By Eric Vandenbroeck

and co-workers

Crypto-Currency Funding Of

Terrorism And The War In Ukraine

Several deposit

addresses received over $1M in illicit cryptocurrency by crime category.

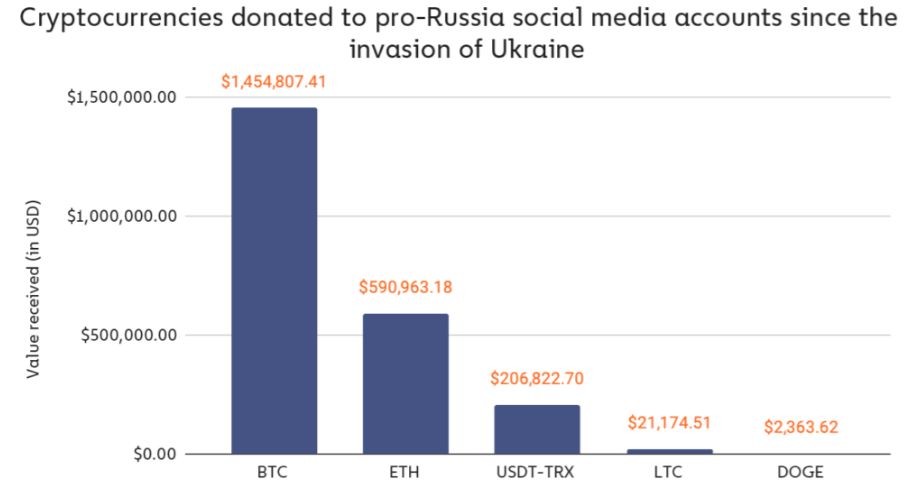

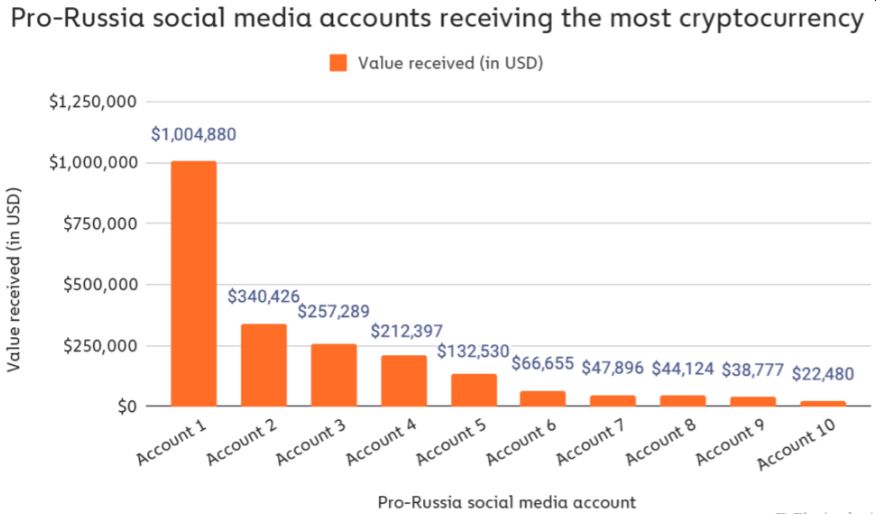

Similar to our earlier report, we said pro-Russian groups had raised $2.2

million primarily in Bitcoin and Ethereum to help finance the war. The

amount of cryptocurrency donations collected by pro-Russian organizations pales

compared to the amount donated to Ukraine.

Ashley Alder, who will

chair the Financial Conduct Authority from 20 February this year, told the

House of Commons Treasury Committee last week that crypto platforms are

“deliberated evasive” and a method by which “money laundering happens at the

size.” As we pointed out, Cryptocurrency has increasingly become a mainstream

option for money laundering and funding terrorism. Global consultants Chainalysis for example, estimated approximately $2.2m in

cryptocurrency had been sent to Russian paramilitary groups, which have posted images of arms bought on social

media.

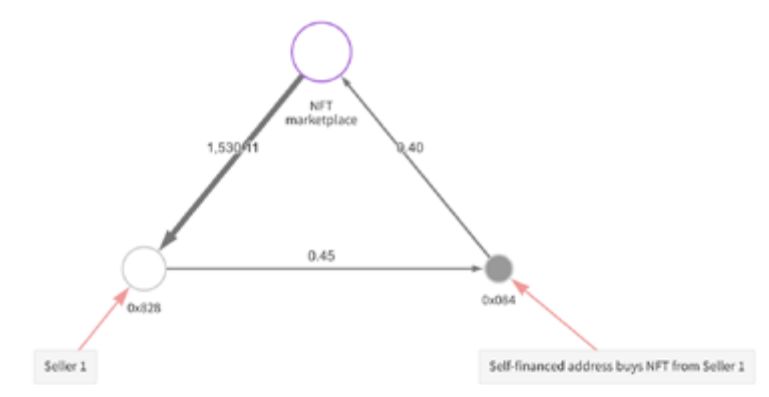

Everything looks

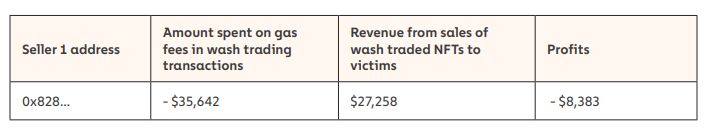

normal at first glance. However, the Chainalysis

Reactor graph below shows that address 0x828 sent 0.45 Ethereum to that address

0x084 shortly before that sale.

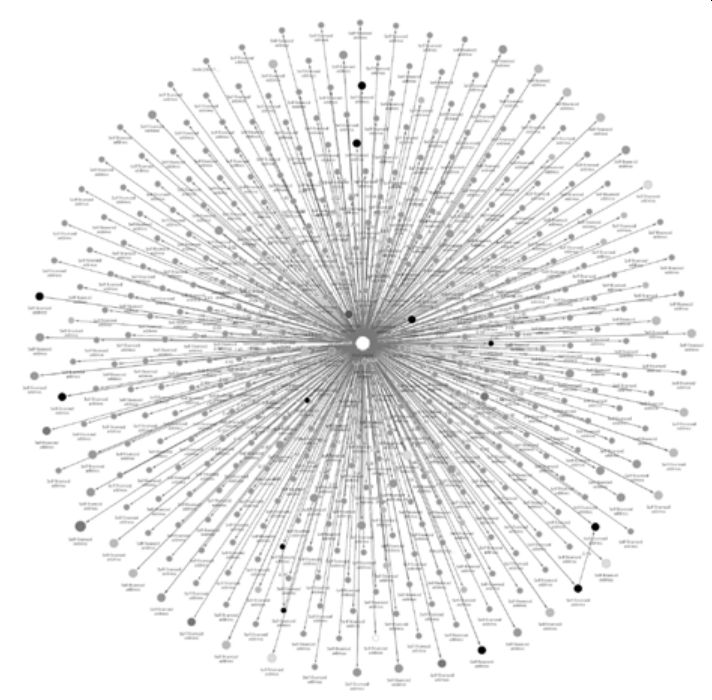

This activity fits a

pattern for Seller 1. The Reactor graph below shows similar relationships

between Seller 1 and hundreds of other addresses to which they’ve sold NFTs.

Seller 1 is the

address in the middle. All other addresses on this graph received funds from

Seller 1’s main address prior to buying an NFT from that address. So far,

Seller 1 doesn’t seem to have profited from their prolific wash trading. If we

calculate the amount Seller 1 has made from NFT sales to addresses they did not

fund — whom we can assume are victims unaware that the NFTs they’re buying have

been wash traded — it doesn’t make up for the amount they’ve had to spend on

gas fees during wash trading transactions.

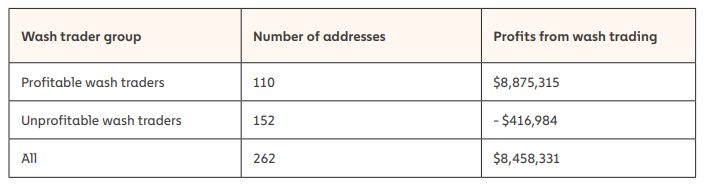

However, the story

changes if we look at a bigger piece of the NFT ecosystem. Using blockchain

analysis, we identified 262 users who have sold an NFT to a self-financed

address more than 25 times. While we can’t be 100% sure that all instances of

NFT sales to self-financed wallets are intended for wash trading, the

25-transaction threshold gives us a higher degree of confidence that these

users are habitual wash traders. Just as we did above for one wash trader, we calculated these 262 wash traders’ overall

profits by subtracting the amount they’ve spent on gas fees from the amount

they’ve made selling NFTs to unsuspecting buyers. One caveat for this analysis

is that it only captures trades made in Ethereum and Wrapped Ethereum, so

there’s likely wash trading activity we’re not considering here.

Nonetheless, an

interesting story emerges: Most NFT wash traders have been unprofitable, but

the successful NFT wash traders have profited so much that, as a whole, this

group of 262 has profited immensely overall.

The 110 profitable

wash traders have collectively made nearly $8.9 million in profit from this

activity, dwarfing the $416,984 in losses made by the 152 unprofitable wash

traders. Even worse, that $8.9 million is most likely derived from sales to

unsuspecting buyers who believe the NFT they’re purchasing has been growing in

value, sold from one distinct collector to another.

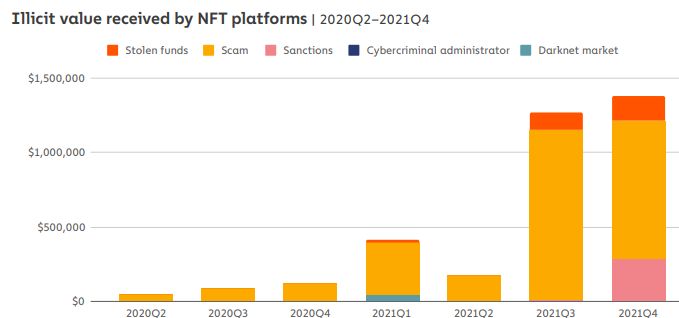

Money Laundering Activity Small But Visible In NFTs

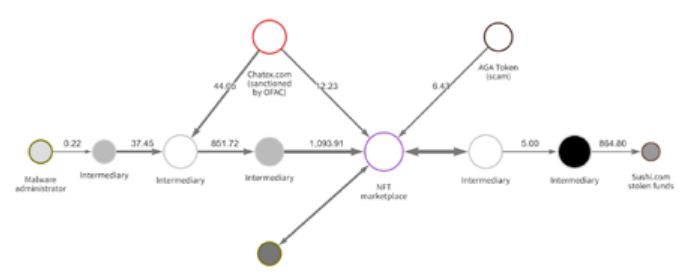

The Reactor graph below shows examples of different

types of criminals buying NFTs.

Here, we can see

addresses associated with several cybercriminals sending funds to a popular NFT

marketplace, including malware operators, scammers, and Chateaux.

This activity

represents a drop in the bucket compared to the $8.6 billion worth of

cryptocurrency-based money laundering we tracked in 2021. Nevertheless, money

laundering, particularly transfers from sanctioned cryptocurrency businesses,

represents a large risk to building trust in NFTs and should be monitored more

closely by marketplaces, regulators, and law enforcement.

As Ransomware Payments Grow, So Too Does Ransomware’s

Role In Geopolitical Conflict.

Cryptocurrency Brings

Millions in Aid to Ukraine, But Could It Also Be Used For Russian Sanctions

Evasion?

As Russia’s invasion

of Ukraine continues, cryptocurrency is taking on an essential role in the

conflict. On the positive side, users worldwide have donated over $56 million

in cryptocurrency to addresses provided by the Ukrainian government, showcasing

the crypto community’s generosity and virtual assets’ unique utility for

cross-border payments.

However, law

enforcement, regulators, and compliance teams are also wondering if and how

cryptocurrency may allow for sanctions evasion. The United States and many of

its allies in the EU and elsewhere have taken unprecedented actions against

Russia, including:

-The addition of

Russian oligarchs, their family members, and their businesses, as well as all

major state-owned banks and many energy exporters, to OFAC’s SDN list

-The sanctioning of

Russia’s central bank, preventing it from using its $650 billion in reserves to

mitigate the impact of the above sanctions

-The removal of

select Russian banks from the SWIFT system, essentially cutting them off from

the global financial system

cryptocurrency to

evade sanctions. While there’s no direct evidence this is happening; It’s a

reasonable concern — Russia accounts for a disproportionate share of several

categories of cryptocurrency-based crime globally and is home to many

cryptocurrency services that have been implicated in money laundering activity.

What Could Cryptocurrency-Based Russian Sanctions

Evasion Look Like?

There are a few

different possible sanctions evasion mechanisms whose on-chain indicators

suggest that Russian actors may be moving funds, at least in isolated

instances. We’ll walk you through those below.

First, we’re

monitoring for transactions involving whales we believe or know to be users

based in Russia. As a reminder, we define “whale” as any private wallet holding

$1 million or more cryptocurrency.

Sbercoin

Sberbank is the

biggest bank in Russia and was one of the first Russian businesses sanctioned

following the Ukraine invasion, along with its subsidiaries. On March 17, 2022,

Russia’s central bank announced that it had issued Sberbank a license to engage

in digital assets, which appears to have led to its issuance of Sbercoin, a new cryptocurrency Sberbank had previously

announced in late 2020. It’s also possible that Sbercoin

was launched by scammers, as Sberbank officials have denied issuing the coin.

Regardless of who

launched the coin, CoinMarketCap data shows that Sbercoin has seen roughly $4.5 million in total transaction

volume, all on one popular decentralized exchange. Sbercoin’s

price has dropped over 90% since its launch and currently sits at $0.00003329

as of March 28, 2022, with a market cap of $113,089

While Sbercoin’s performance and transaction volumes

remain pretty low right now, any trading of the coin by users in the United

States and other countries that have sanctioned Sberbank could create exposure

to sanctions risk. We’ll continue to monitor Sbercoin’s

activity and provide updates on any significant activity as possible.

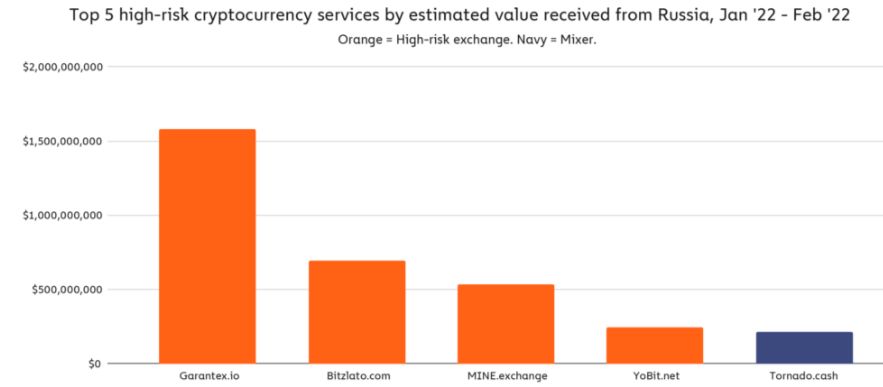

High-risk exchanges

like Garantex and Bitzlato

are prominent here, as well as Tornado, an Ethereum mixer that’s received funds

from several criminal sources. Thus far, none of these high-risk services

have shown spikes in inflows, outflows, or any other unusual activity since the

new sanctions were imposed.

Part One, Part Three, Part Four, Part Five

For updates click hompage here