to below three (or

even two) percent. If handled correctly, most of the cost of this decline will

fall on the government sector and not on households, so this won’t matter too much

to ordinary people. Still, it does mean slower growth for the Chinese economy

overall and especially in the state apparatus.

After almost three

decades with the highest investment share of GDP in history, too much of

China’s investment is directed, by necessity, to projects that create economic

activity (and debt) but that does not create real economic value. That is why

it is unlikely that China can continue to invest anywhere near the same amount

every year.

In that case, China’s

only options are to bring down investment rapidly and accept the consequences

of much lower growth or to maintain high levels of growth by forcing continued

high rates of investment until the resulting surge in its debt burden makes it

difficult or impossible to stay on that path. One way or another, in other

words, Chinese growth will slow sharply, and how it does will have profound

consequences for the country, the CCP, and the global economy.

For updates click hompage here