By Eric Vandenbroeck

and co-workers

We started with this

subject after a reader sent us a copy of the recently poorly written and

inaccurate book Tracers in the Dark By Andy Greenberg. We double-checked

its content and realized that non of the

severe crypto criminals (which included Sam Bankman-Fried) were

even mentioned in the book. When we then wrote our Part One, followed by Part Two and Part Three,

and now Part Four, where we finalize our

investigation of the Macroeconomic Impacts of the Crypto collapse and the undercollateralized,

overcollateralized, and fiat-backed stablecoins. It is also known that Sam Bankman-Fried's collapsed cryptocurrency exchange FTX himself

has more than $5bn (£4.1bn) of assets. Prosecutors have accused FTX's former

chief executive Sam Bankman-Fried of orchestrating an "epic" fraud

that may have cost billions of dollars to investors, customers, and lenders.

The journey of FTX in and out of Hong Kong was

driven by the quest for friendlier crypto regulations, according to US court

documents related to lawsuits against the defunct crypto exchange’s former

management, including its chief executive officer (CEO) Samuel Benjamin Bankman-Fried

and his ex-girlfriend Caroline Ellison.

FTX, once the world’s

third largest crypto exchange valued at $32 billion, filed for Chapter 11

bankruptcy protection in the US on November 11. Bankman-Fried, who co-founded

FTX, pleaded not guilty to eight criminal charges in a New York court on

January 3, according to media reports. The charges include fraud, money

laundering and illegally donating money to US politicians to foster a conducive

regulatory environment for FTX. By pleading not guilty, the 30-year-old has set

the stage for a potentially explosive trial tentatively scheduled for October.

Ellison and Gary

Wang, a co-founder of FTX, pleaded guilty to fraud charges last December 19.

Ellison is the former CEO of Alameda Research LLC, a crypto hedge fund

previously majority-owned by Bankman-Fried. They are likely to be jailed in the

US for years. Bankman-Fried co-founded Alameda in November 2017 in a

three-bedroom apartment in Berkeley, California, USA, with the downstairs

serving as its office, said a lawsuit filed in the US bankruptcy court for

Delaware on December 27. The plaintiffs are Americans Austin Onusz and Nicholas Marshall, a Turkish citizen named Hamad

Dar, and a Dutchman named Cedric Kees van Putten. The defendants include FTX Trading, Alameda,

Bankman-Fried, Ellison, and Wang.

In late 2018, Alameda

“moved its headquarters from California to Hong Kong due to the difficulty of

establishing and maintaining relationships with banks in the US as a

cryptocurrency trading firm,” said the lawsuit. Despite marketing materials

offering investors and lenders “high returns with no risk” and “no downside,”

finding investors and lenders were complex since banks and traditional Wall

Street firms largely shunned crypto because of the lack of regulation and

oversight, the lawsuit explained.

“In late 2018, the

headquarters of Alameda Research was relocated to Hong Kong. The team at

Alameda Research included Defendant Bankman-Fried’s

close friends (and later co-founders for FTX) Nishad Singh and Gary Wang. Defendants

Caroline Ellison and Sam Trabucco

were also part of the group. Upon moving to Hong Kong, the group lived like

college students and fiercely traded crypto,” said a class action complaint

filed in the US district court of Miami on December 7. “The firm shifted to

Hong Kong, partly to take advantage of arbitrage opportunities in Asian bitcoin

markets – including the price discrepancy between BTC in Japan and BTC

everywhere else,” said the complaint.

“According to Defendant

Bankman-Fried, while attending meetings in Hong Kong, he received encouragement

from large players in cryptocurrency. He summoned Defendant Wang to Hong Kong,

and they went to work creating the FTX Group,” disclosed the lawsuit filed in

the US bankruptcy court for Delaware.

FTX launched a crypto

exchange from its Hong Kong offices on May 9, 2019, said the lawsuit. “As would

later become significant, the FTX Executive Defendants did not implement

internal controls over customer property when they created and launched the FTX

Group, nor did they do so later.”

FTX launched its

crypto token, FTT, on July 27, 2019. To maintain its price, Alameda, then based

in Hong Kong, served as FTT’s leading market maker where Alameda could set

prices for the token, the lawsuit said. “Moreover, by keeping half the tokens

uncirculated, FTX.com (the international crypto exchange of FTX) and Alameda

could artificially prop up the price while still counting the uncirculated

tokens as assets.”

“The FTX Group

relocated from Hong Kong to the Bahamas in September 2021, reportedly citing

the favorable regulatory environment amidst regulators worldwide beginning to

examine cryptocurrencies and China outlawing cryptocurrency transactions,” said

the lawsuit.

On September 27,

2021, Markets Insider quoted Bankman-Fried saying FTX was moving from Hong

Kong to the Bahamas due to the Caribbean nation’s crypto-friendly legal

framework. Still, he denied the move was due to China banning all crypto

businesses on September 24, 2021.

“Leading up to the

collapse of FTX (in November 2022), Ellison lived with nine other FTX or

Alameda colleagues in Bankman-Fried’s US$30 million

penthouse in the Bahamas. She reportedly paid SBF rent and occasionally had a

romantic relationship with him. In 2021, Ellison tweeted about recreational

stimulant use. Upon information and belief, Ellison left the Bahamas and moved

back to Hong Kong,” the class action complaint said.

As reported in parts

one and three, Ellison and Wang are currently in the US under bail.

Bankman-Fried’s Hong Kong

Affiliations

After FTX shifted

from Hong Kong to the Bahamas in September 2021, Bankman-Fried founded a

company in Hong Kong called FTX Trading Limited on September 29, 2022,

according to Hong Kong corporate records. This firm had a paid-up capital of HK$10,000

(US$1,279) and was fully owned by FTX Trading Limited, a company registered in

Antigua and Barbuda, which also owned FTX.com. Less than two months later, on

November 11, 2022, FTX Hong Kong filed for Chapter 11 bankruptcy

protection, according to

Kroll, a US risk

consultancy handling creditor claims on FTX.

FTX Hong Kong’s first

directors were Bankman-Fried, and Jen Chan Luk-wai, a

Hong Kong woman who was FTX’s chief financial officer, Hong Kong corporate

records reveal. On November 9, 2022, a Hong Kong man, Clement Joshua Ip,

replaced Chan as director of this short-lived company. Ip co-founded Genesis

Block, a Hong Kong-based over-the-counter crypto trading firm. Genesis suffered

from the collapse of FTX on November 11 and closed its trading operations on

December 10, Reuters reported.

In the corporate

records of FTX Hong Kong, Bankman-Fried registered an address at a flat in Star

Studios I on 8-10 Wing Fung Street in Wanchai. Star

Studios I is a residential tower with flats ranging from 206 to 457 square

feet, which is small by US standards.

Around the time

Alameda moved from Berkeley to Hong Kong on December 14, 2018, Bankman-Fried

established another Hong Kong company, Cottonwood Grove Limited, according to

Hong Kong corporate records. At its founding, the company had paid-up capital

of HK$10,000 and was 100 percent owned by Bankman-Fried. In 2021, Cottonwood’s

paid-up capital increased to HK$1.01 million, wholly owned by a British Virgin

Islands company, Alameda Research Limited, Hong Kong corporate records reveal.

In 2021, Cottonwood had three directors: Bankman-Fried, Charis Law Wing-man, and

Jen Chan, Hong Kong corporate records show.

FTX Trading, Alameda

Research Limited, and Cottonwood also filed for Chapter 11 bankruptcy

protection on November 11, 2022, according to Kroll.

“The implosion of the

FTX exchange also showed that the platforms themselves can be ruinously

problematic in their own right. After all, the FTX case has made clear how

investors seeking genuine, if risky, frontier investments can find themselves

overlooking, or even excusing, the most egregious behavior,” said Steve Vickers,

the CEO of Steve Vickers and Associates, a Hong Kong risk consultancy.

#Sam Bankman-Fried,

mastermind of the multibillion-dollar FTX-Alameda Research fraud, pleaded

not guilty to conspiracy and wire fraud. Drawing on conspiratorial

theories, some have taken this as a sign that Bankman-Fried will pull

strings with friends in high places to finagle his way toward acquittal.

The plea might well

be strategic. Bankman-Fried might be holding out for an improved plea deal.

Maybe he thinks a show of confidence can buttress public and investor faith in

him or be enough to convince a jury of his innocence.

But an equally likely

explanation for the decision to go to a trial in October is that Bankman-Fried

and his allies are in a deep cocoon of delusion about the substance of the

case. Regardless, he is unlikely to win a verdict of innocence if things

proceed to trial.

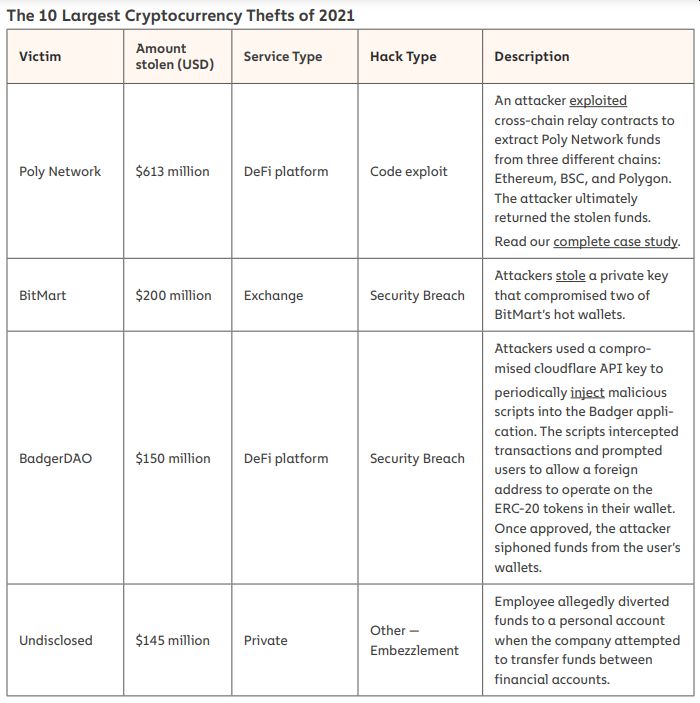

As in most years, the

ten largest hacks of 2021 accounted for most of the funds stolen at $1.81

billion. Seven of these ten attacks targeted (by us earlier mentioned 'DeFi platforms') in particular. The table below breaks down

the details of each theft.

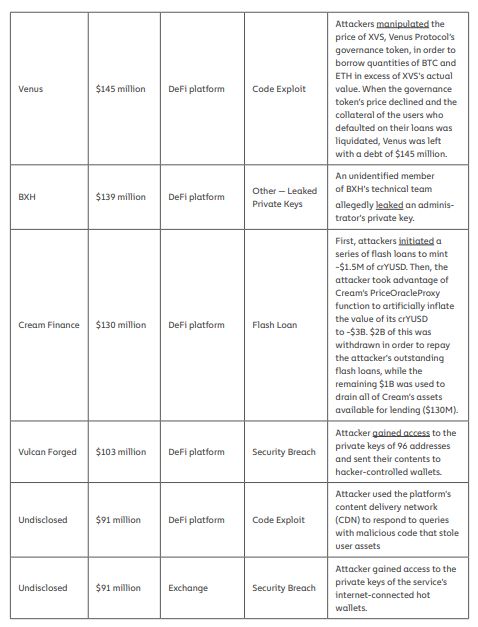

Total yearly cryptocurrency value received by scammers

| 2017–2021

That represents a rise of 81% compared to 2020, a year

in which scamming activity dropped significantly compared to 2019, in large

part due to the absence of any large-scale Ponzi schemes. That changed in 2021

with Finiko, a Ponzi scheme primarily targeting

Russian speakers throughout Eastern Europe, netting more than $1.1 billion from

victims.

Another change that contributed to 2021’s increase in

scam revenue: the emergence of rug pulls, a relatively new scam type

particularly common in the DeFi ecosystem, in which

the developers of a cryptocurrency project — typically a new token — abandon it

unexpectedly, taking users’ funds with them. We’ll look at both rug pulls and

the Finiko Ponzi scheme in more detail later in the

report.

As the most effective

form of cryptocurrency-based crime and one uniquely targeted toward new

Scamming poses one of the biggest threats to cryptocurrency’s continued

adoption. But as we’ll explore, some cryptocurrency businesses are taking

innovative steps to leverage blockchain data to protect their users and nip

scams in the bud before potential victims make deposits.

Total yearly cryptocurrency value received by

investment scams | 2017–2021

This also tells us that

the average amount taken from each victim increased.

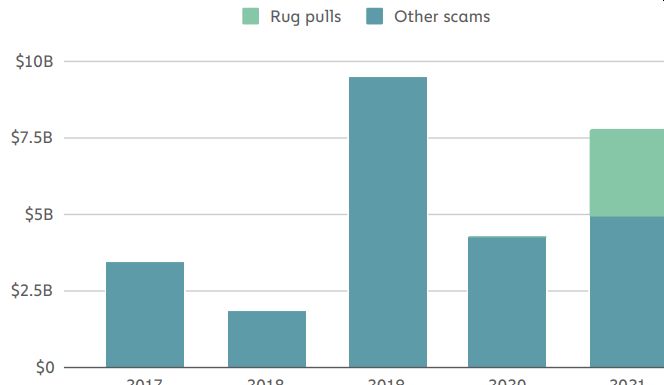

Scammers’ money

laundering strategies haven’t changed all that much. As in previous years, most

cryptocurrency sent from scam wallets ended up in mainstream exchanges.

Exchanges using Chainalysis KYT for transaction monitoring can see this

activity in real-time and take action to prevent scammers from cashing

out.

The number of

financial scams active at any point in the year — active meaning their

addresses was receiving funds — also rose significantly in 2021, from 2,052 in

2020 to 3,300.

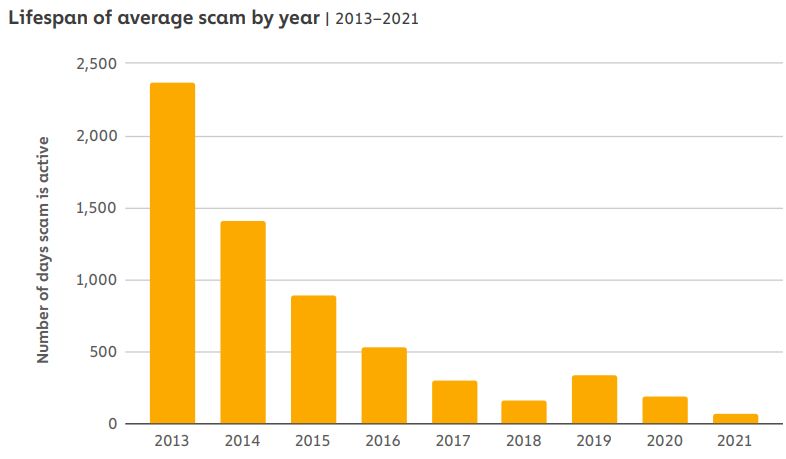

This goes hand in

hand with another trend we’ve observed over the last few years: The average lifespan

of a financial scam is getting shorter and shorter.

September 2021, the

CFTC filed charges against 14 investment scams touting themselves as providing

compliant cryptocurrency derivative trading services — a common scam typology

in the space —. In contrast, they had failed to register with the CFTC as

futures commission merchants. Previously, these scams may have been able to

continue operating for longer. As scammers become aware of these actions, they

may feel more pressure to close up shop before drawing the attention of

regulators and law enforcement.

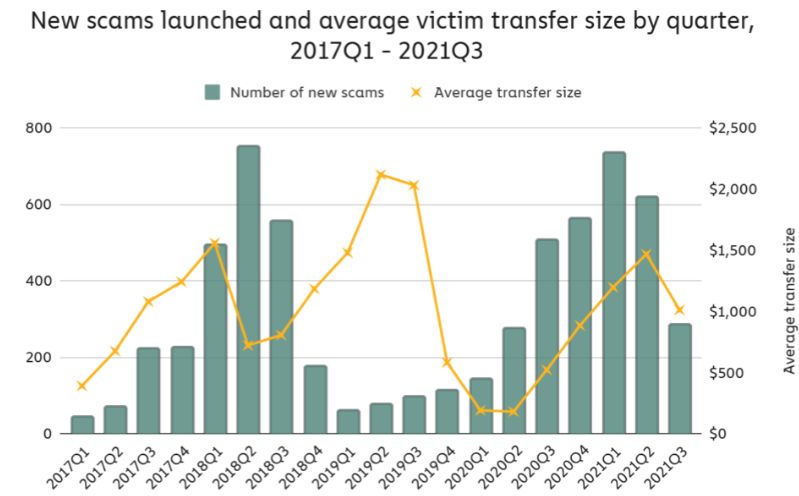

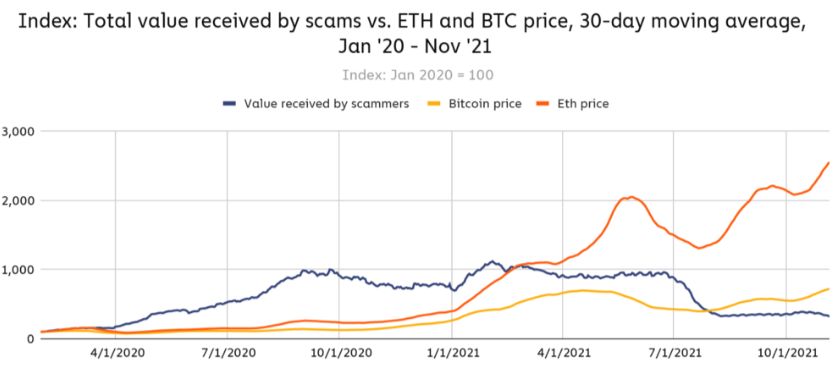

At the same time,

we’re seeing the end of a long-standing statistical relationship between

cryptocurrency asset prices and scamming activity. Scams typically come in

waves corresponding with sustained price growth in popular cryptocurrencies

like Bitcoin and Ethereum, which also lead to influxes of new users. This is

reflected in the chart below — scamming activity spiked following bull runs in

2017 and 2020. This isn’t all that surprising.

New, less savvy users

attracted by cryptocurrency’s growth are more likely to fall for scams than

more seasoned users. However, the relationship between asset prices and

scamming activity is now disappearing. Above, we see scam activity rise in

concert with Bitcoin and Ethereum prices until 2021, when scamming activity

stays flat and even begins to drop regardless of whether prices rise or fall.

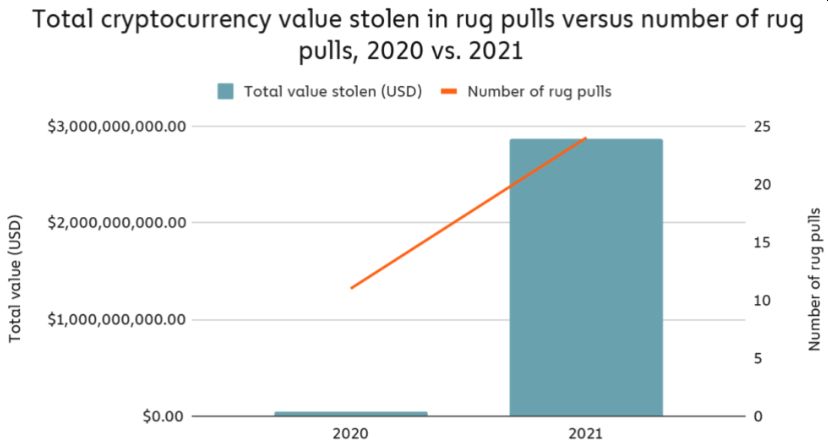

Rug pulls are the latest innovation in scamming. Rug pulls have emerged as the

go-to scam of the DeFi ecosystem, accounting for 37%

of all cryptocurrency scam revenue in 2021 versus just 1% in 2020. Index: Total

value received by scams vs. ETH and BTC price, 30-day moving average Index.

This isn’t all that

surprising. New, less savvy users attracted by cryptocurrency’s growth are more

likely to fall for scams than more seasoned users. However, the relationship

between asset prices and scamming activity is now disappearing.

Rug pulls have

emerged as the go-to scam of the DeFi ecosystem,

accounting for 37% of all cryptocurrency scam revenue in 2021 versus just 1% in

2020.

Rug pulls are

prevalent in DeFi because, with the right technical

know-how, it’s cheap and easy to create new tokens on the Ethereum blockchain

or others and get them listed on decentralized exchanges (DEXes)

without a code audit. That last point is crucial — decentralized tokens are

meant to be designed so that investors holding governance

tokens can vote on how

assets in the liquidity pool are used, making it impossible for the developers

to drain the pool’s funds. While code audits that would catch these

vulnerabilities are standard in the space, they’re not required to list on most

DEXes, hence why we see so many rugs pull.

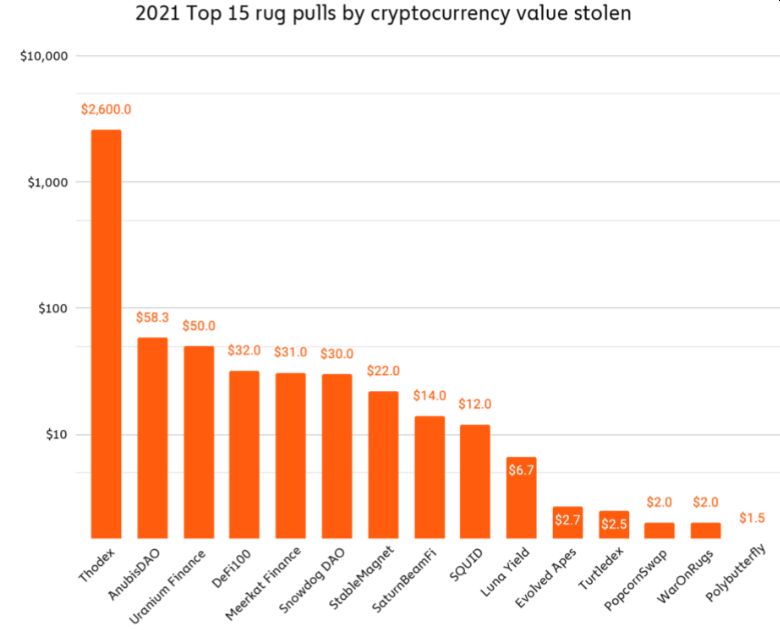

The chart below shows 2021’s top 15 rug pulls in order

of value stolen.

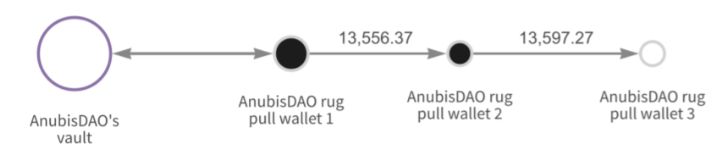

AnubisDAO, the second-biggest rug pull of 2021 at over $58

million worth of cryptocurrency stolen, provides an excellent example of how

rug pulls in DeFi work.

AnubisDAO launched on Thursday, October 28, 2021, claiming it

planned to provide a decentralized, free-floating currency backed by a basket

of assets. With little more than a DOGE-inspired logo — the project had no

website or white paper, and all of its developers went by pseudonyms — AnubisDAO raised nearly $60 million from crypto investors

practically overnight, all of whom received the project’s ANKH token in

exchange for funding the project’s liquidity pool. But a mere 20 hours later,

all the funds raised, primarily held in wrapped Ethereum (wETH),

disappeared from AnubisDAO’s liquidity pool, moving

to a series of new addresses.

Finiko:

2021’s Billion-Dollar Ponzi Scheme

Fumiko was a

Russia-based Ponzi scheme that operated from December 2019 until July 2021. At

that point, it collapsed after users found they could no longer withdraw funds

from their accounts with the company. Fumiko invited users to invest with

either Bitcoin or Tether, promising monthly returns of up to 30%, and

eventually launched its coin that traded on several exchanges.

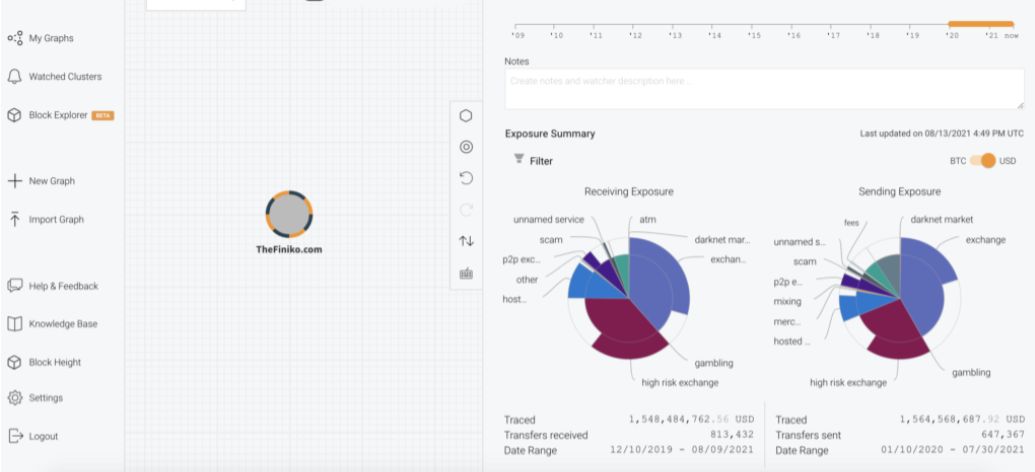

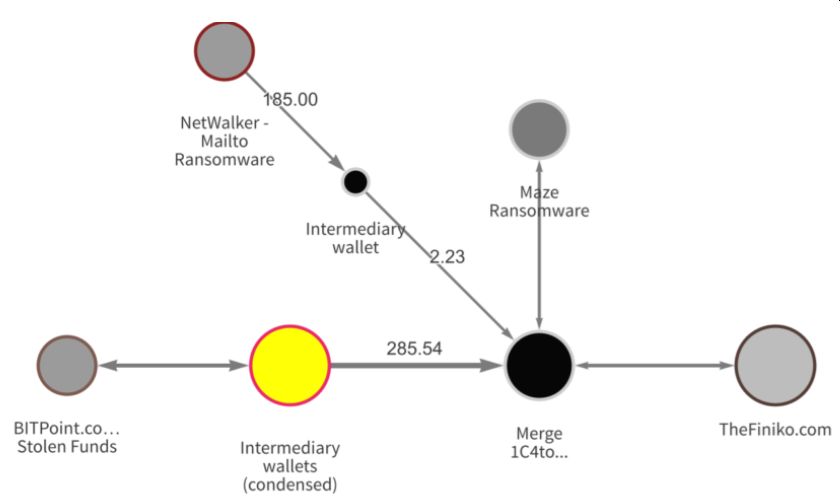

According to

the Moscow

Times, Finiko

was headed up by Kirill Doronin, a famous Instagram influencer associated with

other Ponzi schemes. The article notes that Finiko

was able to take advantage of challenging economic conditions in Russia

exacerbated by the Covid pandemic, attracting users desperate to make extra

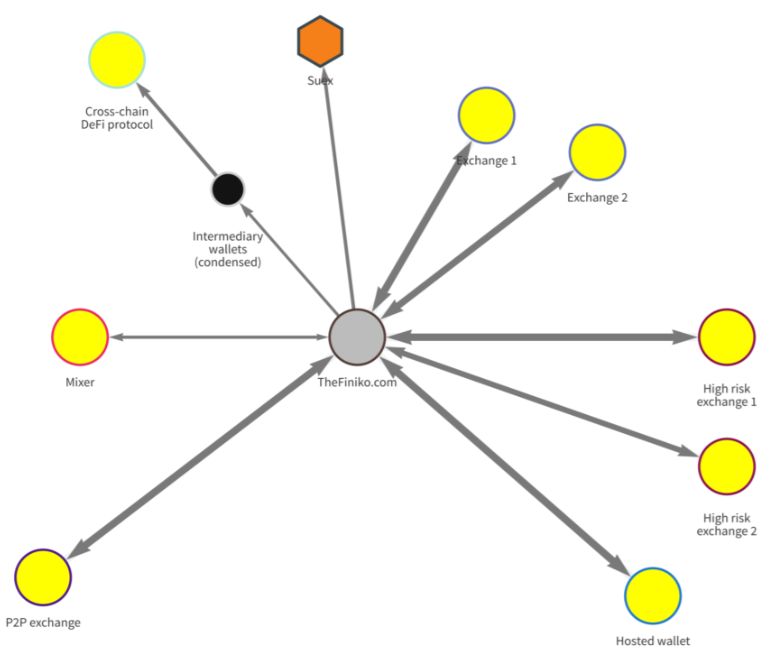

money. Chainalysis Reactor shows us how

prolific the scam was.

During the roughly 19

months it remained active, Finiko received over $1.5

billion worth of Bitcoin in over 800,000 separate deposits. While it’s unclear

how many individual victims were responsible for those deposits or how much of

that $1.5 billion was paid out to investors to keep the Ponzi scheme going, it’s

clear that Finiko represents a massive Bitcoin fraud

perpetrated against Eastern European cryptocurrency users, predominantly in

Russia and Ukraine.

Fumiko sent most of

its more than $1.5 billion worth of cryptocurrency to mainstream exchanges,

high-risk exchanges, a hosted wallet service, and a P2P exchange. However, we

don’t know what share of those transfers represent payments to victims in order

to give the appearance of successful investments.

Most interesting of

all though is Finiko’s transaction history with Suex, an OTC broker that was sanctioned by OFAC for its role in laundering funds

associated with scams, ransomware attacks, and other forms of

cryptocurrency-based crime. Between March and July of 2020, Finiko

sent over $9 million worth of Bitcoin to an address that now appears as an

identifier on Suex’s entry into the Specially

Designated Nationals (SDN) List. This connection underlines the prolificness of Suex as a money

laundering service, as well as the crucial role of such services generally in

allowing large-scale cybercriminal operations like Finiko

to victimize cryptocurrency users.

Soon after Finiko’s collapse in July 2021, Russian authorities arrested

Doronin, and later also

nabbed Ilgiz Shakirov, one

of his key partners in running the Ponzi scheme. Both men remain in custody,

and arrest warrants have reportedly been issued for the rest of Finiko’s founding team.

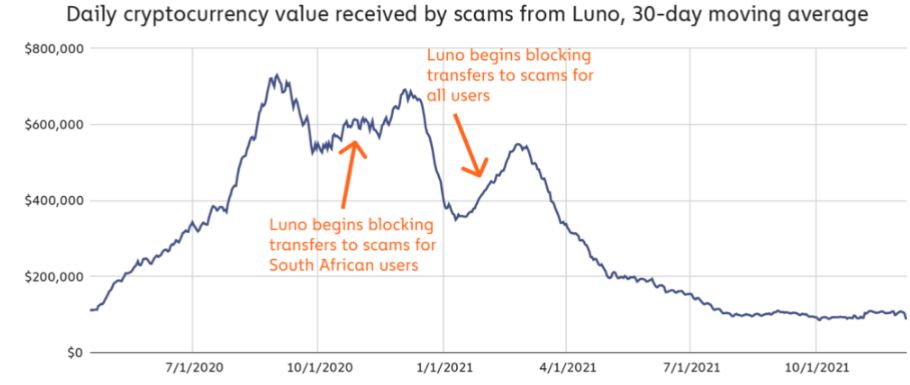

Luno

is a leading cryptocurrency platform operating in over 40 countries, with an

especially heavy presence in South Africa. In 2020, a major scam targeted South

African cryptocurrency users, promising large investment returns. Knowing that

its users were at risk,

The first step was a

warning and education campaign. Using in-app messages, help center articles,

emails, webinars, social media posts, YouTube videos, and even one-on-one

conversations, Luno showed users how to spot the red

flags that indicate an investment opportunity is likely a scam and taught them

to avoid pitches that appear too good to be true.

Luno then

went a step further and began preventing users from sending funds to addresses

it knew belonged to scammers. That’s where Chainalysis

came in. As the leading blockchain data platform, we have an entire team

dedicated to unearthing cryptocurrency scams and tagging their addresses in our

compliance products. With that data, Luno was able to

halt users’ transfers to scams before they were processed. It was a drastic

strategy in many ways. For example, cryptocurrency has historically been built

on an ethos of financial freedom, and some users were likely to chafe at a

perceived limitation on their ability to transact. But thanks to Chainalysis’ best-in-class cryptocurrency address

attributions, Luno established the trust necessary to

sell customers on the strategy.

Luno

first began blocking scam payments for South African users only in November

2020, then rolled the feature out worldwide in January 2021. The plan worked,

and transfers from Luno wallets to scams fell

drastically throughout 2021.

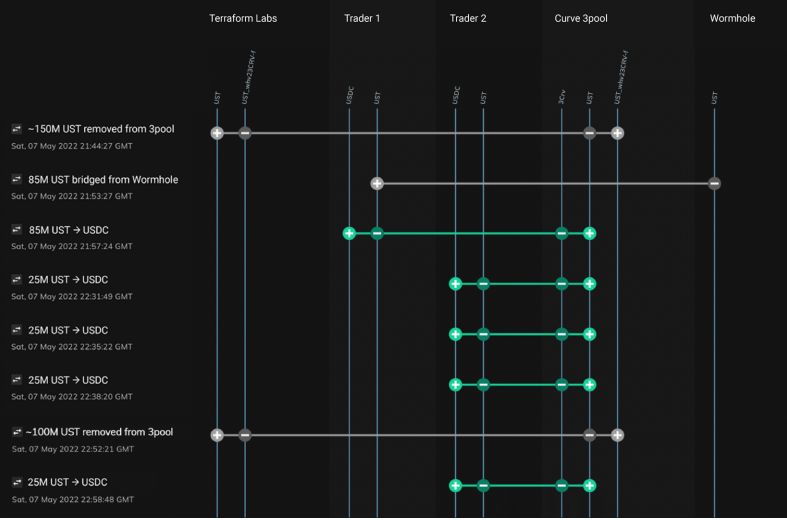

The Trades That Triggered UST’s Collapse

The 2022 crypto market downturn began

with the collapse of Sam Bankman-Fried and the Terra-Luna ecosystem and its

associated stablecoin, TerraUSD (UST).

This single event is estimated to have erased as much as $60 billion in market

value overnight. In this section, we use blockchain analysis to explain five

trades from just two traders:

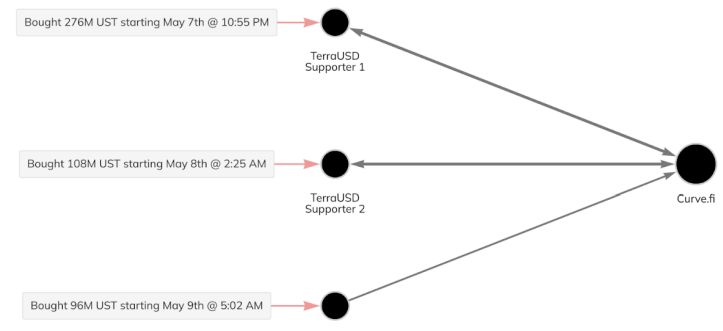

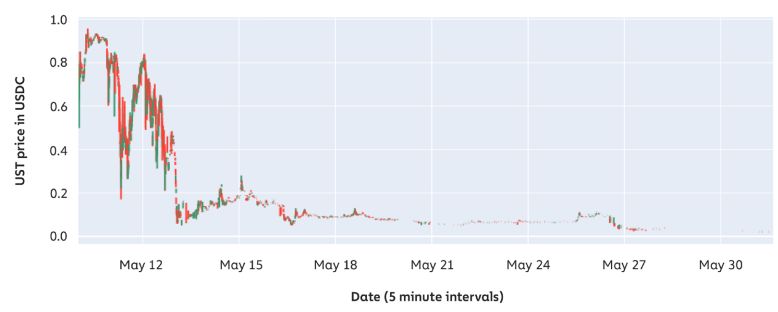

1. Two traders break

UST’s peg. In the first one, where the peg-breaking trades are in green:

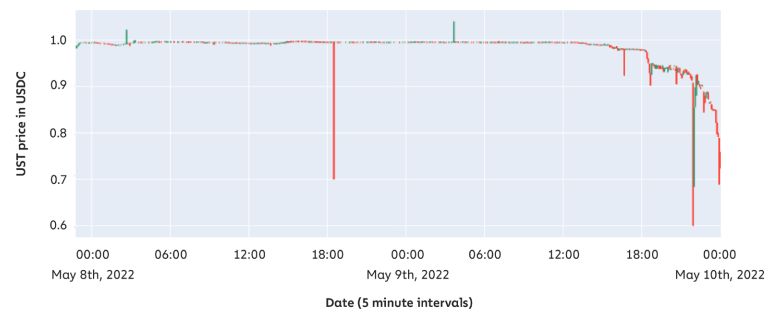

On the night of May

7th, Terraform Labs withdrew 150 million UST from 3pool, a decentralized stablecoin exchange, as part of a planned public effort to

move these funds to another pool. This made the pool more “shallow,” i.e.prone to volatility.

Thirteen minutes

later, one trader – perhaps taking advantage of this vulnerability – swapped 85

million UST for USDC. Over the next hour, another trader then swapped 100

million UST for USDC in increments of 25 million.

In response,

Terraform Labs withdrew another 100 million UST from 3pool. This was intended

to “rebalance” the ratio of UST to other stablecoins.

But by this time,

these large trades – and the many smaller ones that followed – had broken UST’s

peg.

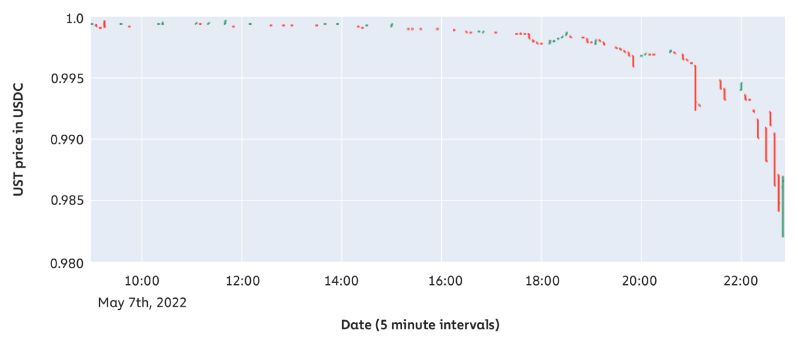

UST-USDC prices on May 7th, 9:00 AM–10:50 PM UTC

Investors panicked,

the sell-off began, and many holders with UST deposited in Anchor started

withdrawing their funds.

On March 13th, Bybit estimated that “at the current yield reserve of

$24.7M UST and a current ratio of deposits and borrowings … [Anchor has] a

runway of about ~13 days before yield reserves have completely depleted.” In

mid-April, Decrypt reported that more than 72% of all UST was deposited in

Anchor – indicating that a significant reason for holding UST may have been to

earn Anchor’s yields.

A Note On Anchor

Anchor is a DeFi protocol operated by Terraform Labs, the creators of

UST. For most of its existence, it has paid 19.5% APY on any quantity of

deposited UST. It has then lends these deposits at APRs that typically vary

from 2% to 15%. Only about one-half to one-sixth of the deposited UST has been

lent out to borrowers at any time.

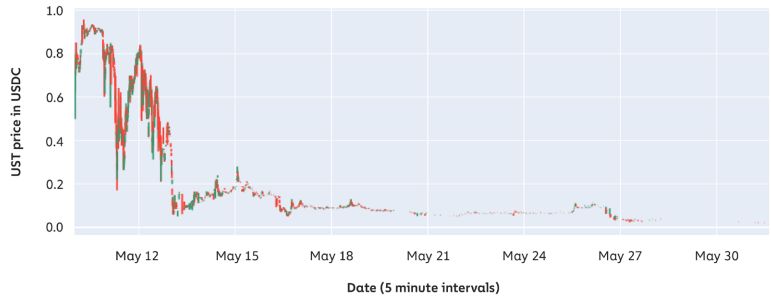

2. Repairs of the peg

are successful but short-lived

To repair the peg and

rebalance 3pool, three unidentified UST supporters swapped a combined $480

million Tether (USDT) for UST on May 7th, 8th, and 9th.

Then, on May 9th, the

Luna Foundation Guard (LFG) sold billions of Bitcoin from its reserves to swap

for UST.

But by May 10th, LFG’s

reserves were depleted, and UST had again lost its peg – this time for

good.

UST-USDC prices on

May 7th, 10:50 PM–May 10th, 00:00 AM UTC

In a last ditch effort

to stop the sell-off, multiple exchanges suspended withdrawals.

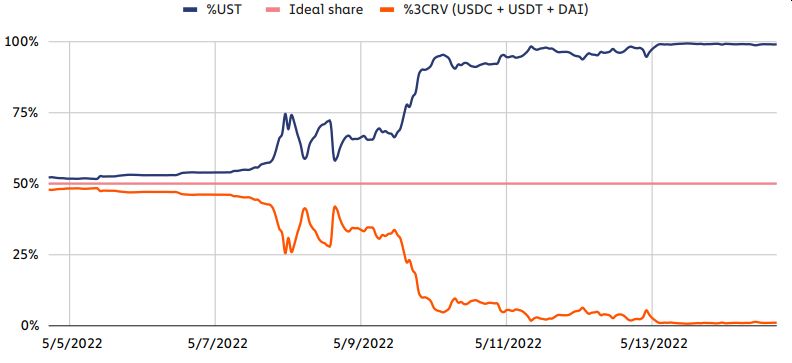

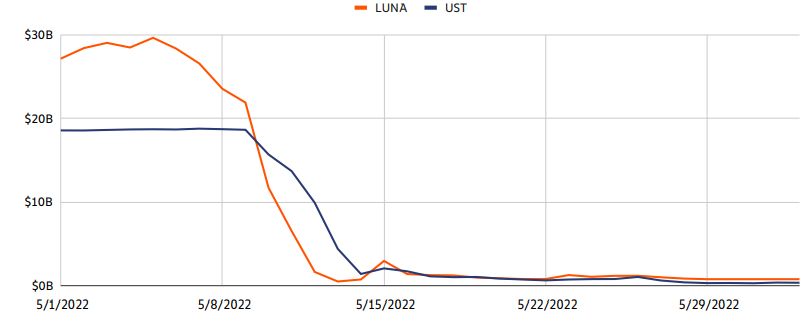

3. The mass minting

of LUNA leads to hyperinflation and a crash.

Meanwhile, UST’s

largest liquidity pool was drying up. 3pool’s balance of UST to 3CRV – a

“basket” of stablecoins that includes USDC, USDT, and

DAI – was fast approaching 95% to 5%, far from the 50% to 50% ideal.

UST-3pool

balance, 5/4/2022–5/14/2022

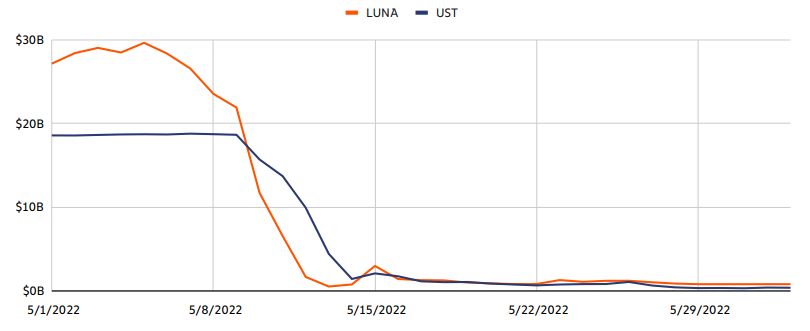

Only a single

value-preserving exit remained. Per the stablecoin’s algorithm,

a UST holder could always “burn” one UST to “mint” one dollar worth of LUNA,no matter the price of LUNA.

And so holders burned

their UST en masse, hyperinflating LUNA. Its supply

entered the trillions; its price fell to fractions of a cent. When LUNA’s

market cap dipped below UST’s, it became clear that not everyone could burn UST

wfor equal value.

UST vs. LUNA market cap, 5/1/2022–6/2/2022

The remaining holders

sold at lower and lower prices until UST was worth little more than a penny.

The algorithmic stablecoin had collapsed.

UST-USDC prices on May 10th, 00:00 AM–June 2nd UTC

Undercollateralized, Overcollateralized, And

Fiat-Backed Stablecoins

Unlike most stablecoins, UST was algorithmic and undercollateralized.

Rather than maintaining its peg by holding assets in reserves, Terraform Labs

used a sister token, LUNA, to “absorb the price volatility of UST.”

Other stablecoins are crypto-backed and overcollateralized, like

DAI. Borrowers must deposit $1.50 worth of ETH for every DAI they wish to

borrow. Still, others are fiat-backed and collateralized one-to-one, like USDC.

Its reserves are held in cash and short-dated government treasuries.

Stablecoins vary in their utility as well. The algorithmic UST

and the crypto-backed DAI serve DeFi, but fiat-backed

stablecoins have other use cases. They can help

exchanges settle trades, migrants send remittances, and citizens of

high-inflation countries store value. Tether recently launched a peso-backed stablecoin to facilitate remittances to and from Mexico,

for example, and stablecoins are quite popular among

inflation-weary Argentines.

Only a single

value-preserving exit remained. Per the stablecoin’s

algorithm, a UST holder could always “burn” one UST to “mint” one dollar worth

of LUNA, no matter the price of LUNA.

And so holders burned

their UST en masse, hyperinflating LUNA. Its supply

entered the trillions; its price fell to fractions of a cent. When LUNA’s

market cap dipped below UST’s, it became clear that not everyone could burn UST

wfor equal value.

UST vs. LUNA market cap,

5/1/2022–6/2/2022

The remaining holders

sold at lower and lower prices until UST was worth little more than a penny.

The algorithmic stablecoin had collapsed.

UST-USDC prices on May 10th, 00:00 AM–June 2nd UTC

What Were The Macroeconomic Impacts Of The Collapse?

UST and LUNA’s

collapse didn’t happen in a vacuum. At the same time, several other crypto

assets, including Bitcoin, also declined in what some have said may be the

beginning of a third crypto winter.

But was the UST’s collapse

to blame for that decline? While it was a factor, we find that because

Bitcoin’s decline was so closely aligned with the

the downturn of

non-crypto assets — especially tech stocks — its price action may. have been

more connected to the tech slump than UST’s crash.

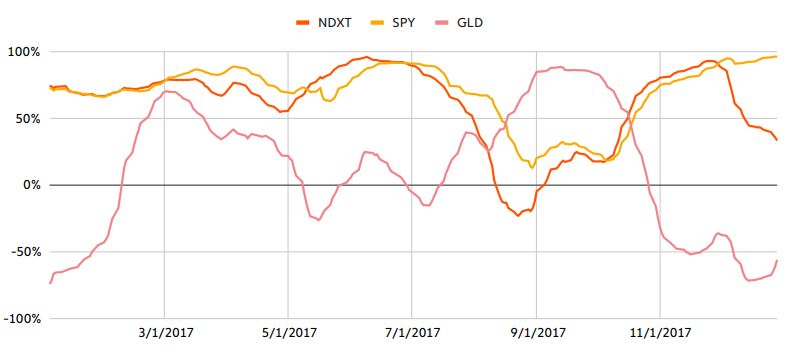

Bitcoin’s correlation

with tech stocks is a relatively new development. The graph below shows the

correlation between Bitcoin’s price and that of several other asset classes in

2017.

Bitcoin correlations with NDXT, SPY, and GLD in 2017

While there were

“waves” of correlation, that is typical of assets with no significant

relationship. This pattern bolstered the narrative that Bitcoin was

uncorrelated and a haven during market declines.

The collapse of UST

may have accelerated Bitcoin’s decline. This was expected — LFG sold billions

worth of Bitcoin to repair the peg — but also short-lived. The accelerated

deterioration ended around May 13 at roughly the close of UST’s collapse, at

which point Bitcoin’s price action fell back in line with non-crypto tech

assets.

One can also observe

a spike in stablecoin sales during UST’s collapse.

From May 9th to 12th, hundreds of billions more stablecoins

than usual were sold for cash.

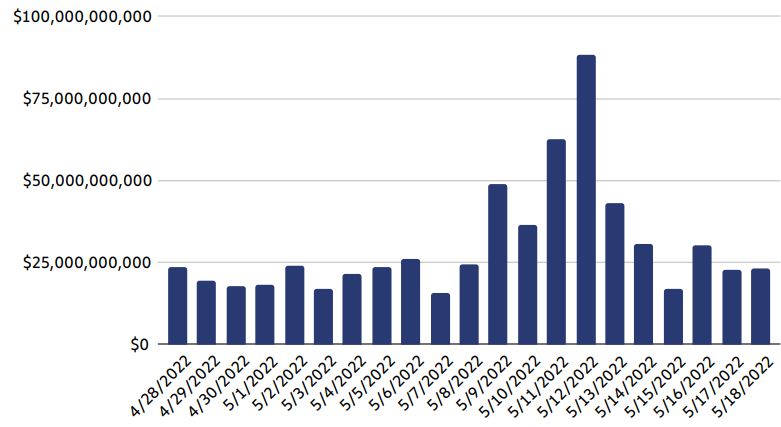

Daily stablecoin volume on

services, 4/28/2022–5/18/2022

All kinds of

investors sold their stablecoins during the crash,

from big institutional players to retail investors.

The daily stablecoin value

transferred to services by transaction size, 5/1/22– 5/16/22

Redemptions peaked

across all stablecoins — algorithmic and

asset-backed.

This suggests that

the collapse scared many investors away from stablecoins

altogether, not just those of a certain class.

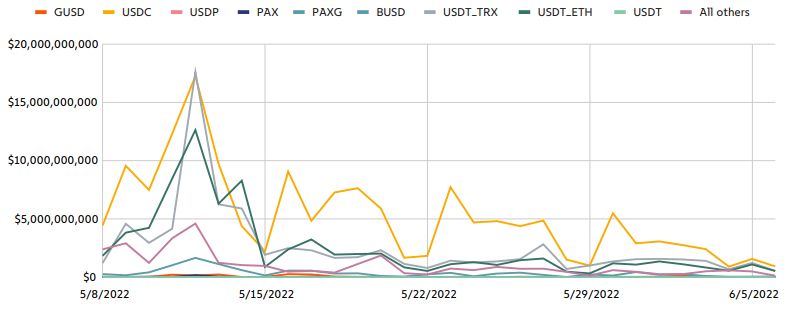

The daily stablecoin value

transferred to services by stablecoin type, 5/8/22–

6/6/22

Nonetheless,

significant stablecoins weathered the storm. Though

Tether briefly fell by 3¢ on May 12, it quickly rebounded and processed over

$13 billion in USDT redemptions over a week-long stretch.

Part One, Part Two, Part Three, Part Four

For updates click hompage here