By Eric Vandenbroeck and co-workers

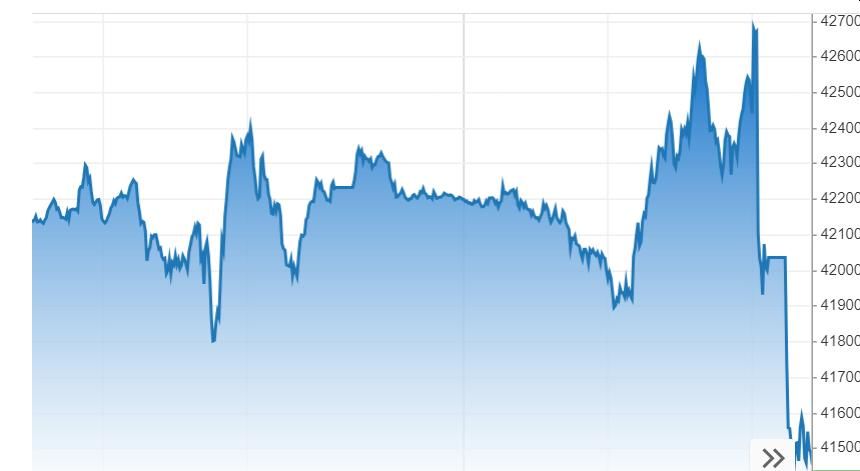

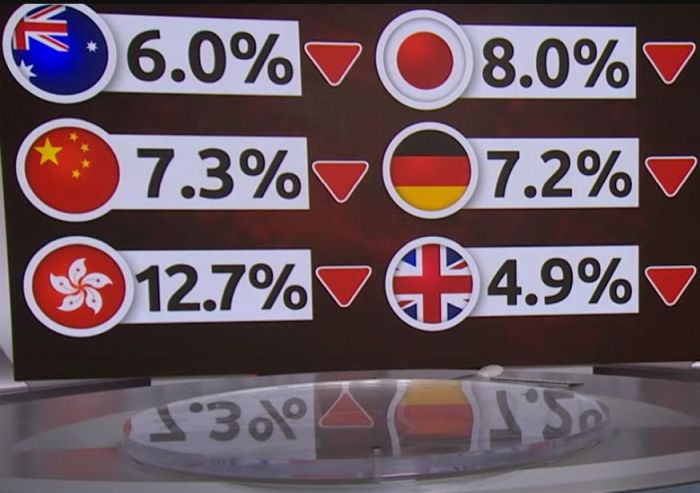

U.S. stock futures

plunged Monday after stocks reeled last week on worries that President Donald Trump has ignited a trade war that will lead to higher

prices and recession.

Trump announced on

Wednesday a 10% tariff on all countries that went into effect over the

weekend. Even higher tariffs on a list of specific countries that included many

Asian nations are set to start on April 9. China hit back, matching the 34%

U.S. tariff with its own on all U.S. imports, while other countries around the

world denounced Trump's moves and threatened

their own retaliatory tariffs.

The surprisingly

aggressive retaliatory tariffs pumled the stock

market. The blue-chip Dow posted back-to-back losses of more than 1,500 points

for the first time,

including a 2,231-point freefall on Friday. The broad S&P 500 posted its

biggest one-day loss on Friday since March 2020, the start of the Covid-19

pandemic, and is edging close to a bear market. A bear market is defined as at

least 20% below its recent peak. The tech-heavy Nasdaq entered a bear market.

Even with the stock

market drubbing, Trump's administration has stood firm. Trump continues to

tell Americans to "hang tough." Commerce Secretary Howard Lutnick told

CBS News tariffs would not be postponed. Trasury

Secretary Scott Bessent said in a NBC interview 50

countries have approached the administration for negotiation but warned these

could take time. Bessent also said he didn't believe

tariffs would lead to recession.

Futures on the

blue-chip Dow were last -3.75%, broad-market S&P 500 futures dived -4.02%;

and tech-heavy Nasdaq plunged -4.36%.

U.S. markets were set

to open also sharply lower.

The domestic arm of

China’s sovereign wealth fund, Central Huijin

Investment, said on Monday that it boosted its holdings in Chinese stocks to

“resolutely safeguard” the country’s capital markets.

The move appeared to

be a response to a slide in share prices triggered by the Trump

administration’s unveiling of sweeping global tariffs last week.

If the stock market

closes in bear territory – a drop of 20% from a recent peak – it would be the

earliest in a new administration a bull market has turned into a bear in the

history of the S&P 500, which dates back to 1957.

These same tariffs

may also take a booming economy and turn it into a recession.

For updates click hompage here