Eric

Vandenbroeck 17 June 2018:

While South Korea and

the United States are expected to announce the

suspension of "large-scale" military drills this week, with the

provision that they would restart if North Korea failed to keep its promise to

denuclearize, news agency Yonhap said on Sunday. The world is muddling through a blurry

transition from the post-Cold War world to an emerging era of great power

competition.

Moscow Tries to Break

a Stalemate with Washington. Poland and other borderland states will make

appeals for stronger security guarantees from Washington while they still have

the United States' attention. Russia will try to break a negotiating stalemate with

the United States to talk sanctions, military build-ups and arms control by

promoting its mediation in the Syrian conflict and its potential utility in

North Korean denuclearization. Don't hold your breath for a breakthrough,

though.

In harnessing the

power of tariffs and extraterritoriality in sanctions, the United States will

polarize many of its security allies in Europe and Asia - strategic partners

that Washington needs to counterbalance the emerging threat from China and

Russia. Attempts to target Russia's strategic relationships will call into

question the long-term reliability of the United States as a defense partner

and invite heavy pushback from Turkey, Vietnam, Germany and India, in

particular.

As the limits of EU

economic safeguards are exposed, Tehran will cautiously walk back its

commitments to the nuclear deal while seeking out willing partners to

circumvent sanctions. Russia will take advantage of Iran's rising vulnerability

to deepen its military ties with Tehran while mediating between Iran and Israel

in Syria. Turkey will be a big feature of the third quarter following a

precarious electoral gamble by Turkish President Recep Tayyip Erdogan. Erdogan

has the tools to eke out a win and whip up a nationalist reaction to any

outside questioning of the vote, but the highly polarized country will remain

on shaky economic ground amid worsening relations with the West.

Mexico's populist

candidate stands a chance of winning big in July elections, which could pose a

threat to energy and education reforms while further complicating NAFTA talks.

A strong anti-establishment current will also be on display in Colombia, where

the FARC peace deal is under threat, and in Brazil and Argentina, where the

appetite for economic reform will plummet.

With several

negotiations still pending - including discussions over the fate of the Korean

Peninsula and high-stakes trade talks - a world weary from grappling with the

fitful superpower is bracing itself for another quarter of whiplash from White

House maneuvers.

But while Trump

thrives on unpredictability as his chief negotiating tactic, many of his moves

fit quite neatly - even predictably - in the context of the United States'

great power rivalry with China and Russia. The United States' intensifying

economic pressure on China, its harder-hitting

sanctions on Russia and its growing support for critical borderland states,

such as Taiwan, Ukraine and Poland, are all a part of this budding competition.

Even the U.S. search for a way to reunify and denuclearize the Korean Peninsula

is a piece of a broader long-term strategy to balance against China.

Yet the United States

is creating bigger distractions for itself in the Middle East with Iran while

putting stress on the very alliances it needs in its global competition with

China and Russia. Although the contradictions in U.S. policy are taxing much of

the world, this prolonged state of confusion is par for the course as the world

muddles through a blurry transition from the post-Cold War world to an emerging

era of great power competition.

For example U.S.-China Competition

Builds

Narratives casting

China as an economic imitator, as opposed to an innovator, are out of date. As

the country grows more economically advanced, focusing its attention on

game-changing technologies, the United States will heighten its economic

scrutiny on China - and squeeze numerous companies along U.S.-Asian supply

chains in the process. This dynamic will endure well beyond the quarter and the

Trump presidency. In the name of national security, the executive and

legislative branches of the U.S. government will continue to target the Made in

China 2025 strategic development program through various means, including

tariffs, sanctions and restrictions on investment and research. U.S. companies,

particularly those involved in sensitive technology sectors, will face growing

risk and uncertainty over the potential for export controls and for closer

monitoring of foreign investments.

Specific measures to

watch for in the third quarter include a special investment regime for Chinese

companies designed to block investment into sensitive areas like robotics,

telecommunications, semiconductors, artificial intelligence (AI), virtual and augmented

reality, and new energy. The White House already has announced its intention to

impose tariffs on up to $50 billion worth of Chinese industrial technology

goods under a Section 301 investigation into Chinese intellectual property and

technology theft. (More details are expected June 15.) The United States will

apply tight scrutiny to outbound investment to or informal collaboration with

Chinese companies, especially in high-tech sectors. Telecommunications firms

Huawei and ZTE are already feeling the pressure; the U.S. Commerce Department

has slapped hefty penalties on ZTE, while Huawei is under investigation by the

Justice Department. In addition to those companies, the United States could

expand its net to ensnare tech giants like Baidu, Alibaba and Tencent,

launching investigations into web services they provide. Washington is also

likely to impose visa restrictions on Chinese researchers and students in the

United States.

And while there

currently is a

lot of talk about a major trade war, Washington and Beijing alike will eventually

make concessions to justify dialing back their more extreme tariff threats.

Still, the negotiations will be bumpy. There are hard limits to what each side

can concede, and Chinese compliance is not assured, leaving the door open for

some tariffs, and retaliatory measures, to shake out this quarter.

Internal White House

dynamics will also be key to watch in tracking the progress (or lack thereof)

in trade negotiations. Treasury Secretary Steven Mnuchin and White House

economic adviser Larry Kudlow will push for a compromise that minimizes

collateral damage, while economic adviser Peter Navarro and U.S. Trade

Representative Robert Lighthizer drive a much harder, and perhaps impossible,

bargain with China. In the lead-up to U.S. midterm elections, the White House

will probably be more sensitive to retaliatory tariffs targeting the U.S. farm

belt, where support for Trump was strong during the 2016 presidential race.

Tariffs on smaller crops such as cranberries and ginseng, for example, could

hit a political nerve in Wisconsin, a state in which the farming vote could

make a big difference.

Even as the

negotiation inches ahead, the United States won't prevent China from providing

heavy, focused support to Made in China 2025 sectors. The U.S. pressure will

only make China more determined to accelerate its drive to forge its own supply

chains for sensitive technologies. China will, however, be willing to negotiate

ways to increase U.S. imports, including of energy, semiconductors, vehicles

and agricultural products; to partially liberalize certain sectors, such as the

financial sector; to reduce some trade barriers for imported vehicles; to

enhance intellectual property protection rights; and to restructure state-owned

enterprises as part of its reform drive. Even if the United States hits it with

tariffs this quarter, China has the political and economic means to withstand

the blow at home. A growing number of maturing corporate bonds will add to the

financial strain on local state-owned and private enterprises, but Beijing will

inject liquidity selectively to ease the pain, particularly in central and

northeastern China, and to manage any fallout.

A Framework for North Korean Denuclearization

Trump and North

Korean leader Kim Jong Un will meet face-to-face June 12 for a much-anticipated

summit in Singapore. While there will be moments throughout the process where

it appears as if the whole dialogue is collapsing, there is reason to believe

that the negotiation will still have legs by the end of the quarter. Our focus

will not be so much on the drama to come, the typical walk-outs, name-calling

and muscle-flexing - as Trump and Kim battle to prove who can play the

unpredictability card most effectively in the talks. Setting aside the theater

of the negotiation, the fundamental question for the quarter is whether both

sides will muster enough political will to develop a framework for

denuclearization. If a dialogue advances, it will likely start with freezing

nuclear development, leaving room to tighten the screws on denuclearization

over time. Just as the United States is unwilling to offer North Korea instant

regime security, North Korea will negotiate denuclearization only over a long

period of time.

Compared with

previous efforts at negotiation, the stakes are much higher this time around.

North Korea is closer than ever to its nuclear deterrent, and if the talks

fail, the United States will have invalidated the diplomatic route. The United

States would find it difficult to build international consensus to reinstate

crippling sanctions on North Korea, much less a consensus to pursue a military

option.

But a breakdown in

talks with the United States would not necessarily lead North Korea to resume

its nuclear testing immediately. Even if the United States walks away, China

and South Korea would keep up the diplomatic momentum with North Korea, giving

Pyongyang an opportunity to press its neighbors to ease up on their own

economic sanctions.

Japan will remain

largely on the sidelines of the negotiation, given its frosty ties with South

Korea and even frostier ties with North Korea. As trade tensions mount between

the United States and Japan over the threat of auto tariffs, Tokyo will do its best

to keep them separate from its security partnership with the United States.

Japan's biggest concerns lie in North Korea's short- and medium-range ballistic

missile threats and any short-term shifts to the U.S. force presence on the

Korean Peninsula that could also lead to a drawdown in Okinawa before it is

politically and militarily ready to compete with China. Japanese Prime Minister

Shinzo Abe will try to keep a high diplomatic profile this quarter both to try

to insert Japan's security interests into the U.S.-North Korea dialogue and to

distract his own constituency from a scandal that threatens his six-year

tenure. Should Abe lose the critical contest for the ruling party's leadership

in September, Japan could enter another period in which prime ministers come

and go more frequently, creating more uncertainty as the great power

competition in the Pacific heats up.

If the United States

can manage to avoid a military conflict with North Korea, it will be able to

apply more resources and attention to reinforcing countries in China's

borderlands. Though China has managed to ease tensions with the states in its

periphery, its continued militarization in the South China Sea will draw the

United States into a more active military role in the region to balance it. The

United States will increase naval deployments and patrols in the South and East

China seas this quarter while working to expand military exercises with members

of the Association of Southeast Asian Nations (ASEAN). An increase in U.S.

deployments will lead to a period of heightened tension between Chinese and

U.S. forces in these waters, and instances of harassment could become more

frequent as the rate of close encounters and interceptions increases.

Friction Points in the U.S.-Russia Relationship

Russia's influence over

North Korea will remain limited so long as Washington sustains its diplomatic

engagement with Pyongyang through the quarter. If the talks make progress,

Russia will try to secure a role in the denuclearization process to make sure

it has a seat at the table. And should the talks collapse, Russia will align

itself closely with China to resist the United States in the U.N. Security

Council on sanctions and military action.

The push and pull

between the U.S. Congress and the president on Russia policy can be messy and

contradictory at times, but the result tends to be a harder U.S. line on the

country. Congress will lean on the Treasury Department to sharpen its aim in

targeting Russian elites with an eye toward sowing divisions in the Kremlin

without creating the kind of significant global economic blowback that

sanctions against Russian aluminum producer Rusal caused in the second quarter.

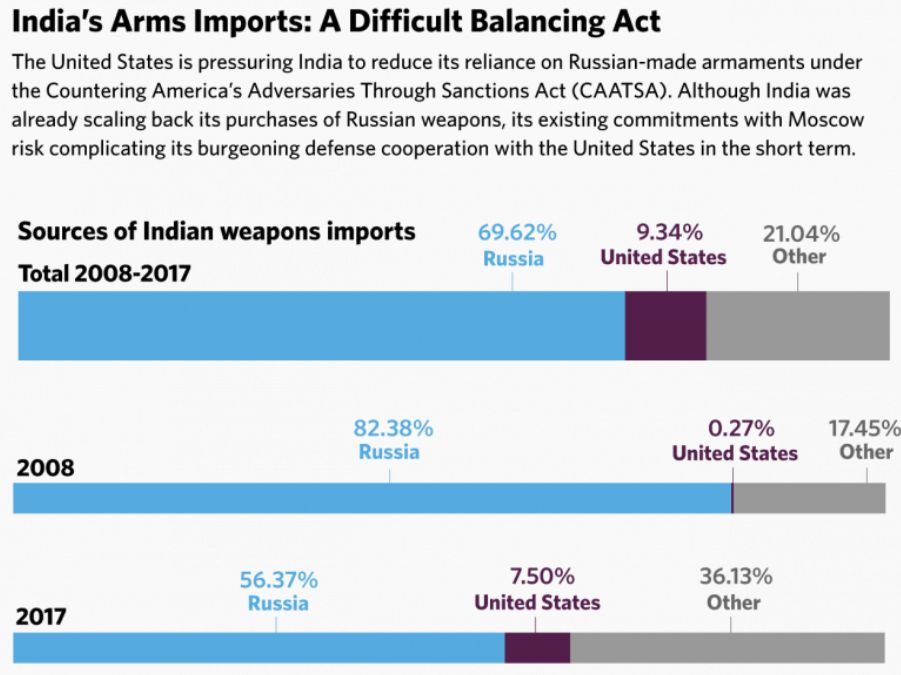

At the same time, U.S. lawmakers will be working to implement the

Russia-related provisions of the Countering America's Adversaries Through

Sanctions Act (CAATSA) to coerce other countries to reduce their defense,

intelligence and energy ties with Russia.

Though the White

House has been more reluctant in the past to confront Moscow, secondary

sanctions targeting Russia's defense and energy sales appeal to its business

sense by creating more export opportunities for U.S. liquefied natural gas

producers. They will also appeal to the United States' business sense by

potentially creating more export opportunities for U.S. defense firms and for

U.S. liquefied natural gas producers. Commercial interests, along with a

growing U.S. strategic focus on Central and Eastern Europe in its competition

with Russia and China, will give Poland, Ukraine and the Baltic states an

opportunity to appeal to the White House for stronger security commitments.

Warsaw, in particular, will try to advance talks with Washington over a permanent

U.S. military presence in Poland, which will in turn cause Russia to up the

pressure on Belarus to host a Russian airbase in its borders.

A potential military

buildup in Russia's periphery is one of several factors that could prompt a

high-level dialogue, or at least preparations for one, between Washington and

Moscow this quarter. Russian President Vladimir Putin has a long list of items ready

for when he sits down with Trump, including sanctions, military buildups and

stymied arms control talks. Russia will try to use its mediation in the Syrian

conflict and offers to help with North Korea's prospective denuclearization to

present itself as a more constructive force. But the White House will engage

with Moscow at a high level only if it feels that it has made enough progress

on North Korea that it can deflect negative attention from the Russia-related

investigations underway. Even if Trump and Putin manage to set up a meeting,

the geopolitical environment will not be conducive to a grand bargain.

Having made it to a

fourth term in office in elections in March, Putin will have to maneuver

carefully among the government, his inner circle and Russia's powerful

oligarchs as the United States dangles the threat of heavy sanctions over them.

Efforts to consolidate the assets of Russia's elite will continue in the third

quarter, as the Kremlin works to maintain economic stability and political

loyalty. Higher oil prices will help ease some of the strain that honoring

social pledges made during the campaign season, increasing security spending

and hosting the World Cup have put on the Kremlin's finances. Competition among

the security services remains a key area to watch as Putin balances among rival

factions. We'll also be watching carefully for further signs that the longtime

president is elevating younger members of the elite in search of a successor.

The more immediate

priority in the quarter will be for Putin to try to take more steam out of

opposition protests. In the second quarter, a wave of opposition protests in

Armenia that swept longtime leader Serzh Sargsyan from power was another

wake-up call for the Russian government and the heads of other former Soviet

states: Once a protest movement has gathered enough momentum, not even brute

force tactics can quell it. Determined to avoid a similar fate, the Kremlin

will work on co-opting opposition leaders into government positions. Opposition

leaders like Alexei Navalny are unlikely to fall for this strategy. But figures

from other prominent dissident parties - especially those that stand to do well

in September's regional elections, including Yabloko and the Communist Party -

may yield to the Kremlin.

Doubling Down on Iran

A big element of the

U.S.-Russia competition will also play out in the Middle East. In walking away

from the Iran nuclear deal and reinstating hard-hitting sanctions, the White

House is hoping against all odds to foment enough economic frustration in Iran

to set regime change in motion. Israel, meanwhile, is seizing a rare

opportunity to escalate its military campaign against Iranian and Hezbollah

assets in Syria, knowing that it has firmer security guarantees from the United

States to manage the fallout of a cycle of attacks and retaliatory attacks that

risks drawing in Russia. Moscow will plan its next steps carefully with the aim

of avoiding a direct collision with the United States while exploiting U.S. and

Israeli needs to deconflict on the Syrian battlefield. Despite its attempts to

mediate between Israel and Iran - in hopes of bargaining on a more strategic

level with the United States - Russia's limited influence on the Syrian

battlefield will prevent a lasting truce. Russia also will try to take advantage

of Iran's vulnerability with the United States to deepen its own military

footprint in the region. Watch for discussions between Iran and Russia over

boosting Iranian air defenses and appeals from Moscow for access to Iranian

bases.

Tehran's focus for

the third quarter will be to buy itself as much room to maneuver as possible

with those trading partners willing to risk U.S. secondary sanctions. In the

immediate term, Iran will take care to avoid aggressive actions that could push

the European position closer to that of the United States. But as the limits of

the European Union's economic guarantees become more evident in the coming

months, Iran's internal debate over how to proceed will intensify. Iran will

probably still confine retaliatory attacks against Israeli strikes in Syria to

the Golan and potentially the Palestinian territories as it tries to avoid a

bigger conflagration. It will also test the limits of the nuclear deal and its

cooperation with Europe, for instance by threatening to increase enrichment, to

limit access to International Atomic Energy Agency inspectors or to withdraw

from the Nuclear Non-Proliferation Treaty.

The European Union,

for its part, has imposed regulations to block the application of U.S.

secondary sanctions to European companies. In addition, it will consider such

measures as compensating EU firms for their losses in Iran, increasing

euro-denominated trade with Iran, offering new credit lines for companies doing

business in the country and arranging currency swaps to bypass the U.S.

financial system. Italy, France and Germany will be the most motivated to set

up financial mechanisms to continue trade with Iran. Likewise, smaller Chinese

and Russian firms with fewer connections to the U.S. financial system will be

willing to maintain or even expand their economic ties with Iran. But most

corporations with financial exposure to the United States will make the

pragmatic choice to reduce or eliminate their ties to Iran to maintain access

to the U.S. market. And even China will be wary of defying the United States

because of the case involving ZTE, which Washington hit with a crippling

punishment for flouting sanctions.

Growing economic

strain will continue to depress the value of the Iranian rial and spur

inflation, creating a groundswell of domestic discontent that could drive

sporadic demonstrations. But Iran has already been preparing its economic

insulation strategy. To muddle through, the Iranian government will emphasize

domestic production and negotiate agreements and barter arrangements in

nondollar trade. Tehran will also work on financial reform to comply with

international banking regulations as part of a broader effort to cushion the

blow of U.S. sanctions. Since the United Arab Emirates is on more hostile terms

with Iran today than it was when the Islamic republic was last under crippling

sanctions in 2012, Tehran will depend more this time on Qatar and Oman to

re-create a web of financial and shipping methods to skirt the measures.

Similarly, Turkish banks - now under much tighter U.S. scrutiny - probably

won't be as reliable an option for circumventing sanctions this time around,

though Turkey will maintain significant economic ties with Iran.

The Cost of Alienating Allies

The White House is

stretching the limits of executive action in fighting multiple battles on the

economic and foreign policy fronts. By harnessing the power of tariffs and

extraterritoriality in sanctions, the White House will polarize many of the

security allies it needs to counter an emerging threat from China and Russia.

Taiwan and South

Korea, and to a lesser extent Japan and ASEAN, are the most exposed to major

disruptions in the U.S.-China supply chain and are bracing themselves for

blowback from the tariffs that may emerge from the U.S.-China economic

standoff. The threat of auto tariffs this quarter will add strain to the United

States' relationships with South Korea and Japan, though Seoul may have a

better shot at negotiating exemptions as part of its talks to revise the United

States-Korea Free Trade Agreement.

Europe, too, is

caught in the middle of this broader competition. Costly tariffs and unilateral

sanctions are stirring the Continent to reclaim its economic sovereignty from

its long-standing Western partner across the Atlantic. The problem is that

Europe is not a single nation with a unified voice. Germany, whose heavy

dependence on exports gives it incentive to a find compromise with the United

States, particularly as the threat of auto tariffs looms, will not be able to

negotiate a comprehensive trade agreement among more skeptical EU member states

to try to defuse trade tensions with Washington. Nevertheless, the European

Union will consider more modest measures to appease the United States, such as

eliminating reciprocal tariffs on industrial products (and lowering the EU

tariff on cars), reducing regulatory barriers to trade and restricting exports

or introducing import quotas.

France will lead the

battle to maintain the European Union's relevance in the face of great power

competition and growing U.S. unilateralism. Paris will work this quarter to

strengthen Europe's strategic autonomy through defense cooperation pacts,

including the Permanent Structured Cooperation (PESCO) and the European

Intervention Initiative. In trying to ensure Europe is still in the global race

to develop AI alongside the United States and China, France will try to

spearhead a European strategy for the technology. Connected to this goal, the

European Commission will work to deepen the digital single market by

eliminating barriers to international e-commerce while protecting consumers.

But fragmented markets and differing regulations among member states will slow

progress to that end. The complications from EU fragmentation will be on

display this quarter when the bloc starts implementing the General Data Privacy

Regulation and could undermine AI development on the Continent in the long

term.

France will also try

to drive a discussion around reforming the World Trade Organization (WTO),

another casualty of U.S. unilateralism. The United States has made a legally

explosive national security argument under Section 232 of the Trade Expansion

Act of 1962 to justify protectionist measures on imports of steel, aluminum and

now automobiles and auto parts. While polarizing key allies in Europe and Asia,

the Section 232 cases also put U.S. Gulf partner Qatar in the uncomfortable

position of battling the United States in the WTO. Doha has cases against Saudi

Arabia, the United Arab Emirates and Bahrain for waging an economic attack on

it in the name of national security. Either way the case goes, the risks are

high: If the WTO upholds the national security argument for trade

protectionism, it will set a dangerous precedent, and if it shoots down the

U.S. case, it will risk exacerbating its credibility crisis should the United

States ignore the ruling altogether.

Managing Difficult Relationships

Europe, in turn, is

trying to demonstrate its support for the United States in countering China's

trade abuses, but not at the cost of wrecking the WTO's credibility. The

approach of an EU-China non-Market Economy case and the precarious position of

the WTO Appellate Body will prompt the European Union to push for a reform

dialogue and mediate between the United States and China. But the United States

won't be receptive to Europe's appeals this quarter while it's still on the

economic warpath. Despite calls from Macron, a serious discussion on reforming

the WTO that has any chance of keeping the United States engaged will have to

come later.

A concerted push by

the U.S. Congress to get CAATSA up and running will further complicate U.S. security

relationships abroad. The legislation contains a secondary sanctions provision

for states engaged in significant defense, intelligence and energy transactions

with Russia. The U.S. executive branch will still be able to rely on a national

security waiver to exempt more sensitive allies from punitive measures, but the

legislation is designed to hold the White House accountable for other

countries' efforts to steadily reduce their strategic ties with Russia in

exchange for the waivers. Germany, Vietnam and Turkey are the states most

likely to defy U.S. pressure on their Russia relations, while India is the most

vulnerable and will struggle to find a balance between Moscow and Washington.

The CAATSA drive could in some cases generate defense sales opportunities for

foreign competitors if countries think the United States is too unreliable a

defense partner.

A Turbulent few months for Europe

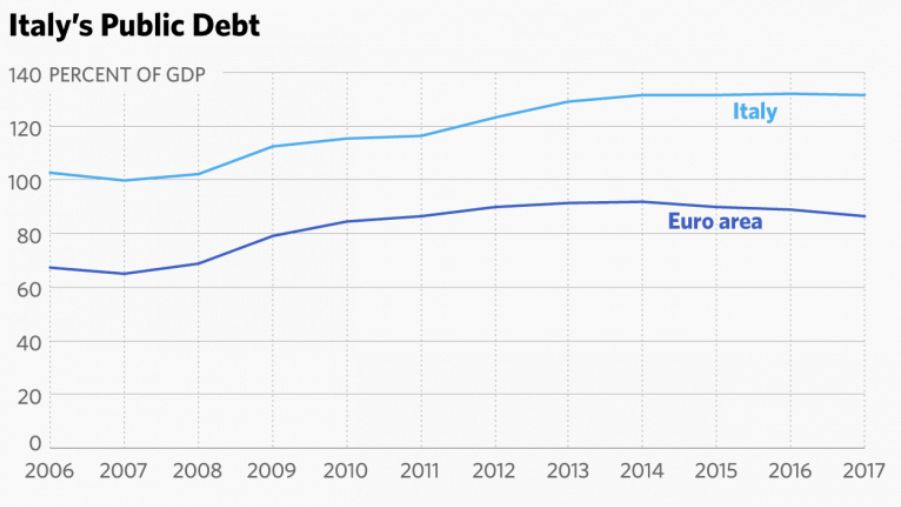

A Euroskeptic

government has taken hold in the European Union's core: The new Italian

government, led by Euroskeptic and nationalist parties the Five Star Movement

and the League, will try to reverse austerity policies instituted by prior

governments and increase spending. Specific measures include abolishing a

controversial pension reform, lowering household taxes and increasing

assistance for low-income families. Moving the proposals forward will be no

small feat and will require the government to overcome internal divisions and

institutional constraints. Even so, because of the expense - and the challenge

to EU fiscal deficit rules — that the measures entail, EU institutions and the

German government will be on guard. Italy will be ready to ignore EU deficit

and debt rules in bargaining with Brussels, but it won't go so far as to make a

unilateral move to pull out of the eurozone this quarter. And even though Italy

isn't facing an imminent financial crisis, the country's defiance toward EU

fiscal rules is still a threat to the currency area. After all, Italy will be

looking for allies in Southern Europe, including France, Spain and Greece, to

join its calls for increased spending at the continental level and more

flexible EU fiscal rules.

Italy's closer ties

with Russia will raise concerns in the European Union - and hope in Moscow -

that Rome could keep the bloc from reaching the unanimous vote required to

uphold EU sanctions on Russia. Italy could demand a review of the measures and

greater justification for continuing them during the EU debate, but Rome is

unlikely to take too strong a stand on Russian sanctions when it has a much

bigger battle with Brussels looming over its economic agenda. A potential

Italian rebellion is one of several factors driving an EU debate over how to

escape the "unanimity trap." Watch for an important proposal from the

European Commission this quarter that would streamline decision-making by

allowing the bloc to make decisions on foreign policy issues by a majority

vote. The change, if eventually adopted, could threaten states' national

sovereignty on critical foreign policy matters.

While Italy spooks

the eurozone, the German government, under pressure from both conservative

lawmakers at home and from its allies in Northern Europe, such as the

Netherlands, will try to shelve, postpone or water down reform proposals from

France. We expect the two to reach agreement on issues such as the introduction

of mechanisms to increase investment across the European Union, the

introduction of a common backstop for eurozone banks or the creation of a

European monetary fund. But they will probably postpone more controversial

plans, such as the introduction of a common guarantee for deposits in eurozone

banks, or at least link the proposals to measures to reduce financial risk in

the region's banks.

France and Germany

likely will abandon other suggestions, including the creation of a finance

minister for the eurozone. The continued debate over the EU budget will add to

the friction. Net contributors - most of which are in Northern Europe - will

resist enlarging their national contributions to the budget, while net

receivers of structural funds (mainly in Eastern Europe and, to a lesser

extent, Southern Europe) will fight to keep their share. Proposed cuts to

agricultural subsidies will rile up farm lobbies in France, Spain, Ireland and

elsewhere. And states in Central and Eastern Europe will form a united front

against Brussels' attempts to make the disbursement of EU funds contingent on

respecting the rule of law.

Adding to the

political risk in the eurozone, the Brexit process will become increasingly

toxic this quarter. The British government will have to deal with an

increasingly rebellious Parliament, where the idea of remaining in the customs

union is gaining traction. The British government has until the EU summit in

late October to try to patch up this divide while bargaining with Brussels over

its two seemingly incompatible goals of leaving the customs union while

maintaining an open border between Ireland and Northern Ireland. The longer

London plays for time, though, the weaker and more divided the government will

become - increasing the chances of Parliament taking control of the Brexit

process and keeping the United Kingdom in the customs union.

Market Volatility in the Energy Sector

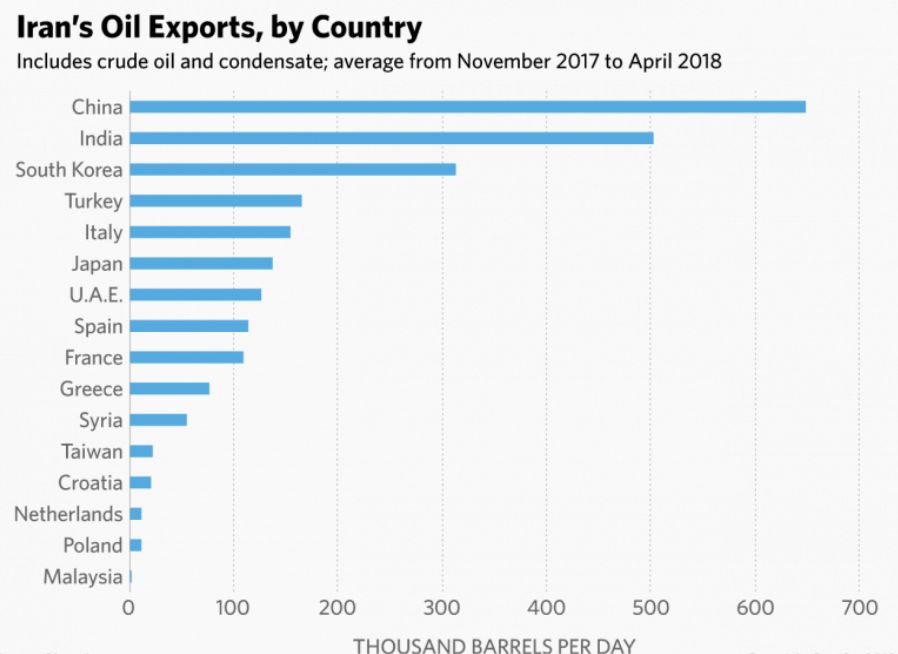

In anticipation of

the return of U.S. sanctions on Iran's oil exports Nov. 4, many countries will

work to reduce their oil imports from the country throughout the quarter. Along

the way, they could create a gap in supply in global oil markets that threatens

to drive up prices. The size of the gap will depend on how stringent the United

States will be in granting sanctions waivers to countries that reduce their oil

imports from Iran. Under former President Barack Obama's administration,

countries could qualify for waivers after cutting their imports of Iranian oil

by around 20 percent, but the Trump White House could raise the requirement.

(Either way, the U.S. sanctions will gradually reduce Tehran's incentive to

stay in the Iran nuclear deal since countries must keep lowering their imports

to continue qualifying for the waivers.) The key White House negotiations to

watch in the quarter will be with EU members - especially ltaly,

Germany and France - China, South Korea and India. We can expect at least

400,000 barrels per day of Iranian oil to go offline by the end of the year.

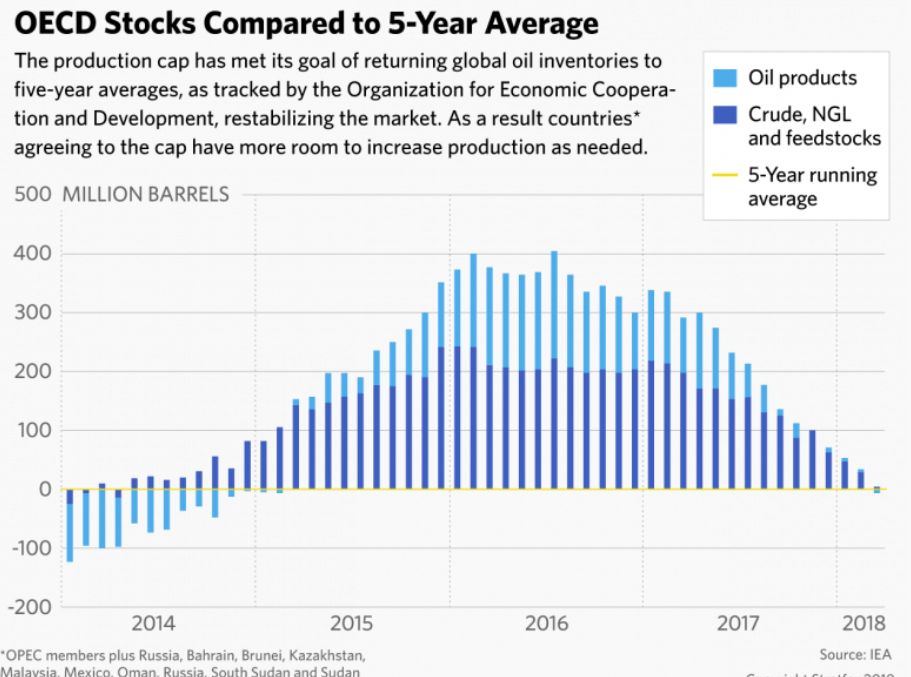

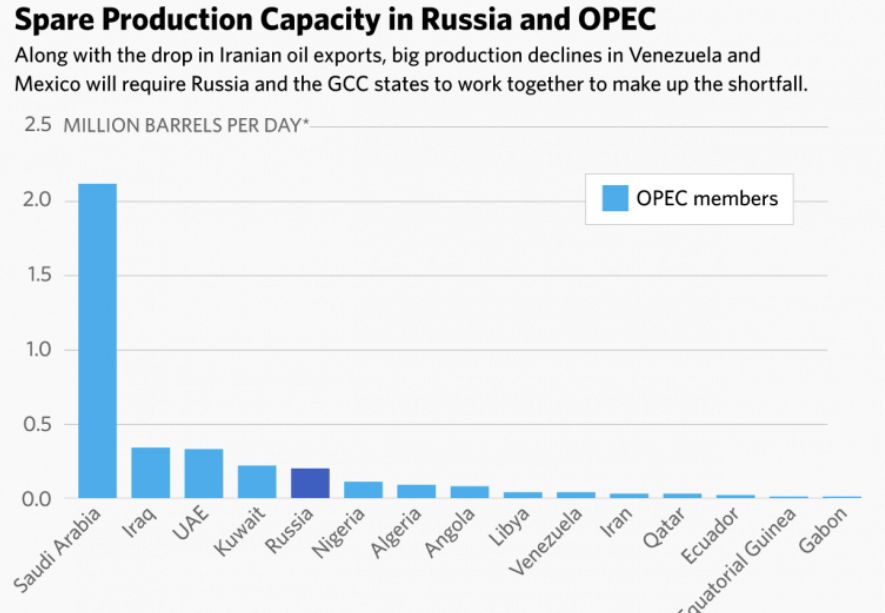

Saudi Arabia and its

Gulf Cooperation Council (GCC) allies Kuwait and the United Arab Emirates, as

well as Russia, will keep an eye on the oil market this quarter in case they

need to intervene. Along with the drop in Iranian oil exports, big production declines

in Venezuela and Mexico will require Russia and the GCC states to work together

to make up the shortfall. When the world's major oil producers meet in Vienna

on June 22, they could agree to loosen oil production quotas while watching and

waiting for the Iran developments to take their toll on the markets. The group

of oil producers participating in the production cap has already met its goal

of returning global oil inventories to five-year averages to restabilize the

market. As a result, its members have more room to increase production as

needed.

Saudi Arabia,

however, will be cautious in planning a market intervention. Riyadh is aiming

for a higher price band (possibly around $100 per barrel) in preparation for

the initial public offering of its state-owned oil company, the Saudi Arabian

Oil Co., and in a bid to reduce its budget deficit. But Saudi Arabia will have

to weigh those economic considerations against its strategic partnership with

the United States. The White House will be leaning on Riyadh to intervene in

the oil market and prevent a big hike in gasoline prices ahead of U.S. midterm

elections. The Saudi government may well acquiesce.

When we step back and

assess the main sources of geopolitical risk to the global economy the next few

months, it's a mixed bag. Trade frictions will be high on multiple fronts, but

they are unlikely to spiral into a trade war. There will be dramatic episodes

in the U.S.-North Korea negotiation, but the risk of a military scenario will

be low. Iran's risk to oil markets is largely known and underway. The election

of a Euroskeptic government in Italy is driving up financial risk in Southern

Europe. A confluence of macroeconomic factors is at the same time creating a

perfect economic storm over several spots on the map.

The U.S. Federal

Reserve appears to be on course for further monetary tightening this year,

while other major central banks are proceeding with caution, creating upward

pressure on the dollar. Combined with higher oil prices, the dollar's rise will

compound pressure on countries that have large energy needs. The pain will be

more acute for those countries with high amounts of dollar-denominated debt

that are more vulnerable to swift capital outflows when spooked investors take

cover under safer assets. The resulting currency pressures will stoke inflation

and aggravate political problems in many countries, including Turkey,

Argentina, Brazil, Colombia, Mexico, South Africa, India and Venezuela.

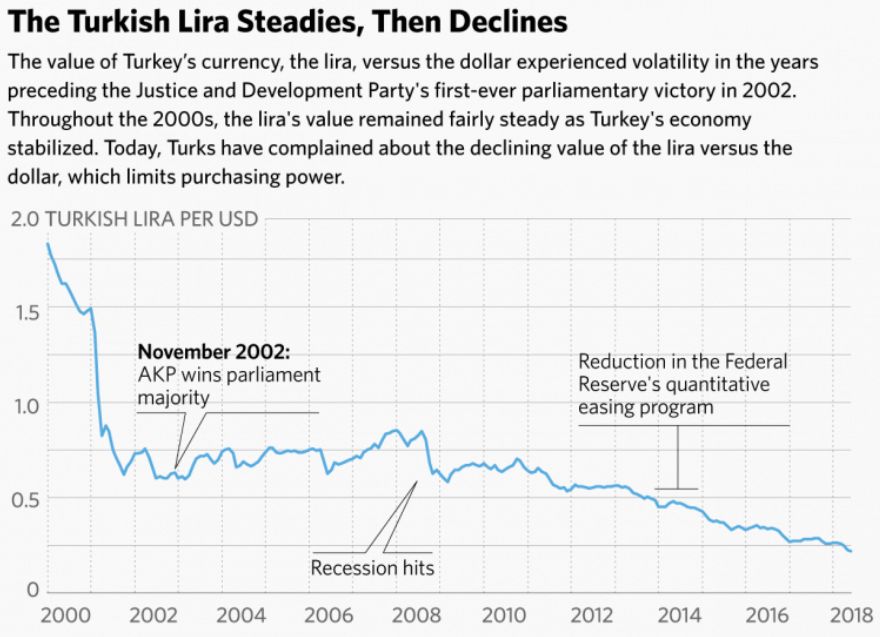

Turkey

Turkey will hold

presidential and parliamentary elections June 24, a year and a half ahead of

schedule. Turkish President Recep Tayyip Erdogan has a lot riding on the vote

after narrowly winning a referendum to enhance the powers of the presidency; if

he wins, he could remain in the presidency until 2029. By holding the election

so early, Erdogan is trying to head off both a nascent opposition coalition and

an economic hailstorm pelting his voter base. Turkey's electorate is

essentially split down the middle, and a diverse set of opposition parties are

forming a coherent argument against Erdogan and his handling of the economy. An

election that could yield narrow margins and end in a runoff raises the

potential for vote rigging and public outcry, but Erdogan will have the benefit

of power working in his favor.

The incumbent

president can rely on the country's state of emergency to manage any fallout,

all the while spinning any criticisms from Europe into nationalist propaganda.

Turkey's hefty dollar-denominated debt, together with Erdogan's attempts to

strong-arm the central bank to defy market pressure, will make this a

particularly stressful quarter for the Turkish economy. On top of the country's

political and economic woes, Turkey is facing stiff headwinds in its strained

relationship with the United States as Washington tries to leverage secondary

sanctions against Russia and Iran to constrain Ankara's relations with them.

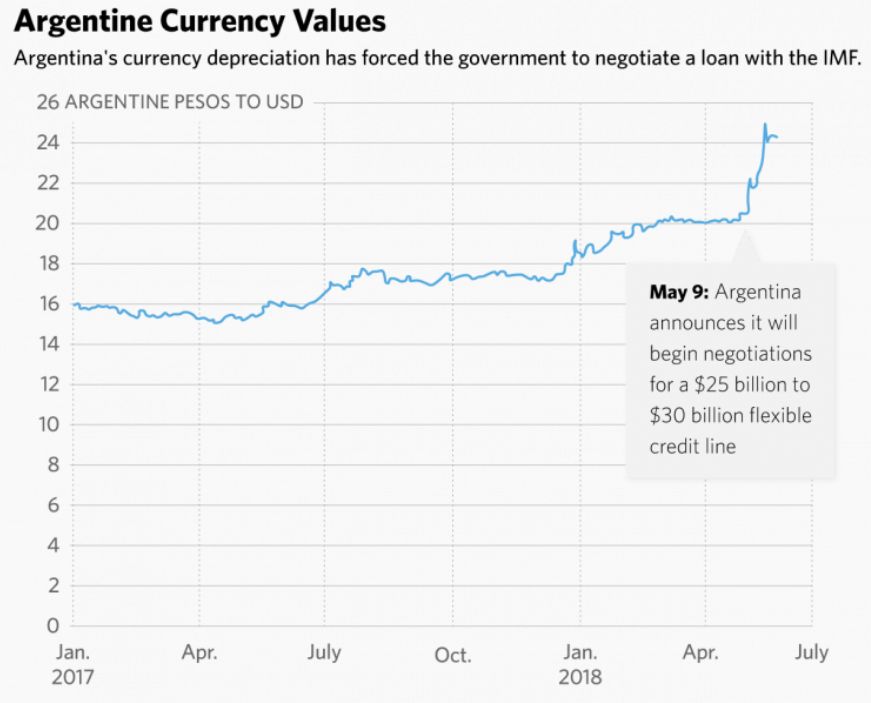

Argentina

Argentina, under

currency pressure from a rising dollar and a mountain of dollar-denominated

debt, faces a story similar to Turkey's. But in Argentina, the political damage

is likely already done: As the weak peso continues to feed stubbornly high

inflation, it will further erode President Mauricio Macri's support base.

What's more, under the conditions of a deal with the International Monetary

Fund for credit lines, Macri's government will probably have to cut public

spending, including transfers of funds to provincial governments. The cutback

will cause opposition governors to pressure the national government for more

money by pulling back congressional support for Macri's proposed legislation,

such as labor reform. Coupled with Argentina's growing trade and current

account deficits, voters' economic pain will push the next government toward

greater protectionism. It will likely resist moves from the Common Market of

the South, better known by its Spanish acronym, Mercosur, to explore additional

trade agreements, though deals that are already well underway - such as the

EU-Mercosur trade agreement - are safe. In time, Argentina will be out of step

with other Mercosur members, such as Uruguay and Paraguay, on foreign trade.

Mexico

In Mexico, the strong

U.S. dollar is already hitting the peso hard. Prolonged uncertainty over the North

American Free Trade Agreement renegotiation and a potential populist victory in

the presidential election this quarter threatens to create more economic

turmoil. Mexico will hold elections for the presidency and for Congress on July

1. Among the presidential contenders, populist candidate Andres Manuel Lopez

Obrador leads the pack. Lopez Obrador's political influence, should he become

president, will depend on whether he controls a congressional majority. Much of

his policy agenda, which includes a rollback of education reform, fuel price

freezes and cuts to the federal budget, will be virtually impossible to

implement without congressional consensus. Mexico's historically dominant

parties, the Institutional Revolutionary Party (PRI) and the National Action

Party (PAN), will form a tactical alliance in Congress to try to block Lopez

Obrador. In the event that Lopez Obrador picks up a majority in both houses,

PRI and PAN would have to rely on the courts to resist the president's more

controversial policies.

At this point, the

odds are looking slim that the United States will reach its goal of closing a

NAFTA deal ahead of the Mexican elections. Canada, Mexico and the United States

still have yet to agree on overall rules of origin requirement or on regional

content quotas for individual automotive components. While Canada could adapt

to the U.S. demand to shift a portion of vehicle production to higher-wage

areas, Mexico, which relies on lower wages for competitiveness, would find it

more difficult, if not impossible. And even if NAFTA's parties come to an

agreement in time, the White House is likely to face resistance from the U.S.

Congress if a deal lacks strong protections for investors and labor. Trump

could try to break the stalemate by threatening a withdrawal from the agreement

or by breaking the negotiation down to the bilateral level, but such extreme

moves on NAFTA would likely galvanize Congress to take legislative action to

prevent or nullify them.

Colombia

The Colombian peso

has fared far better than its regional peers, but there are still lingering

risks to the country's peace agreement with the Revolutionary Armed Forces of

Colombia (FARC) that will bear close watching this quarter. A pending

investigation into high-level FARC leaders by Colombian and U.S. authorities

will complicate things for the next government if a centrist or leftist

candidate comes to power in the June 17 runoff election. Depending on how far

the investigations go, the peace deal with the FARC could falter and put oil

companies and other businesses in northeastern and southwestern Colombia in

danger of extortion or attack. Colombia's next president will also be more

reluctant to sign new trade agreements as domestic industries come under

greater pressure. Pending trade agreements, particularly those with Turkey and

Japan, will be at risk unless their proposals for agricultural trade improve

significantly for Colombia.

Brazil

As presidential

campaigning picks up this quarter in Brazil for the October elections, the pace

of economic reforms will slow. Higher fuel prices are inspiring protests and

feeding a growing anti-establishment current in the country. In Congress,

lawmakers won't have the appetite to approve controversial measures like

pension reform. The traditional parties that back the current government, such

as the Brazilian Democratic Movement, will try to seal an alliance with as many

other parties as possible to try to fend off the anti-establishment threat

coming from right-wing lawmaker Jair Bolsonaro, environmentalist Marina Silva

and center-left nationalist Ciro Gomes.

India

For India, the

world's third-largest oil consumer, rising oil prices and a strengthening

dollar mean a wider trade deficit and investor outflows from the country's

equity and debt markets. These global developments are happening as the ruling Bharatiya Janata Party is ready to fund populist measures

to win votes ahead of the 2019 elections, suggesting that the fiscal

consolidation drive in the world's fastest-growing major economy will slow

through next year, while job creation stays sluggish.

India is walking a

tightrope among China, Russia and the United States. Prime Minister Narendra

Modi wants to avoid another politically costly standoff with China as he

campaigns for a second term in office. With that in mind, he's embarking on a

tactical recalibration with Beijing, suggesting the relationship between the

two nuclear giants will return to a state of managed tension, even as each side

quietly continues military and infrastructure buildups on the border. Facing

the threat of U.S. sanctions for its economic ties to Iran and its defense ties

to Russia, New Delhi will begrudgingly bargain for exemptions while balancing

with Russia. The U.S.-India relationship will be strained as a result. The

degree to which these irritants undermine the growing strategic defense

partnership between the two countries will become more evident when their

foreign and defense chiefs meet in July.

South Africa

As the 2019 elections

draw closer, South African President Cyril Ramaphosa is trying to have it both

ways: He needs to push a pro-business agenda to stimulate the economy while

pursuing populist measures to shore up the African National Congress's electoral

defenses. Ramaphosa will be focused mostly on winning over investors in the

next quarter before the 2019 campaign season gets into full swing, though

downward pressure on the rand threatens to ratchet populist pressures up.

Steadily rising investor confidence is likely to extend to the mining industry

as the new administration tries to streamline regulation and increase

transparency through a new mining charter. Anti-graft efforts, moreover, will

continue apace under Public Enterprises Minister Pravin Gordhan, who plans to

target South Africa's state-owned enterprises, a hotbed of corruption.

Venezuela

Venezuela is too far

gone for higher oil prices to alleviate its troubles this quarter. In fact, its

cratering oil production - already down by 500,000 barrels per day this year,

is a big factor behind the global shortfall. Production will fall further as

inflation worsens, currency shortages at state oil company Petroleos

de Venezuela become more acute and workers desert their posts. The Venezuelan

government, meanwhile, will try to keep local transport ships from docking at

oil terminals where creditors could seize the oil as payment for arbitration

awards and disrupt the country's energy export activities. Along with possible

U.S. sanctions on the energy sector, the threat of large-scale asset seizures -

which would raise the risk of unrest or even a coup - will loom large in

Venezuela this quarter.

For

updates click homepage here