By Eric Vandenbroeck and co-workers

How Crypto-Currency Fraud Functions

Fifteen years after

Satoshi Nakamoto’s Bitcoin whitepaper, cryptocurrency has exploded from an idea

for a single digital asset to a thriving asset class whose global market cap

exceeds $1 trillion. Around the world, people of varying backgrounds have embraced

crypto, using it for everything from investing to sending remittances to

hedging against inflation. Recognizing these trends, governments worldwide are

continually passing and refining crypto regulation while traditional financial

institutions think about how to incorporate crypto into their product

offerings. But despite global adoption and increased regulation, many

misconceptions about cryptocurrency persist.

In an earlier

overview, we started with Ethereum, whereby Sam Bankman-Fried's seven counts of

conspiracy and fraud make for a good starting point.

Less than a week

after several liquidity pools on Curve Finance were exploited in a

multi-million dollar scheme, the hacker returned 4,820

alETH and 2,258 ETH to Alchemix, worth around $12.7 million. These transactions were

accompanied by an encrypted

message in which the

hacker wrote, “I saw some ridiculous views, so I want to clarify that I’m

refunding you not because you can find me, it’s because I don’t want to ruin

your project, maybe it’s a lot of money for a lot of people, but not for me,

I’m smarter than all of you. . .” NFT lending protocol JPEG also confirmed receipt of most of its stolen

funds, worth around $10 million.

On August 6, 2023,

Curve Finance announced on

Twitter that the

established deadline for the hacker to voluntarily return the remainder of the

funds had passed. Thus, the company extended its bounty offer of $1.85 million

to anyone able to uncover the hacker’s identity

Investigation reveals

more than 150 fake firms are targeting people online, breaking their hearts,

and emptying their bank accounts.

Sometimes Crypto

fraud goes like this:

A woman meets a man

online. They flirt. Then, after a few weeks, they begin imagining a future

together. Fast forward a few months, and one has had their heart broken and

been defrauded of their life savings.

It sounds like a

classic romance scam, but it isn’t. This is “pig butchering”: a brutal,

elaborate, and rapidly expanding form of organized crime, often involving

criminal syndicates, modern-day slaves, and victims worldwide.

An investigation by

the Observer and the Bureau of

Investigative Journalism has

found that global organised crime gangs are using the

UK as a virtual base for their operations – systematically exploiting lax

company registration laws to carry out fraud on an industrial scale.

One east London tower

block resident has been inundated with letters addressed to businesses and

people he has never heard of.

A scam victim who

wants to remain anonymous. Many feel ‘stupid’ to have been

duped. Photograph: Andy Hall/The Observer

Key to the success of

pig-butchering scams is convincing victims that they are using a legitimate

trading platform or virtual wallet. To do this, criminal groups set up real

companies that they can then refer to on their scam websites, creating a veneer

of legitimacy.

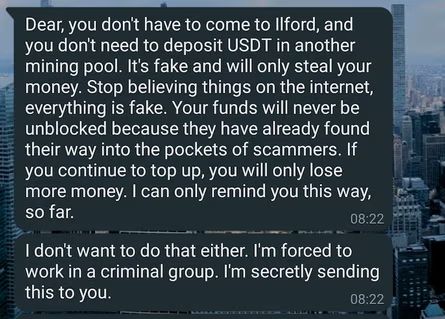

A message from a

‘scammer’ who claims they’re a victim of forced labor and being forced to carry

out this scam.

Around the world, law

enforcement agencies are working harder to tackle cryptocurrency crime. The

National Crime Agency is preparing to launch a new unit devoted

to tackling the scams. Interpol, which facilitates worldwide police

cooperation, recently set up a financial crime and anti-corruption center.

It currently costs as

little as £12 and takes a few minutes to register a company online without the

need to provide any proof of ID. The government has pledged to tighten the

rules, including introducing a requirement to verify information provided to

Companies House. However, the second part of the economic

crime bill is

yet to go before the Lords, and the timeline for its future implementation is

unclear.

Within a few years,

two brothers from Ohio were imprisoned for cryptocurrency-related crimes. The

first, Larry Dean Harmon, was arrested and

charged for a

money laundering conspiracy from his operation of Helix, a cryptocurrency

mixing service operating on the dark web. Shortly after Internal Revenue

Service Criminal Investigations (IRS-CI) seized Larry’s Bitcoin wallets, his

younger brother, Gary James Harmon, used Larry’s passwords to steal some of the

Bitcoin back from the seized wallets. In April 2023, Gary was sentenced to

four years in prison for

his theft from the government.

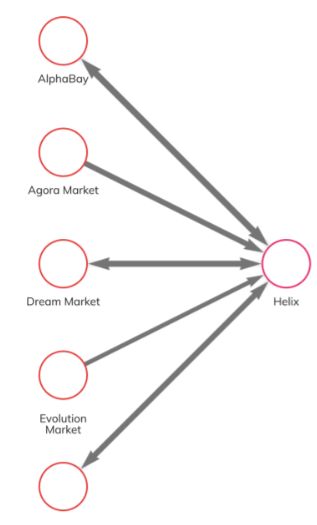

In the early stages

of the investigation, an undercover FBI

agent transferred Bitcoin from

an AlphaBay wallet to Helix and confirmed that using

the mixer reduced direct traceability to AlphaBay.

Then, law enforcement used Chainalysis to

identify 16 Bitcoin

wallets which contained

nearly 5,000 Bitcoin worth of proceeds from Helix’s operation. When law

enforcement searched Larry’s residences in Ohio and Belize, they recovered

multiple cryptocurrency storage devices linked to these wallets, and also found an

accounting spreadsheet in

his Google Drive that indicated ownership of more than $56 million worth of

Bitcoin and other assets.

After Larry’s arrest

in 2020, Gary was laid off from Coin Ninja and struggled financially. Sensing

an opportunity to acquire funds from his brother’s 16 wallets in custody, Gary

used Larry’s passwords to access several of them. He transferred 712 Bitcoin (worth more than $5 million at the time) to

eight new wallets. We can see those transactions below in Reactor.

Once complete, Gary

deposited 68 Bitcoin as collateral for a $1.2 million loan from BlockFi, which he used to purchase a luxury condo in

Cleveland, Ohio. He spent at strip clubs and on private jets. The below image

shows Gary in a

bathtub with cash at a

nightclub, which investigators recovered on his phone. Additionally, text

messages on the phone suggest he made extravagant purchases around the same

time.

On July 30, 2023,

several liquidity pools on Curve Finance were exploited, resulting in approximately $70 million in losses and

triggering panic within the DeFi ecosystem. These hacks occurred due to a

vulnerability in Vyper, a third-party Pythonic

programming language for Ethereum smart contracts used by Curve and other

decentralized protocols. Since then, several white hat hackers and MEV bot operators

have helped recover some of the funds, which means the actual value lost may

end up being lower than the total currently reported. Below, we’ll share what

we know so far about the hack.

After news broke of

the hacks, CRV declined 5%. This decline, along with the risk that malicious

hackers possessing millions’ worth of CRV could sell into the token’s

now-illiquid market, triggered fears of contagion effects

for some DeFi protocols.

In particular, AAVE's lending protocol is at risk of incurring debt due to

Egorov’s massive and well-known borrow position secured by CRV token

collateral.

At this time, Curve

has not detailed any recovery plans but publicly

advised its users to

withdraw funds from Vyper-based pools. We have

labeled all addresses relevant to the Curve hacks in Chainalysis

products and will continue to provide updates on the situation when possible.

For updates click hompage here