By Eric Vandenbroeck and co-workers

Deglobalization

A consensus is

emerging that the world is cleaving into blocs—not only geopolitically but economically,

too. In 2020, the economist Douglas Irwin wrote that “the COVID-19 pandemic is

driving the world economy to retreat from global economic integration.” In the

years since, how to manage this purported deglobalization has been a consistent

theme at World Economic Forum meetings; in May, an Economist cover

depicted a map of the world physically fracturing into competing economic

blocs. The associated story presumed that deglobalization is a long-term

certainty, arguing that it is becoming “visible in the economic data, as

investors reprice assets and redirect capital in a less integrated world.” Last

week, a Bloomberg columnist piled on, concluding that “global trade and finance

are fragmenting into rival and increasingly hostile blocs, one centered on

China and extending into the global South and another around the United States

and other Western countries.”

But there is a

problem with the assumption that deglobalization is a fact on the ground: the

data does not fully back it up. As evidence of continuing deglobalization,

observers often cite phenomena such as the United States’ reluctance to

establish new free-trade deals, the debilitation of the dispute-settlement

system overseen by the World Trade Organization (WTO),

the proliferation of new national measures restricting trade, and declines in

both short- and long-term capital flows from their past peaks. The COVID-19

pandemic certainly did reveal that economic interdependence carries risks, and

the efforts Russia has made since 2022 to use its natural gas pipelines to

influence the G-7’s response to its invasion of Ukraine—as well as the many

sanctions the G-7 has imposed to try to weaken Russia’s economy—have

highlighted the vulnerabilities that can arise when countries trade across

geopolitical divides. But a closer look at economic data shows that even though

governments have increasingly adopted policies aimed at strengthening their own

resilience, the world economy is still evolving to become more, not less,

globalized in key ways—and more dependent on Chinese supply in particular.

Global trade surged

during the pandemic, and the world’s trade with China accelerated rather than

slowed. A pandemic-era shift toward goods and away from services partly

accounts for the acceleration. But the growth in trade with China also reflects

the fact that China is simply producing things—high-tech exports such as

electric vehicles, wind turbines, solar panels, and vital electronic and

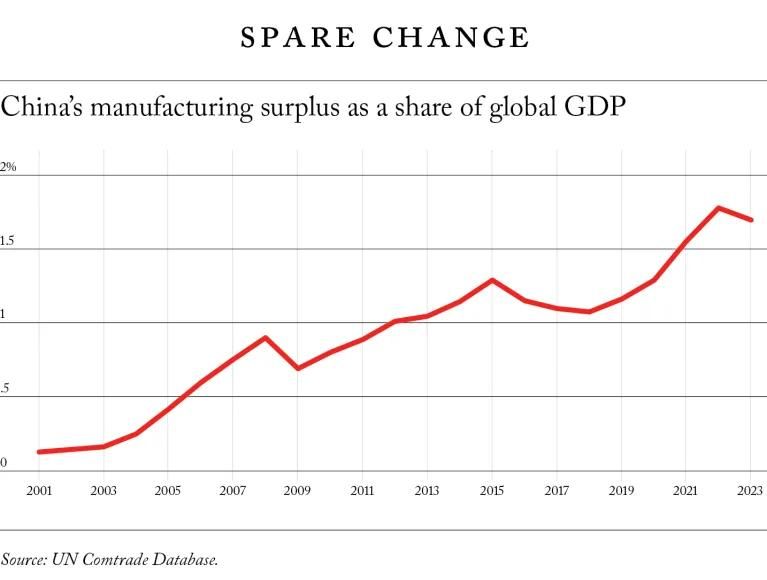

battery components—at a price point few can match. Between 2019 and 2023,

China’s manufacturing surplus rose by about a percentage point of global GDP;

it is now far larger than the surpluses run by Germany and Japan, the world’s

other manufacturing powerhouses.

There is also less to

the fall in capital flows than meets the eye. The decline in foreign direct

investment (FDI) after 2016, for example, largely resulted from specific

changes in tax regulations that led to a big reduction in the use of

special-purpose vehicles in Luxembourg, the Netherlands, and a few other key

European tax centers. And that tax simplification has not blunted one of the

less savory forms of globalization: trade and financial flows that appear to

serve only as a vehicle for multinational tax avoidance.

The now pervasive

misperception of the world’s economy has consequences. Policymakers’ efforts to

defend globalization by equating more global trade flows with increased

efficiency tend to ignore the ways reality is more complex: for example, even

those pursuing a healthy form of globalization will need to work to reduce

multinational corporations’ tax avoidance. More fundamentally, if observers

downplay the extent to which the world’s economies are still integrated, they

will underestimate the cost of actions that would fracture the world economy,

such as launching a conflict over Taiwan or a unilateral U.S. retreat from

trade. World leaders must take steps to increase their economies’ resilience,

but they must first understand those steps’ true costs.

Trading Up

The idea that the

world’s economy is deglobalizing took hold after the 2016 election of U.S.

President Donald Trump. In his rhetoric, Trump repudiated the post–World War II

bipartisan consensus around the value of free trade. He also made some genuine

policy shifts: pulling out of the Trans-Pacific Partnership (TPP),

renegotiating the North American Free Trade Agreement to tighten the rules of

origin for the trade of automobiles, and introducing tariffs on roughly

three-fifths of the trade between the United States and China.

A container ship leaving the port of Santos, Brazil,

May 2024

But globalization has

deep roots now, and such bilateral trade policies did little to change its

fundamental trajectory. New trade deals and tariff programs always get a lot of

ink. In reality, the changes in tariff rates in modern free-trade deals tend to

be small, as most tariffs are already low or zero. Countries lacking

preferential access to the U.S. market can still do incredibly well with the

WTO’s standard trade terms. U.S. imports from Southeast Asia have soared in the

past half-dozen years. The Southeast Asian members of the TPP increased their

exports to the United States much more rapidly after Trump withdrew from the

TPP than they had been able to before.

Any serious

discussion of what drives trade must extend beyond tariffs and trade deals. The

value of currencies also factors into trade flows, as do worldwide patterns of

saving and investment. The dollar has remained strong since the United States

withdrew from the TPP, and American consumers have not hesitated to buy foreign

goods, helping drive the growth in U.S. imports.

Chinese exports to

the United States are down since the 2018 introduction of the Trump tariffs, as

are China’s reported holdings of U.S. Treasury and government-backed agency

bonds. But those indicators are poor measures of these two economies’ true interconnection.

When considering the impact of the United States’ much-ballyhooed bilateral

tariffs on Chinese products, it is important to look beyond U.S. data showing a

fall in direct imports from China and pay more attention to data

from China itself. Surprisingly, those data reveal a much smaller decline in

direct trade with the United States and a steep rise in Chinese exports to

countries that are now exporting more to the United States. Careful studies of

the impact of the Trump tariffs by the Bank of International Settlements and

the economist Caroline Freund have found that the most important effect of

bilateral tariffs was to lengthen supply chains, not to shrink overall global

trade or to reduce the United States’ fundamental reliance on Chinese-sourced

critical inputs. More Chinese parts now head to Malaysia, Thailand, and

Vietnam—and to a more modest degree, Mexico—for final assembly. The underlying

dependence on China is less visible, but no less substantial.

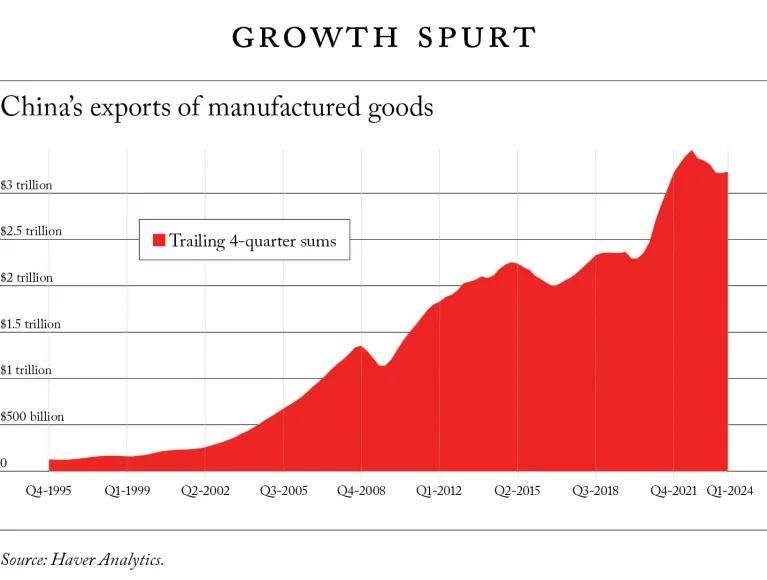

In fact, since the introduction

of the Trump tariffs, China’s economy has become only more central to world

trade. The data points here are often overlooked by American and European

commentators, but they are unambiguous. Over the five years between the end of

2018 and the end of 2023, China’s exports of manufactured goods increased by 40

percent, from $2.5 trillion to $3.5 trillion, much more than the roughly 15

percent increase between 2013 and 2018.

Although China’s

ratio of exports to GDP fell in the years following the global financial

crisis, exports have once again become a crucial driver of Chinese growth.

After discounting imports of parts, China’s exports of manufactured

goods increased from around 11 percent of GDP before the pandemic to 14 percent

of GDP in 2022. Predictions that this increase would turn out to be a one-off

pandemic-related surge have not been borne out: although export growth slowed

in 2023 as consumer spending diminished worldwide, it has now recovered, with

export volumes growing by over ten percent in the first part quarter of 2024.

China’s manufacturing surplus has increased even more dramatically, rising from

a low of around six percent of China’s GDP in 2018 to a stunning 10 percent in

2023.

China’s post-pandemic

export boom undermines the argument that the world’s economy is deglobalizing.

For all of China’s economic weaknesses, it can still produce goods at a scale

that no other country can match. After the end of a property boom that lasted

more than a decade, China responded to weakening internal demand by investing

more in the production of manufactured goods for export. Consider the

trajectory in one prominent sector: automobiles.

Historically, China

was not a major auto exporter. But as domestic automobile demand trended

downward, China went from being a net importer of automobiles to the world’s

largest exporter of them in just three years. This export wave is not about to

weaken: China can produce at least twice as many internal combustion cars as it

needs to meet shrinking domestic demand, and the country’s leading electric car

manufacturer, BYD, is doubling its production capacity to ramp up exports. It

is hard to think of a more potent symbol of China’s steadily growing

integration with the global economy than the enormous fleet of car carriers BYD

now has on order from Chinese shipyards.

Dodge Ball

U.S. policymakers are

rightly concerned that the world has become too reliant on China for supply,

particularly with respect to clean energy and green technology. In a mid-May

speech, Lael Brainard, the director of the U.S. National Economic Council, put

it well: “China’s industrial capacity and its exports in certain sectors are

now so large that they can undermine the viability of investments in the U.S.

and other countries. … Markets need reliable demand signals and fair

competition for the best firms and technologies to be able to innovate and

invest in clean energy and other sectors. The Chinese government has made clear

that China’s massive investments in electric vehicles, solar panels, and

batteries are an intentional strategy to effectively capture these sectors.”

Chinese policymakers

should be equally worried that their country’s economy has become too dependent

on the world for demand. But they do not appear to be. Chinese leader Xi

Jinping’s policy of supporting “new productive forces,” together with his

perhaps surprising resistance to “welfarism,” has yielded an unbalanced

domestic economy that increasingly must externalize its internal distortions.

China’s surplus in manufacturing has risen as much relative to world GDP in the

last few years as it did during the first China shock following the country’s

accession to the WTO, when a surge in Chinese exports and a sharp rise in

China’s manufacturing surplus displaced workers across the world’s advanced

economies. As a share of the world’s GDP, China’s manufacturing surplus now

substantially exceeds any other country’s recorded surplus since the end of

World War II.

China’s need to grow

through exports, however, is not the only explanation for globalization’s

surprising resilience. Another is corporate tax avoidance. Changes in the way

pharmaceutical companies behave are illuminating: U.S. pharmaceutical firms now

often sell the rights to profit from promising new drugs to subsidiaries

located in low-tax jurisdictions. These drugs are manufactured abroad and then

sold at a high price in the United States. As a result, the major U.S.

pharmaceutical companies—and other multinationals—now report earning almost all

their profits abroad and pay little or no domestic corporate income tax. This

particular form of globalization extends beyond the pharma industry: American

multinationals now often produce abroad in order to book large profits in

offshore tax havens.

The low-tax haven of

Ireland, and not China or India, is now by far the largest exporter of

pharmaceuticals to the United States: in 2023, the United States imported twice

as many pharmaceutical products from Ireland as it did from Canada, China,

India, and Mexico combined. The trend extends well beyond pharmaceuticals.

Ireland is also the biggest global market for the export of U.S.

research-and-development services. The Cayman Islands and the British Virgin

Islands are the biggest export markets for U.S. financial services, and Bermuda

is the United States’ main international supplier of insurance services. A 2017

International Monetary Fund study showed that the resilience of FDI flows in

the wake of the 2008–09 global financial crisis can largely be credited to a

steady rise in FDI flows through centers of corporate tax avoidance.

In 2015, the members

of the Organization for Economic Cooperation and Development agreed to change

their tax regulations to try to make it harder for companies to locate their

profits in zero-tax jurisdictions. But these changes, which were implemented at

the end of 2020, have not curbed tax-avoidance-driven globalization. Following

a tax strategy pioneered by Apple, a number of major U.S. companies directed

their Irish subsidiaries to buy their affected subsidiaries in zero-tax

jurisdictions, effectively “Ireland-shoring” their intellectual property while

simultaneously generating large depreciation allowances that lower their

effective tax rates in Ireland.

These moves have made

corporate tax avoidance more visible because Ireland is the only center of tax

avoidance that follows Europe’s rigorous standards for the disclosure of

economic and balance-of-payments data. Consequently, it is easy to track how

foreign multinationals’ profits in Ireland have soared from around 40 billion

dollars per year ten years ago to over 180 billion dollars per year today and

now constitute roughly 70 percent of Ireland’s real domestic economy. Even more

important, these profits represent over one percent of the eurozone’s GDP and

close to three-quarters of a percent of the United States’ GDP. The resulting

loss of U.S. tax revenue is far larger than most analyses capture, because

corporations have no incentive to highlight just how little tax they actually

pay in the United States.

Risk Reversal

Why does it matter if

many people, including political leaders and influential commentators,

misunderstand the trajectory of contemporary globalization and overstate the

impact of a decline in political support for further economic integration?

First, if policymakers focus discussion on the costs of deglobalization, they

risk overlooking the many unhealthy forms of globalization that still exist and

persist relatively undisturbed. China’s role in middle America’s

deindustrialization is now widely acknowledged. But the role that the U.S.

corporate tax code plays in that deindustrialization is not. Allowing American

corporations to continue to use tax-avoidance strategies that transfer profits

and production out of the United States is unhealthy for the global economy,

even if it boosts measures of U.S. trade and foreign investment. If, instead,

the U.S. Congress changed the tax laws to raise the global minimum tax and made

it harder to shift intellectual property created in the United States to

low-tax jurisdictions, U.S. pharmaceutical companies would likely shift the

production of their most profitable drugs out of locations such as Ireland and

Singapore and back to the United States.

Those who worry about

deglobalization also often assume that all forms of economic integration are

healthy. But they are not: the surge in cross-border bank flows before the

global financial crisis, for example, reflected an unhealthy level of leverage

and risk in the world’s big banks. Today, too, an excessive amount of the

world’s FDI flows merely reflect tax avoidance, not productive economic

activity.

There is also an

opposing risk: that if policymakers do not acknowledge the degree to which

globalization persists, they will grossly underestimate the shocks that would

stem from a fuller decoupling of Chinese and U.S. trade. Even with the rise in

U.S. tariffs on China, the world’s economy is still deeply integrated. If

anything, China has become more central to global trade since Trump imposed his

tariffs, and U.S.-Chinese interdependence has been masked, not severed. For

instance, China could not have achieved its current $800 billion trade surplus

in goods if the United States did not have a large trade deficit. That deficit

is no longer financed by the direct purchase of U.S. bonds by China’s central

bank. But it is still indirectly financed by China, in the form of the large

stockpiles of dollars that Chinese exporters now hold offshore. The way China

surplus’s remains the mirror image of the U.S. deficit is just one of the many,

complex forms in which the U.S. and Chinese economies continue to rely on one

another, even as the ties become harder to see in top-line economic data.

Some deglobalization

here could, in fact, also be healthy. If China relied less on global demand to

make up for its internal weaknesses, that would put less pressure on its

trading partners’ manufacturing sectors as well as reduce the overdependence of

the United States, most European countries, and other democracies on China for

critical inputs. But right now, the strong pressures on China to solve its

domestic economic problems by increasing exports are likely to keep driving the

world toward deeper, more unbalanced economic integration. The United States is

trying to resist this pressure in the realm of electric vehicles, at a cost to

U.S. consumers. As Chinese electric vehicle firms go global, however, it is not

clear that the United States can successfully insulate its own electric-vehicle

industry simply by imposing tariffs on bilateral trade. Avoiding

interdependence with China would likely require bigger policy shifts—and a

greater willingness to pay for the costs of regionally rather than globally integrated

supply chains.

Historically, the

trade in automobiles has always been more regional than global; preserving that

trading pattern in the face of a growing Chinese supply will require more

restrictions on trade. But those sectoral restrictions can only limit the

development of new forms of integration; they cannot reverse globalization writ

large. The biggest economic challenge China now poses to G-7 policymakers is

how to limit the dislocations that flow from China’s increasingly export- and

manufacturing-dependent economy. Discussions about deglobalization miss the

point.

For the United States

shortly, any true decoupling from the Chinese economy would be costly—far more

costly than the past few years superficial decoupling. An easy, and relatively

cheap, way for the United States to avoid bilateral tariffs is to import parts

from Vietnam that China has shipped there for final assembly. It would be much

harder to engineer Chinese parts out of U.S. supply chains entirely. And it

would be equally difficult for China to restructure its economy so it relies

more on internal demand.

Deglobalization

offers analysts a simple story to tell about changes to the global economy. But

the reality is more complex: put plainly, it is impossible for a global economy

characterized by a large U.S. deficit on one side and a large Chinese surplus on

the other to truly fragment. The world needs to have a healthy debate about the

drawbacks and benefits of economic integration. But that debate must start from

a frank acknowledgment that many characteristics of the contemporary global

economy still push toward more, not less, integration and that addressing these

factors will have real costs.

For updates click hompage here